ZIMBABWEAN businessman Enock Kamushinda and the former chief executive officer of the Small and Medium Enterprises Bank, Tawanda Mumvuma, committed “grand fraud” against the bank and were involved in the theft of nearly N$350 million from the bank, it is alleged in an explosive affidavit filed at the High Court last week.

The amount of money suspected to have been stolen from the SME Bank has grown from an initial figure of about N$200 million to a total amount of “at least N$347 million”, one of the two provisional liquidators put in charge of the bank when it was ordered to be wound up, Ian McLaren, says in an affidavit filed at the court on Friday.

In the sworn statement, McLaren charges that Kamushinda, who was the deputy chairperson of the SME Bank’s board of directors and has stakes in the bank’s two minority shareholders, Mumvuma, who was the bank’s CEO, the SME Bank’s former finance manager, Joseph Banda, and a group of Zimbabweans employed in the bank’s finance department perpetrated the theft that led to the bank’s financial collapse and closure in July 2017.

McLaren’s affidavit provided the backbone to an application through which McLaren and fellow provisional liquidator David Bruni yesterday got the go-ahead from the High Court to take the first step towards suing five Zimbabweans who received money allegedly stolen from the bank.

In an order granted by acting judge Collins Parker, it is directed that Namibian assets belonging to Kamushinda, Mumvuma, Banda and fellow Zimbabweans Chiedza Goromonzi, who was employed in the bank’s finance department and also doubled up as an assistant to Kamushinda, and Lyndon Gaidzanwa should be attached.

That step is taken to confirm the court’s jurisdiction over the five Zimbabweans in future legal proceedings in which the two liquidators intend to sue them in an effort to recover money allegedly stolen from the bank.

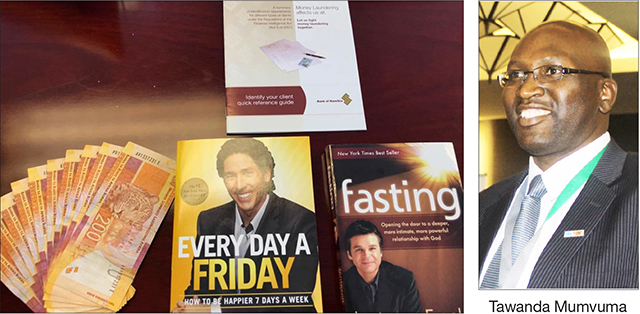

The assets ordered to be attached include shareholding in companies registered in Namibia, memberships in Namibian close corporations, and an immovable property in Windhoek. The assets also include four pairs of shoes and a diary that Goromonzi left behind at the SME Bank’s head office when she left Namibia around the time that the management of the bank was taken over by the Bank of Namibia at the start of March 2017, and the contents of a drawer in Mumvuma’s desk at the bank’s head office.

An amount of 4 000 South African rands, a Bank of Namibia publication titled ‘Money Laundering affects us all’, and two books authored by televangelists – the one a guide to a happier life and the other on the topics of fasting and a better relationship with God, were discovered in one of Mumvuma’s desk drawers.

The books, the publication on money laundering, and an amount of R2 200 which was found to remain in the locked drawer when it was opened again last month, were ordered to be attached to confirm the court’s jurisdiction over Mumvuma.

McLaren says in his affidavit that a total of N$247 million was stolen from the SME Bank when it was transferred from SME Bank accounts held at Standard Bank Namibia and First National Bank of Namibia to South African bank accounts between December 2013 and December 2016.

While accusing Kamushinda of having played a central role in the theft of money from the bank, McLaren also charges that the theft was perpetrated by Mumvuma, Banda, Goromonzi and others in the bank’s finance department as well.

The bank was at first defrauded through payments that were falsely reflected in its financial records as purchases of computer software and equipment or for building costs, McLaren says. However, after the bank’s auditors began to question a number of transactions and required a physical inspection and verification of certain assets, the thieves inside the bank attempted to conceal their crimes by creating false documentary records indicating that the money that had been stolen had been invested in South Africa.

That was how the company Mamepe Capital, run by an alleged friend of Kamushinda, Mauwane Kotane, entered the picture, with the creation of records indicating that funds had been invested with it while that was not the case, McLaren says.

With commissions of inquiry having been authorised in Namibia and South Africa to assist the liquidators in trying to trace the money suspected to have been stolen from the bank, McLaren says the liquidators are also in the process of establishing an inquiry in Dubai, where some N$69 million of the stolen money was transferred to.

McLaren further states that the liquidators’ investigation thus far indicates that at least N$100 million to N$140 million “was spirited away from the SME Bank’s accounts to persons and entities inside Namibia, and to persons and entities in countries other than South Africa”.

The total amount of N$347 million would not have been stolen from the bank without the cooperation, planning and common purpose of the people accused of having been involved, and for that reason, they can be held liable to have N$347 million returned to the bank, McLaren says.

The two liquidators were represented by senior counsel Raymond Heathcote, assisted by Jesse Schickerling, Francois Erasmus, the bank’s legal adviser, Tania Pearson, and Corlia Kruger in court yesterday.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!