FNB Namibia has disbursed N$85 million, of the N$150 million allocated to the institution through the Small and Medium Enterprises (SME) Economic Recovery Loan funds from the Ministry of Finance and Public Enterprises in collaboration with the Bank of Namibia (BoN).

This was said by Tomas Iindji, FNB Namibia head of business banking in a statement issued yesterday in which he said the bank received a total of 139 applications valued at over N$174 million from SMEs nationwide.

“To date, FNB Namibia has assisted 89 businesses with a total disbursement of N$85 million through the SME Economic Recovery Loan Scheme, leading to increased liquidity in their operations, job creation, sustainability of existing jobs, and economic growth,” he said.

Iindji added that FNB is currently evaluating credit for applications worth N$57 million from 38 customers.

“The bank maintains its commitment to support businesses and SMEs with viable plans and the ability to repay their loans,” he said.

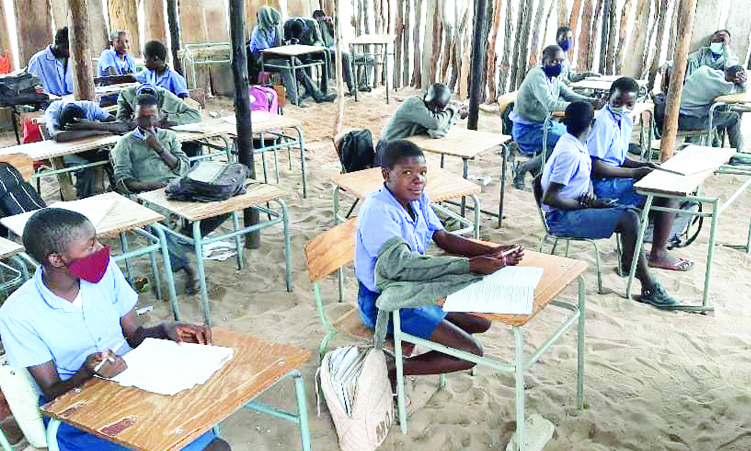

IIndji believes SMEs play an important role in the country’s economic stability and should receive more support to enable them to keep contributing to job creation in the country, especially given the current high unemployment numbers among the Namibian youth.

He said SMEs need support to enable them to help with the country’s economic recovery efforts as small businesses fulfil a vital function and a move to support them is a move towards supporting the economic growth of the country.

He acknowledged that access to finance remains a key constraint to SME growth, as it is one of the most cited obstacles in emerging markets and developing countries worldwide.

“A key area of our work is to improve SMEs’ access to finance and find innovative solutions to unlock sources of capital. Our approach is holistic, combining advisory and lending services to clients to increase the contribution that SMEs can make to the economy including underserved segments such as women-owned SMEs,” he said.

Iindji highlighted that not all businesses that applied for loans were successful, with 12 applications for N$31 million being declined for various reasons.

“FNB remains devoted to serving as a strategic partner in the economic recovery process and encourages entrepreneurs to approach our branch network for assistance. Let me also emphasise that proper cash flow management is crucial for eligibility for any lending activity,” he added.

“As part of our efforts to empower SMEs nationwide, we have also taken our updated value proposition to the regions, hosting stakeholder engagements with key regional representatives from the various municipalities, regulatory bodies as well as keen business people in the areas,” the banker said.

He said through these engagements, the bank gained further insights into the needs of SMEs on a regional level, allowing for better support for them.

– email: matthew@namibian.com

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!