*Petrus’ family has sat him down for serious talks more than once since 2021.

As a teacher and former soccer player, he should be enjoying a good life at home at Biro village in the Kavango East region.

His debt situation has, however, spun out of control.

Loan sharks are on the hunt for him, trying to collect the over N$200 000 he owes after suffering devastating losses on sport betting.

“I have made money from betting in the beginning. The most I have won was N$76 000 in one bet,” he says.

“I have built my house with the money. The other money I have spent was on clothes and sleeping in lodges at Divundu and Rundu. I love the lodges and entertaining friends.”

He shares his story while sitting under a tree, waiting for an uncle from Windhoek to meet with him to discuss his financial situation.

Things started going south in May 2021.

Petrus started betting his whole salary, borrowing money from relatives, friends and later from loan sharks.

He failed to win the money back.

“I don’t know what happened. It is like the computers were throwing my name out,” he said. “I started winning N$800, sometimes N$100 after putting up N$3 000 or N$5 000,” he says.

Petrus now sees the sport betting world as a dark place.

“I don’t drink, smoke or go after women, and that’s the bad part, because I did not use the winnings on my family, but I entertained my friends,” he says.

“I thought it was a sinless activity. Today I have been rescued from taking my life twice by my family, because I just can’t stand the shame I have brought them.”

Petrus’ sister says they are keeping a close eye on him since he has written a suicide note twice already.

“The first time, he left the letter with the kids at home, and we had to cut him out of the rope,” she says.

“The second time was at his girlfriend’s place while people were sleeping. Luckily she woke up when he was about to put the rope around his neck.”

The family would like to send him to rehab, but they don’t know where.

“I don’t know why our government does not do something about the betting business, because it will destroy families,” she says.

IT’S A LIFESTYLE

This is the story of many victims of over 1 500 sport betting establishments in the country.

Regular customers wear bucket hats, flip-flops and soccer team shirts. Sometimes they are responsible members of society.

‘OkaBetting’a’, as it is commonly known in the townships, often features in young men’s conversations.

They will incur massive debts, and the chain of addiction will continue.

A few will drop out, but new betters always join.

A Windhoek-based taxi driver, who wishes to be known only as ‘Chippa’, believes it is only a matter of a few more attempts before he gets his ‘big break’.

“One day, I will eat that machine, and I will leave all this donkey work behind,” he says.

From across the street of JSB betting house in Werner List Street, Chippa firmly believes “anything can happen”.

At 18h00 it’s rush hour for taxi drivers, but while his fellow drivers fight for customers, Chippa says he’s done for the day.

“I had a small setback yesterday. I lost an N$800 bet that Switzerland would beat Spain. I was attracted by the potentially big reward of multiplying my money seven times. OG! This soccer, neh.

“I have now asked for a loan from a friend, so I can at least have something to give to my boss later tonight, and he asked me to wait for him here,” he says.

The slender 29-year-old, originally from Oshakati, is adamant that he will bounce back from this “small setback” with more wisdom.

Chippa says he started gambling during the pandemic, when he wasn’t earning enough money as a driver.

“A friend showed me his winnings on a bet slip, and I thought this could be a viable way to supplement what I was making in a day driving around three customers per trip,” he says.

The countless adverts on TV only made betting more enticing, he says.

“Do you know Betway? They are right in saying betting makes watching soccer even more exciting,” he says.

CHASING LOSSES

For psychologists, these stories are all too familiar. In the field of behavioural finance, researchers have found the pain of losing money is greater than the pleasure experienced when gaining the same amount.

Clinical psychologist Cynthia Beukes of Saffron Psychologists says this often leads gamblers to “chase their losses” by doubling bets to quickly make up for previous losses.

Chippa’s behaviour is characterised as aggressive, and labelled as ‘cognitive bias’.

A report by Charles Schwab Asset Management, the third-largest asset manager in the world, says: “This bias occurs when investors (people) focus on the outcome of a process rather than on the process used to attain the outcome.

“Behavioural finance is a growing field that challenges the traditional economic theory that presumes customers are rational.”

The asset manager says human behaviour is rather driven by “fear and greed”, and that people can be self-destructive.

BOOMING INDUSTRY

In southern Africa horse racing, slot machines, roulette, poker, blackjack, and baccarat are the most popular gambling activities apart from sport betting.

The value of global sport betting was estimated at N$3,2 trillion, according to research firm Polaris.

Namibia has a booming gambling industry too.

Data from the Namibia Statistics Agency shows that over N$300 million worth of gambling machines were imported into the country between 2010 and 2021.

According to statistics obtained from an industry player, the company has a monthly turnover in excess of N$1,4 million on average, and a yearly turnover of more than N$17 million.

The Khomas region features the highest number of transactions, while the average number of bets placed by customers per day equals 3 000.

According to BtoBet, a multinational company which develops new gambling technologies, heavy sport bettors meeting the criteria for clinical gambling disorders are “typically male, young (up to age 35), single, fully employed, and have a high level of education”.

These players believe sport gambling is more about skill than luck, which distorts their thinking process.

Across Africa football is the most popular sport for wagers – especially when it comes to the English Premier League.

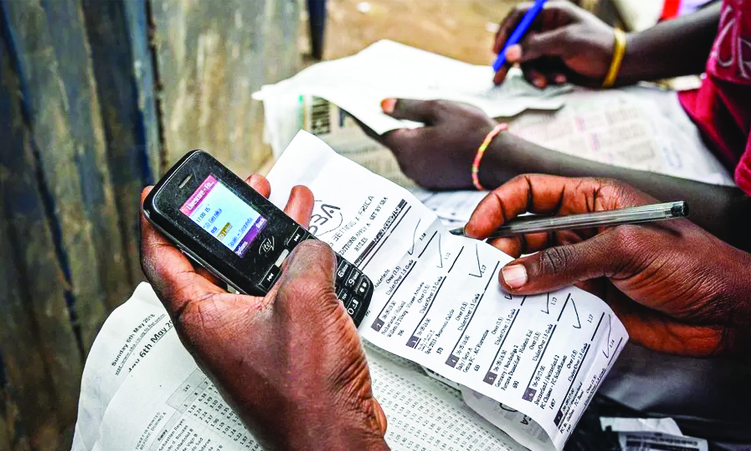

According to BtoBet, mobile payment options have brought gambling to the masses – even to those without bank accounts.

But credit card and Bitcoin payments are also becoming popular, and telecoms and gambling operators are also teaming up.

BOOKMAKER

Gambling arrived in Namibia with South Africa’s JSB betting in 1989, but the business has mushroomed over the last decade.

Namibia is yet to appoint a regulatory authority.

The Ministry of Environment, Forestry and Tourism temporarily acts in this capacity, but has no record of the number of operators, spokesperson Romeo Muyunda says.

The owner of Premier Sports Trading (PST), Steve Hamunyela, says he sees sport betting as recreational.

Rather than frowning upon the industry, Hamunyela calls for better protection and regulation, so that betting would benefit the community and contribute to state revenue.

“Sport betting needs regulating to protect problem clients, create more jobs, ensure industry players plough back in the community, and the government gets its fair share,” he says.

“At the moment, there are foreign operators with a large presence in Namibia. I am not too sure the government is benefiting as it should.”

Hamunyela says this would help prevent illicit activities, such as money laundering, and develop partnerships with leagues, teams, and player associations.

This, according to him, would improve overall sport participation and enthusiasm in the country.

PST betting shops run throughout the country, and have a growing online offering.

Hamunyela says PST currently has about 150 000 active users on their online platform, a turnover of about N$4 million a month, and payments to clients of no less than N$1 million per month.

“We have created employment for 350 shop operators in our brick-and-mortar betting shops, and 17 more employees at our head office,” he says.

FRIEND OR FOE?

But Beukes says gambling and sport betting are highly addictive, which could lead to psychiatric disorders.

The ‘feel-good’ emotion from winning shares the same neural process as the ‘high’ from taking drugs, she says.

“These are the same neurons that process sexual stimuli, cravings and drugs. This feeling can quickly create an addiction,” she says.

“It’s an invisible disease. Many people do not think they have a problem.”

Once the habit is formed, the mind gets hooked on a certain elevated level of dopamine, which the body “thinks it needs”.

Beukes says some people are born with a vulnerability to addiction, while others exhibit ‘cross-addiction’, giving up one vice to quickly exchange it for another.

The clinical psychologist says television advertisements are a critical influence.

“Adverts usually show happiness or success derived from the consumption or usage of a particular product. The brain is learning subconsciously,” she says.

BENEFACTOR

Last year, Premier Sports Trading announced a N$550 000 sponsorship of Namibian Premier league side Civics Football Club.

Hamunyela says such investments could become more common if it came with better protection from foreign players.

Johan Muller, the chief executive of Cricket Namibia, says his organisation has associations with ‘Dafabet India’, which assists the organisation financially during local cricket tournaments.

Muller says sport betting can be a “double-edged sword”, as the cash injections could help develop a sport.

“However, this can also create incentives for players not to act in the best interest of their teams. This is why it needs regulating, but I am thankful to Dafabet,” he says.

Last year, United Kingdom-based ‘Skysports’ reported half the English Premier League was sponsored by sport betting companies last season.

Lawmakers have since recommended that gambling operators should no longer be allowed to advertise themselves on team kits from 2023.

This effort to tackle ‘problem gambling’ has not been welcomed, as English Football League chair Rick Parry has warned of the financial ramifications if sponsorships were completely removed.

‘NOT COMPLYING WITH THE LAW’

Environment minister Pohamba Shifeta yesterday expressed concern about industry actors in the lottery and gaming sectors who are not abiding by the law.

During a media briefing in Windhoek, Shifeta spoke about the need for industry players to comply with the Lotteries Act of 2017 and the Gaming and Entertainment Act of 2018.

“It is concerning that we continue to see or observe non-adherence to the provisions of these two pieces of legislation by operators in both industries,” he said.

The two laws and their respective regulations were operationalised in December 2021 after having undergone a rigorous consultation and review process.

“The ministry continues to observe illegal or unregistered lottery activities being conducted or announced in Namibia without prior authorisation or approval of such lottery activities by the board,” he said.

He said people who violate section 74 (1) of the Lotteries Act face a N$4 million fine, up to 20 years in prison, or both.

“I must also warn any person or media house that is participating, promoting, or facilitating such illegal activities within their publications or platforms, without first confirming with the lottery board that such activities are legal, that they too are liable to be fined,” he said.

Shifeta also asked gaming and entertainment operators to register their enterprises with the Gambling Board of Namibia.

He said gambling house licences that were issued prior to the act’s implementation must also apply to the board for approval or reclassification under the new categories.

The minister said operators have until 31 August to register gambling machines for operation.

“The gambling house licences that operated prior to the act’s coming into effect are encouraged to formalise their operations by applying to the board for approval or reclassification in terms of the new categories, and the board may consider their continued operations to avoid any vacuum.”

Shifeta said the ministry and the Gambling Board of Namibia will continue to monitor the gaming and entertainment industries to ensure they comply with the law.

*Not his real name.

- This article has been produced by The Namibian’s Investigative Unit. Contact us via your secure email at investigations@namibian.com.na

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!