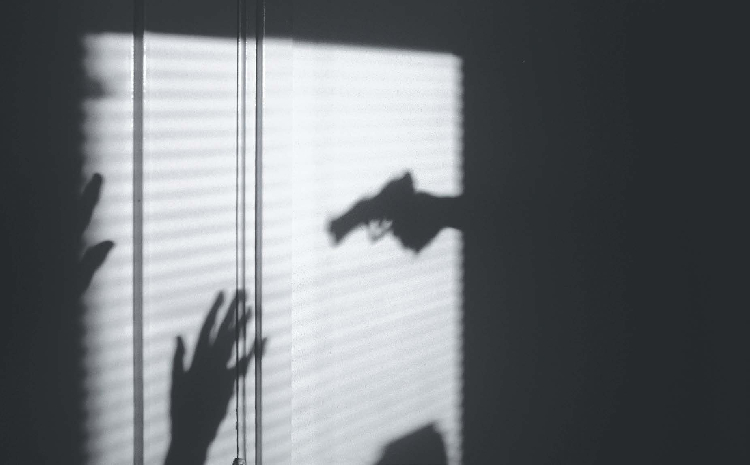

INCIDENTS of bank clients being robbed of hard cash straight after withdrawing money inside a bank are often reported.

Some of these incidents have allegedly taken place at First National Bank Namibia and Standard Bank Namibia at Ondangwa in the Oshana region, among other places.

This type of robbery is known as ‘knocking’ and typically occurs soon after a client has withdrawn a large amount of money inside a bank or at an ATM.

Early in 2020 Sofia Elifas and her husband, who were planning on buying a new vehicle, withdrew a sum of N$60 000 from Standard Bank Namibia’s Ondangwa branch.

They subsequently got into their vehicle and drove to Omashaka at Ondangwa.

While travelling, Elifas says he noticed a vehicle following them at full speed.

He says they slowed down to allow the vehicle to pass, upon which the driver of the vehicle also slowed down, shouting to Elifas that one of his tyres was flat.

Elifas says he immediately pulled over, leaving his wife and a bag of cash in the vehicle while he checked the alleged flat tyre.

Before long he heard his wife screaming and saw the same people grabbing the bag of money from their vehicle and speeding off.

The incident was reported to the police, which Elifas says was to no avail.

Lucia Shiweda, a resident of a village outside Ondangwa and a client of the same branch, says she drove to Onethindi after withdrawing N$50 000 at the beginning of the year.

Upon arriving home, there was a knock at the door, she says.

She opened the door, was hit on the head, and came to finding the money she had withdrawn was missing.

“I still don’t understand how those people knew I had money on me. Something is seriously going on that needs to be investigated. Clients are suspecting that some bank employees are working with criminals and are informing them when a client has withdrawn a large sum,” she says.

Shiweda says she had applied for a N$50 000 loan to pay her daughter’s university fees in India.

She says she had to wait for almost an hour before the bank teller gave her the cash.

“I don’t understand why the teller had to make me wait. I just sat there for a long time, and eventually I was called up to get my money. I suspected something serious was happening there,” she says.

Several other similar incidents have been reported last year, clients claim.

FNB spokesperson Elzita Beukes says the bank is aware of incidents of customers being accosted after visiting a branch, “however, we have not been presented with any evidence concerning the potential involvement of any of our employees in this regard”.

“As always, we encourage our customers to make use of our many digital offerings to transfer, deposit and make payments via online banking, the FNB app, cellphone banking, E-wallet or Cashplus.

“However, we urge customers to not draw cash routinely, but to rather make use of different ATMs and to never carry large sums with them, to follow precautions recommended at all banks, and to be aware of their surroundings,” Beukes says.

She says the bank encourages affected customers to report incidents to law-enforcement authorities.

Standard Bank’s spokesperson, Isack Hamata, says: “Standard Bank has no recollection of customers being robbed after withdrawing money at our Oshakati branch. We, however, advise clients to resist the temptation of withdrawing and handling large amounts of money, but rather to use the digital channels at their disposal to do transactions. We also want to advise clients against sharing confidential details which may result in theft of money from their accounts.”

Oshana police regional commander, commissioner Rauha Amwele, said many such ‘knocking’ incidents are regularly reported to the police, but they have not been able to fully determine the modus operandi of the culprits.

“We have cautioned people to avoid withdrawing large sums of money through even radio announcements.

“It would help further if banks could make all their cubicles private, so that people can do their business away from prying eyes,” Amwele added.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!