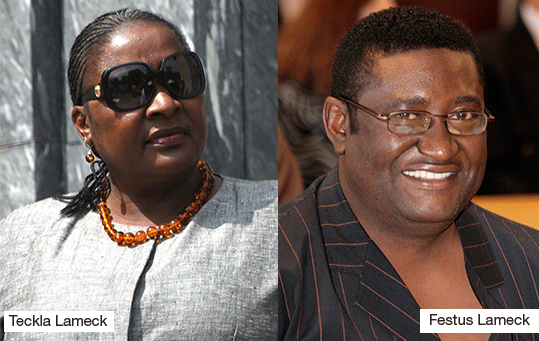

FORMER Public Service Commission member Teckla Lameck and her husband, Festus Lameck, are at risk of losing their farms and other assets after failing to keep up with the repayment of loans totalling millions of Namibia dollars that they got from Bank Windhoek.

The bank obtained three default judgements for the payment of a combined amount of N$10,4 million against the couple and the close corporation Naapopje Trading CC, through which they have been doing business, in the Windhoek High Court last week.

A fourth application for a default judgement – for the payment of a further N9,3 million – was removed from the court roll on Friday, because the court documents giving the couple notice of the bank’s legal action had not been served on the address that they chose for the receipt of such notification. The court documents had been delivered to the Lamecks at an address in Suiderhof in Windhoek, instead of at their Grootfontein district farm Wiesental.

With the bank claiming that the couple and Naapopje Trading CC owe it a total amount of N$19,7 million, it has given notice that it plans to ask for a court order declaring that properties over which mortgages in favour of Bank Windhoek have been registered can be sold to recover the money owed to the bank.

The mortgaged properties are the Grootfontein district farms Wiesental and Kainami, measuring a total area of 7 664 hectares, three plots of land at Okahandja, with a combined size of almost 21 900 square metres, and a property in Klein Windhoek that is 1 068 square metres in size.

The couple, who were sued in their personal capacities and also as trustees of the Lameck Family Trust, and Naapopje Trading CC have not opposed any of the four claims for the repayment of money that Bank Windhoek instituted against them in the High Court in October last year.

The bank sued them over a loan of N$1,5 million that was granted to the Lamecks in September 2009, a loan of N$6 million that was given to the couple in December 2013, an overdraft facility that was given to Mr Lameck in April 2010, and an overdraft facility given to Naapopje Trading in December 2010.

According to the bank, the couple and Naapopje Trading fell into arrears with the repayment of their loans from June last year.

By October last year, Mr Lameck owed N$153 188 on his overdraft facility, Naapopje Trading’s overdraft stood at N$9,3 million, and the couple owed Bank Windhoek N$2,5 million on the loan dating from September 2009 and N$7,79 million on the loan given in December 2013, the bank also claimed in documents filed at the court.

Contacted by telephone yesterday, Mrs Lameck did not want to talk about the matter. “I don’t have any comment,” she said.

Also contacted yesterday, Mr Lameck told The Namibian that while Bank Windhoek has informed him it was planning to take legal action against him, summonses notifying him that the bank has lodged claims at the High Court have not been served on him. Summonses have been served at his and his wife’s former address in Suiderhof, though, he said.

Mr Lameck, who is a former chairperson of the transport parastatal TransNamib’s board of directors, commented that the difficult economic climate over the past couple of years has resulted in a situation where he and his wife were not able to repay their loans on time. However, he said, he was working with the bank to make arrangements for the repayment of their debts.

Mrs Lameck is also facing legal challenges on another front. She, a business partner, Kongo Mokaxwa, and a Chinese citizen, Yang Fan, are jointly facing criminal charges in connection with an allegedly crooked deal through which Namibia’s government bought X-ray scanning equipment from a Chinese company in 2009, and are due to go on trial in the Windhoek High Court for a second time on 14 May this year.

They first went on trial in April 2013, when they denied guilt on all charges, but applied for the recusal of the presiding judge in the wake of a ruling he had made in June 2014.

They appealed to the Supreme Court after the judge refused to step down from their case, and in June last year that court ruled that the judge should have recused himself. The Supreme Court also ordered that their trial should start anew before another judge.

The state is alleging that the price of X-ray scanning equipment that the government bought at a total cost of US$55,3 million (then about N$477 million) from a Chinese company, Nuctech, which was represented by Yang, in early 2009 had been inflated to enable Nuctech to pay a ‘commission’ of at least US$12,8 million to a close corporation of Lameck and Mokaxwa, Teko Trading CC, while Teko Trading played no role in the transaction between the ministry and the Chinese company.

After the Ministry of Finance had made an advance payment of about US$12,8 million to Nuctech in February 2009, the company paid some US$4,2 million (about N$42 million at the time) into Teko Trading’s bank account during March 2009. Out of that amount, N$9,39 million was then paid to Mrs Lameck, while N$8 million was paid to Mokaxwa and Yang received N$16,8 million.

The Lamecks, who are married in community of property, bought farm Kainami for N$3 million in March 2009.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!