MORE Namibian companies are resorting to borrowing from their parent companies as opposed to equities or utilising the domestic capital market.

The latest Bank of Namibia quarterly bulletin shows intercompany lending has increased on a quarterly basis from December last year, N$52,1 to N$63,6 billion at the end of March 2020, before it moderated to N$62,4 at the end of June 2020.

Similarly, external debt of the direct investor through intercompany lending rose by 17,5% to N$62,4 billion, year-on-year.

This was primarily due to a 22,2% depreciation of the Namibia dollar against the US dollar which increased the debt in local currency and interest accrued not yet paid during the period under review.

Intercompany lending includes loan transactions between parent companies and their subsidiaries or investee companies, and subsidiaries of the same group.

By the end of June 2020, the country owed external investors N$131,4 billion, which is a reduction from N$136,1 billion recorded in the first quarter of 2020.

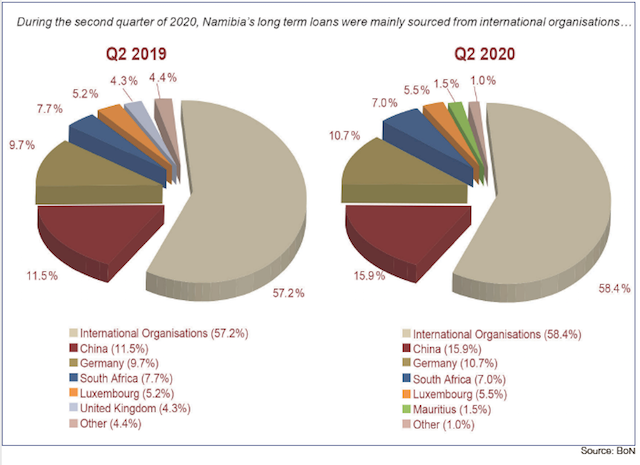

External debt is led by locally operating companies borrowing from parent or sister companies abroad, with N$62,4 billion followed by the central government owing N$34,9 billion.

The government’s external debt could increase after it secured N$10 billion to meet its current external borrowing budget deficit.

State-owned enterprises and other sectors follow – both owing the world more than N$10 billion, followed by commercial banks with external debt valued at N$9,3 billion.

The central bank owes N$3,4 billion in external debts.

As a result, the country spent N$6,5 billion dollars on external debt repayments in the second quarter of 2020 – an increase from N$3,2 billion it spent in the first three months of the year.

Leading external debt repayment are the subsidiaries of various international and regional companies paying back to their parent companies amounting to N$2,3 billion in the second quarter of 2020 – an increase from N$1,5 billion in the first quarter of 2020.

The Bank of Namibia uses the ratio of debt-servicing to exports to assess the country’s ability to cover its periodic debt obligation.

According to the central bank, “debt service as a percentage of merchandise exports is a good measure of how readily serviceable the debt is”.

This is due to the fact that higher growth rates in exports build up international reserves, which in turn are used to service foreign debt.

“Therefore, the lower the percentage, the better,” the bank said in the report.

Currently, the ratio is at 42,5%, which is way above the maximum international benchmark of 25% for it to be considered distressed.

International benchmark values give an assessment of the country’s risk of debt distress.

If the ratio falls below the threshold of 15% to 25%, the country is seen to meet its debt-service obligations and is at low risk.

Should the country’s debt burden fall within the threshold, but stress tests indicate a possible breach in the presence of external shocks or abrupt changes in macroeconomic policies, it would be at a moderate risk.

Lastly, if the country’s debt burden falls outside the threshold, the country would be considered to be in debt distress and stringent policy interventions would need to be taken.

According to the central bank, the country’s external debt has closed the 25% international benchmark quarterly five times – with last year being the worst.

At the end of 2019, 62,1% of the country’s export revenue were supposedly channelled to external debt payment according to the ratio as calculated by the bank.

In the same quarter, the country also recorded the lowest level of foreign reserves since quarter two of 2018.

Email: erastus@namibian.com.na

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!