Bank of Namibia (BoN) governor Johannes !Gawaxab says South Africa’s new government of national unity (GNU) will positively impact Namibia’s economy.

This is due to the currency peg and South Africa (SA) being a trade partner.

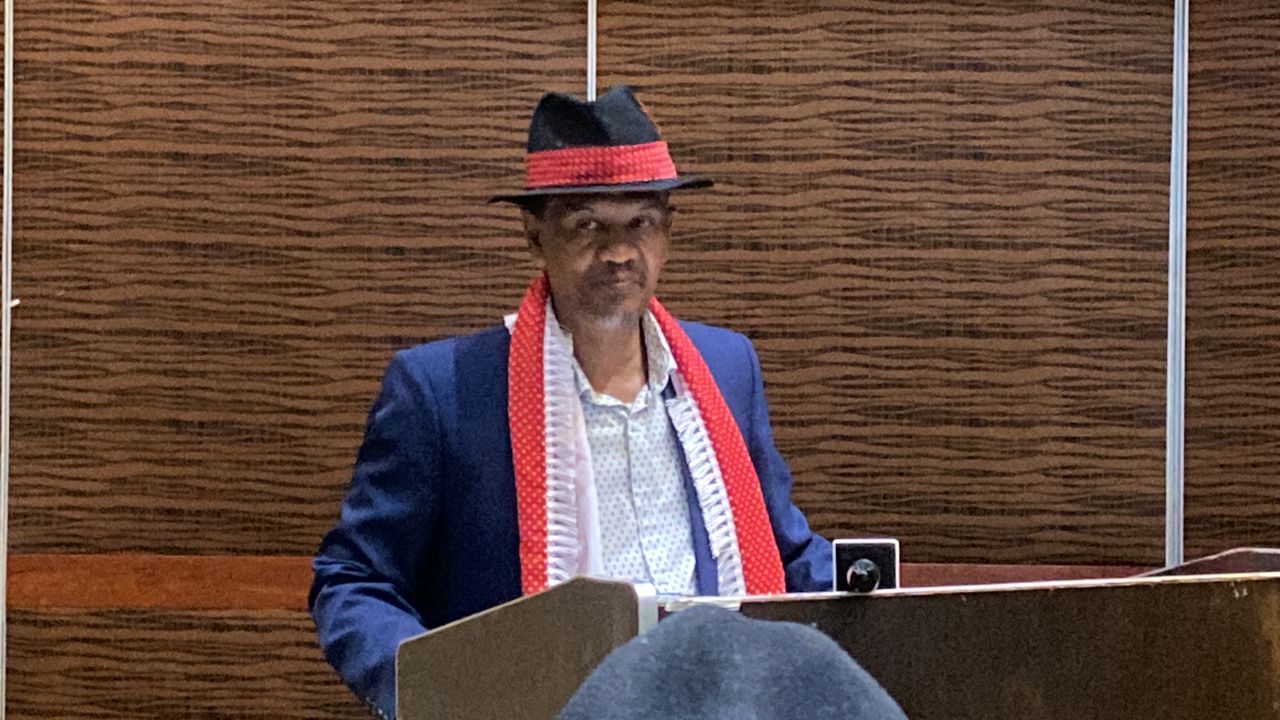

!Gawaxab said this yesterday while announcing that the repo rate will remain unchanged at 7,75%. In comparison, South Africa’s repo rate stands at 8,25%.

He said the recent South African election outcome, which saw the African National Congress lose its parliamentary dominance for the first time since independence and necessitated a coalition government with the opposition, carries political, social, and economic implications.

“It impacts our economy because we have a currency peg arrangement. It seems like we are dealing with a market-friendly outcome regarding the (South African) government of national unity.”

He said the unity government has definite balance of payment implications.

!Gawaxab said prior to the elections in May, the South African rand was trading at N$19 to US$1, but now trades at around N$18.

“If the currency strengthens, it’s not good for our exports. However, it is a welcome development from an import point of view. As a nation we normally run a trade deficit. We are a net importer and it is a welcome development from our perspective.

“We import quite a lot of fuel, so if our currency is stronger, it has positive implications on inflation, particularly inflation from the transport category,” he said.

!Gawaxab further said the unity government in the neighbouring country also has potential implications for the country’s foreign reserves.

At the end of May, Namibia’s stock of international reserves stood higher at N$55,6 billion, up from N$54,3 billion in March supported by higher receipts and customer foreign currency placements from the Southern African Customs Union (Sacu).

He said this is sufficient to support the currency peg and meet the country’s international financial obligations.

“Our reserves are at a good point now. It has positive implications to the unrealised gains and losses.”

!Gawaxab further said the outflows for 2024 was about N$12,2 billion year to date, compared to the same period last year when the outflows were about N$1,9 billion.

“We have about N$2 million more than last year, but we are not too concerned about that. We are in a peg environment where there is a free-flow of capital,” !Gawaxab said.

INTEREST RATE

Maintaining the repo rate at 7,25% also means the prime lending rate will remain at 11,50%.

Economist Josef Sheehama says the central bank’s decision to maintain the repo rate was difficult but the right one, given that inflation has unexpectedly decreased to 4,9% from 6,3% during the same period last year.

“This means both property seekers, including first-time buyers and sellers, are facing difficulties in the current market. The loan-to-value, which was expected to strengthen the domestic property market will not yield expected results.

“Therefore, for sellers to draw in buyers, accurate pricing will now be their primary concern,” Sheehama says.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!