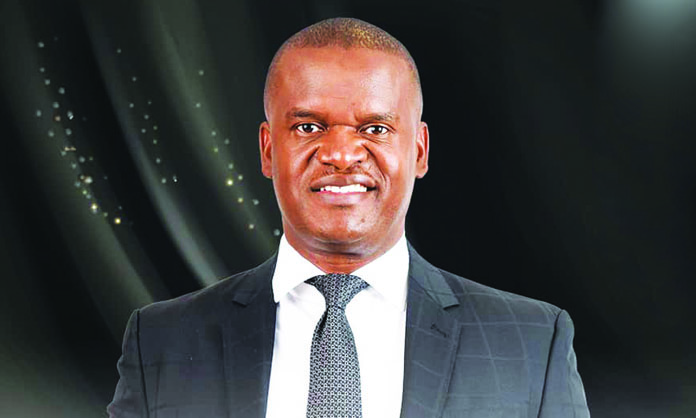

The National Petroleum Corporation of Namibia (Namcor) is charging suspended managing director Immanuel Mulunga with fraud involving N$123 million, breaching his employment contract, and allegedly leaking information to The Namibian.

Mulunga is reportedly facing three charges, with two emanating from the controversial Sonangol deal in which Namcor paid US$6,7 million (N$123 million at the time) on behalf of third parties to buy into an oil well owned by the Angolan state-owned oil company.

Mulunga yesterday declined to comment on the matter.

“I still have no comment,” he said.

Namcor spokesperson Paulo Coelho yesterday said he is unable to provide comment on ongoing proceedings.

“As the case is currently in progress, it is our policy to maintain confidentiality and uphold the principles of fairness and due process,” he said.

ANGOLA’S BLACK GOLD

The transaction that landed Mulunga in hot water is a N$123 million payment that pushed Namcor into oil-producing blocks in Angola involving Sonangol.

They formed a joint venture called Sungara Energies which includes Namcor, Sonangol and Sequa Petroleum from Britain.

This joint venture agreed to pay N$8 billion (US$451 million) to Sonangol P&P for a 10% interest in oil blocks.

The consortium was supposed to pay N$400 million (US$22,6 million) as a deposit to Sonangol Petroleum.

Namcor agreed to pay US$10 million (N$170 million) towards the deposit.

However, the partners only paid US$6 million (N$102 million), leaving a shortfall of US$6,7 million (N$123 million).

Mulunga then took the transaction to Namcor’s board on 19 August 2022, but the board allegedly rejected the proposal to pay the N$123 million.

It turns out Mulunga had already given instructions for the payments to be made before he sought the board’s blessings.

The board is charging Mulunga for fraud by withholding information from the director, “by making fraudulent misrepresentations to the board”.

SIN NUMBER TWO: BREACH OF TRUST

Mulunga is accused of breaching conditions of employment, causing a material breach of trust in relation to the Angolan transaction.

The board says by making the N$123 million payment to Sungara, Mulunga was in breach of his employment conditions.

He is accused of “not respecting and obeying company” rules and as managing director.

One of the rules Mulunga allegedly broke is failure to “display honesty and integrity at all times”.

The board charged him for failing to “report irregularities, fraudulent acts or omissions when becoming aware of such transgressions, failure to be honest and faithful to Namcor in all his dealings and transactions related to the company’s business and interest and to protect and promote Namcor’s reputation”.

The Angolan transaction was also investigated by international law firm Cliffe Dekker Hofmeyr Incorporated. The firm was already on Namcor’s payroll on a consulting basis to advise on a number of transactions and negotiations.

The firm concluded its review of the process leading up to the transfer of the N$123 million to Sungara and presented its findings to the board.

Its report, dated 14 December 2022, concluded that Mulunga’s actions were aimed at saving the deal, but pointed to the fact that he committed illegalities in the process.

“Our impression is that Mulunga’s decision to make the payment to Sungara was in the interest of saving the deal,” noted the internal investigative report.

However, the law firm did not clear Mulunga.

Its report further stated that he failed to follow advice from his own corporate governance department.

It further concludes that Mulunga was not authorised to make such a payment to Sungara without board approval, and that his instruction to former chief financial officer Jennifer Hamukwaya to make the payment was illegal.

The firm recommended three possible causes of action against Mulunga to the Namcor board.

“We recommend that the board address this issue with Mr Mulunga and that its concerns be recorded, and that Mulunga be cautioned that if a similar scenario should occur that it may result in his dismissal,” reads the law firm’s report.

The firm also advised that, should the board be of the opinion that its relationship with Mulunga is irreparably damaged, it had two options: to enter into settlement negotiations for Mulunga to leave his job voluntarily, or launch disciplinary proceedings against him.

The recommendations further state that should the board choose to go the disciplinary route, it needs to seek legal advice and input from the minister of mines and energy.

The Anti-Corruption Commision (ACC) also investigated the Angolan transaction, a probe that resulted in an unprecedented move by its director general, Paulus Noa, who issued a public statement in July, clearing Mulunga.

“He however, did so in the interest of Namcor and the country, after the board was consulted and kept deferring the discussion and decision on the matter,” Noa said.

The ACC said Mulunga was aware of the fact that despite the powers granted to him, he was not empowered to execute financial transactions, and therefore sought board approval by way of round ribbon and formal board meetings in his quest to save the deal.

“There is no evidence to prove criminal intention against the MD,” Noa said.

WALLS WITH EARS

The third charge involves the leaking of a conversation between Mulunga and Namcor board chairperson Jennifer Comalie.

The Namibian published an article titled ‘Namcor’s Power Struggle Exposes Suspicious Deals’ earlier this year.

The article reported that Comalie applied pressure on Mulunga to take action against Namcor’s executive of supply and logistics, Cedric Willemse.

In a way, Comalie was asking Mulunga about the concerns of Mathew Hamutenya, a businessman who accused the national oil company of stealing his company’s oil stored at the state-owned storage facility at Walvis Bay.

Hamutenya and Comalie are friends, but she denied any wrongdoing or that her intervention on Hamutenya’s behalf constituted a conflict of interest.

“Hi Imms, Mathew called me now very upset about this story as well and mostly the threats. I thought I could calm him down, but he says he can also threaten and get politicians involved,” Comalie told Mulunga in November last year.

She told Mulunga the fuel issue should be fixed so that the threats would stop.

“[He] has been going on for a while that they don’t get what they pay for … you really seriously need to address this,” she said.

Namcor is now punishing Mulunga for allegedly leaking this conversation to The Namibian.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!