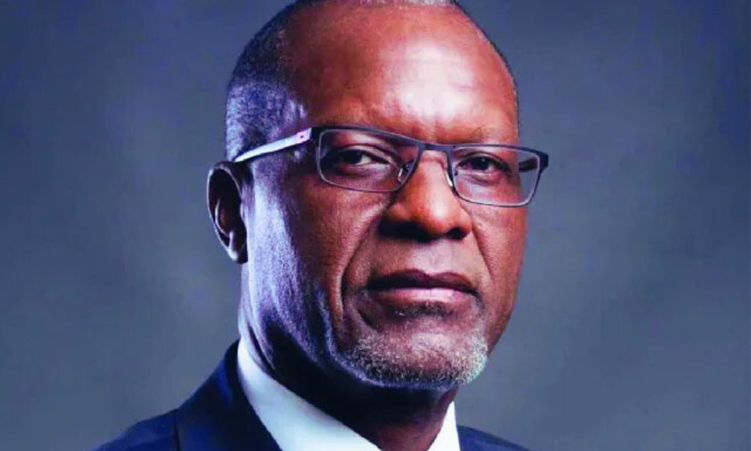

Mines and energy minister Tom Alweendo has welcomed the recommendation by the International Monetary Fund (IMF) to make contracts between the government and oil companies public.

“I couldn’t agree more that transparency is key when negotiating contracts with oil companies; in fact it is key to achieving public acceptance of such contracts,” says Alweendo.

He adds that transparency will eliminate the common perception of corruption involved in oil contracts.

“It is only through transparency that we eliminate persistent concerns of dishonesty that is often associated with oil contracts,” says Alweendo.

Alweendo further says transparency will also allow for the best interests of Namibians to be met.

“Given that oil is an asset that belongs to the nation, transparency will prevent public officials from agreeing to terms that do not consider the best interest of the citizenry,” says Alweendo.

According to the High-Level Summary Technical Assistance Report by the IMF, the government should adhere to the highest standard of transparency and governance.

“An immediate down payment on this effort could be realised by making publicly available in an easily accessible manner all petroleum agreements concluded by the government,” notes the report.

The government has also been advised to establish an inter-ministerial committee to coordinate petroleum sector policy design and implementation.

Additionally, the government has been advised to establish an inter-agency petroleum modelling team and adopt the modelling tools developed by the mission.

“Government could progress on a memorandum of understanding for inter-agency sharing of data and information pertaining to petroleum sector projects.”

According to the report, while no oil discoveries have been confirmed as commercially viable yet, the potential for significant revenue over several decades is undeniable.

However, the IMF cautioned against factoring this income into immediate budgets, as the long-term demand for oil and gas is uncertain.

“Government has not yet incorporated any revenue from these potential investments into the medium-term fiscal planning. This is appropriately prudent,” notes the report.

This includes ensuring clear and efficient tax regulations, building capacity to manage revenue collection and developing a framework for forecasting future oil income.

According to the report, Namibia’s current oil and gas tax system appears balanced between the government and investor interests.

It combines a corporate income tax, a profit-based tax that kicks in after a certain level of profitability is reached, a royalty on sales and some government ownership in projects.

The IMF sees this system as positive but recommends some changes for better clarity and revenue protection. These include setting limits on certain deductions and simplifying some tax calculations.

“The technical team reviewed the petroleum tax policy and legislation recommending policy measures to provide clarity and simplicity for taxpayers while safeguarding revenue collections.”

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!