Capricorn Group has recorded a loan book value of N$48,9 billion – up with 8,5% compared to the same period last year.

This was recorded in the group’s six-month financial results as at 31 December, which were released yesterday.

According to the report, the group recorded a profit after tax of N$827,6 million – a 18,5% increase when compared to the N$698,2 million in the comparative period in the prior year.

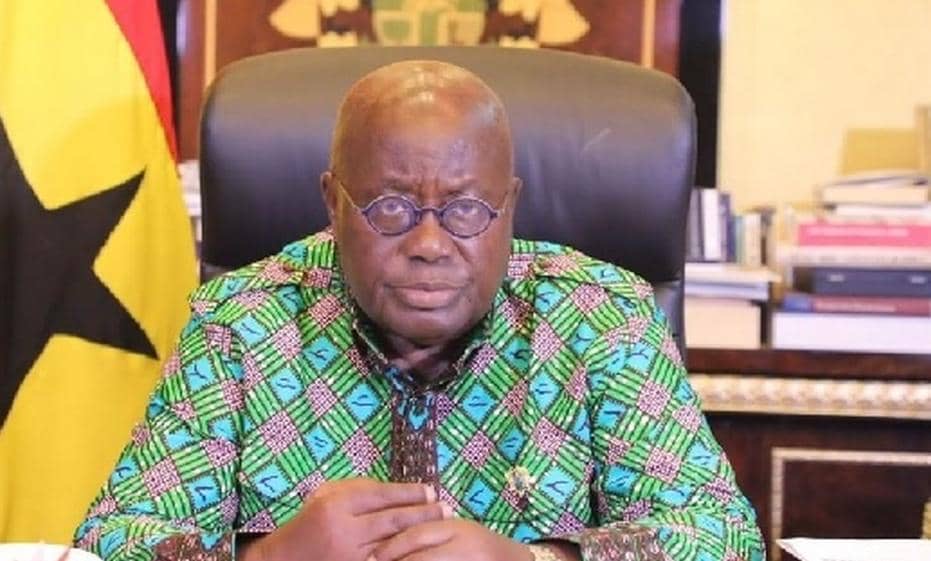

“The group’s strong performance is attributable to loan book growth and increased transaction volumes, offset to some extent by escalated credit impairment charges. Furthermore, the group’s profitability benefited from implementing International Financial Reporting Standards (IFRS) 17,” says Thinus Prinsloo, the group’s chief executive.

IFRS 17 replaces IFRS 4 and sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts.

“Excluding the positive impact of IFRS 17 on the group’s capital reserves, return on equity would have been 17,3% for the six months ended 31 December 2023,” Prinsloo says.

The lending businesses managed their cost of funding very effectively, leading to a 23 basis point enhancement of the net interest margin to 5,1% for Bank Windhoek.

However, non-performing loans increased from N$2,46 billion in June 2023 to N$2,66 billion in December 2023 – mainly due to increased inflation rates.

Additionally, the group pumped N$574 million into the government’s coffers through taxes.

“The group created a value of N$2,42 billion during the six months ended 31 December 2023, which was shared by its main stakeholders,” Prinsloo says.

The group made more money from fees, commissions and trading in the past six months, compared to the same period last year.

This is due to a strong growth in unit trusts and an increase in transaction and trading volumes.

“Non-interest income increased by N$177,5 million (19%), mainly from a N$67-million (10%) increase in fees and a N$57-million (62%) jump in net trading income for commissions,” Prinsloo says.

Expenses increased, mainly due to higher staff costs and increased business activity.

However, the group’s profits are still healthy and it has more than enough cash to meet its obligations.

The group has also recorded a healthy liquidity position, exceeding regulatory requirements in Namibia and Botswana by over 100%.

Additionally, the group declared an interim dividend of 48 cents per share, which is 23% higher than the previous year.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!