The combination of high inflation and no salary increases has caused the formally employed to additionally carry the heavy burden of unemployed family members.

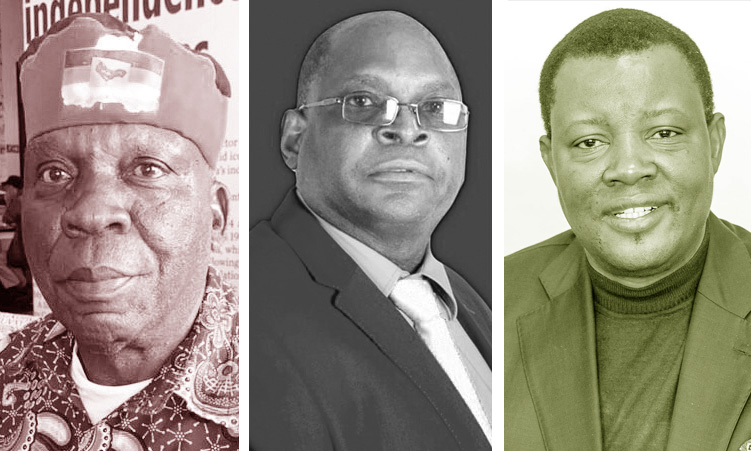

Economist Omu Kakujaha-Matundu says many households and families have hit rock bottom, with many turning to cash loans out of desperation.

This comes as a study by TransUnion Namibia showed that nearly three quarters of Namibians reported flat or falling incomes in the past three months, with job losses and salary cuts.

According to the study’s report, this has led to many cutting back on discretionary spending, like dining out and entertainment.

“Many consumers have revised their household budgets in response to these financial pressures. Over the past three months, 52% of households opted to reduce discretionary spending, primarily millennials (27- to 42-year-olds) at 56%, and Gen X (43- to 58-year-olds) at 57%,” the report states.

“This unfortunate and untenable situation leaves households with nothing to save or invest in wealth-creating assets.

It paints a bleak picture of households thrown into deep poverty,” Kakujaha-Matundu says.

This affects intergenerational wealth transfer too, he says.

“The future generation is going to inherit poverty from their parents and so the viscious circle of poverty continues.

Under such financial strain, households find it difficult to have any savings, despite the intention to save,” he says.

The report confirms that financial pressure has also impacted saving habits.

“While some are prioritising paying off debts, a concerning number of people have reduced their retirement contributions,” the report states.

However, a quarter of households have also been increasing their emergency fund contributions.

“While many consumers are feeling the strain of high inflation and stagnant or declining incomes, there are also signs of resilience and a hopeful outlook for the future,” the report says.

It says almost half of those who took part in the survey anticipate difficulty paying bills and loans, forcing them to make partial payments, take on temporary work and increase borrowing.

However, many people feel there is no sufficient access to credit, while others fear rejection due to income or job security.

The high cost of credit is another deterrent.

“Despite the current struggles, a significant majority of Namibians remain optimistic about their future income prospects, particularly the younger generations,” the report says.

“So, in the end, the question is: What employment strategies is the government pursuing to reduce the burden of the unemployed on families?” Kakujaha-Matundu says.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!