Our president, Hage Geingob, has repeatedly complained about the classification of Namibia as an upper middle income country by the Bretton Woods institutions.

The president argues that this classification denies Namibia access to soft loans and grants.

He further states that Namibia needs concessional loans and grants to fight poverty and inequality.

The president reasons therefore that Namibia should be classified as a lower income country or lower middle income country like our neighbour Zambia.

On 12 October 2023, I had the opportunity to follow the Global Sovereign Debt Roundtable debate which took place in Marrakech, Morocco, during the 2023 World Bank and International Monetary Fund meetings.

I listened keenly to finance minister Situmbeko Musokotwane of Zambia. He started his intervention by saying he was embarrassed about the debt situation of his country.

DEBT DISTRESS

In 1996 the World Bank and the International Monetary Fund initiated the Heavily Indebted Poor Countries (HIPC) initiative.

HIPC was launched to ensure that no poor country faced an unmanageable debt burden.

Some debt for poor countries was actually forgiven. Zambia benefited from the HIPC initiative.

Today Zambia finds itself as one of the debt-stressed nations. Minister Musokotwane’s sense of shame is understandable.

Zambia is not alone in this dilemma.

Ghana, Chad and Ethiopia and a few other countries face a similar situation.

All these countries are low income or middle low income countries.

For its part, Zambia has enacted a law which gives power to parliament to reject or approve borrowing proposals from the executive branch of government.

The IMF recently said that 60% of low income countries are at risk or are already in debt distress.

It is for this reason that in recent years the G20 launched an initiative called the Common Framework for Debt Treatment.

The idea is to work out a mechanism for debt service suspension, while a debt restructuring exercise is under way.

This is envisaged to help the poorest countries deal with insolvency and problems of liquidity.

TEMPTATION

Zambia is one of the countries benefiting from the Common Framework for Debt Treatment.

The country has to negotiate with both bilateral and multi-lateral creditors, the likes of the Paris Club creditors, the IMF and others.

This demonstrates that to be classified as a low income or low middle income country can tempt poor countries to go on a borrowing spree, because concessional loans look ‘cheap’ at face value.

However, these loans, even the zero-rated interest rate ones, eventually have to be paid back in hard currency.

Risks of exchange rates fluctuations, sluggish economic growth and other externalities have to be taken into account.

Over time, low income countries will end up facing debt distress.

The IMF will then be happy to come in with a range of borrowing facilities to help debt distressed countries meet their repayment obligations or balance of payment support.

The facilities include funds from the Poverty Reduction and Growth Fund, Rapid Credit Facility, Rapid Financing Instrument, Catastrophic Containment and Relief Trust and similar financing facilities.

Most of these facilities are concessional loans, but they are still loans.

RESTRAINT

Looking at Namibia’s current national debt in relation to the Gross Domestic Product (GDP), we should already be alarmed by the rate of debt growth. According to Aaron O’Neil of Statista (13 October 2023), a global data platform, Namibia’s debt to GDP rose from 48,74% in 2018 to 70.38% in 2021.

Meanwhile, in 2020, the budget deficit hit an all-time high of 8,07%.

With such high rates of borrowing and high budget deficits, if Namibia had access to soft loans, the country could now be part of the G20 Common Framework for Debt Treatment.

In 2021, Namibia decided to redeem part of its Special Drawing Rights at the IMF. The value at the time was US$191 100 000.

Looking at the latest Namibia transaction with the IMF, I noticed that Namibia paid US$1 148 057 in interest.

The Bretton Woods system is therefore doing Namibia a favour by keeping it as a high middle income country. Our president should thank them for the favour!

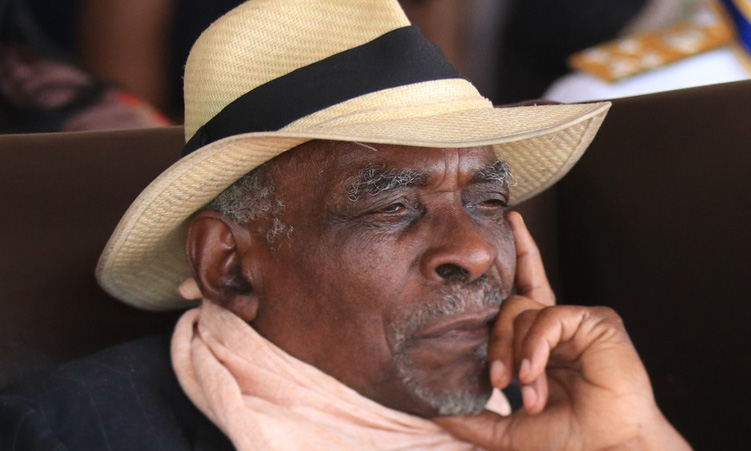

- Nahas Angula is a senior citizen and teacher emeritus.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!