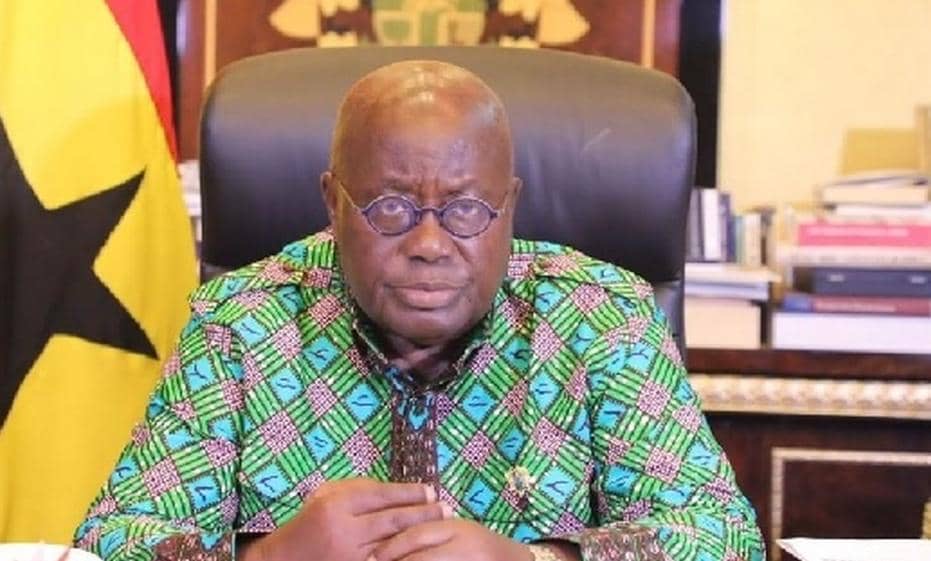

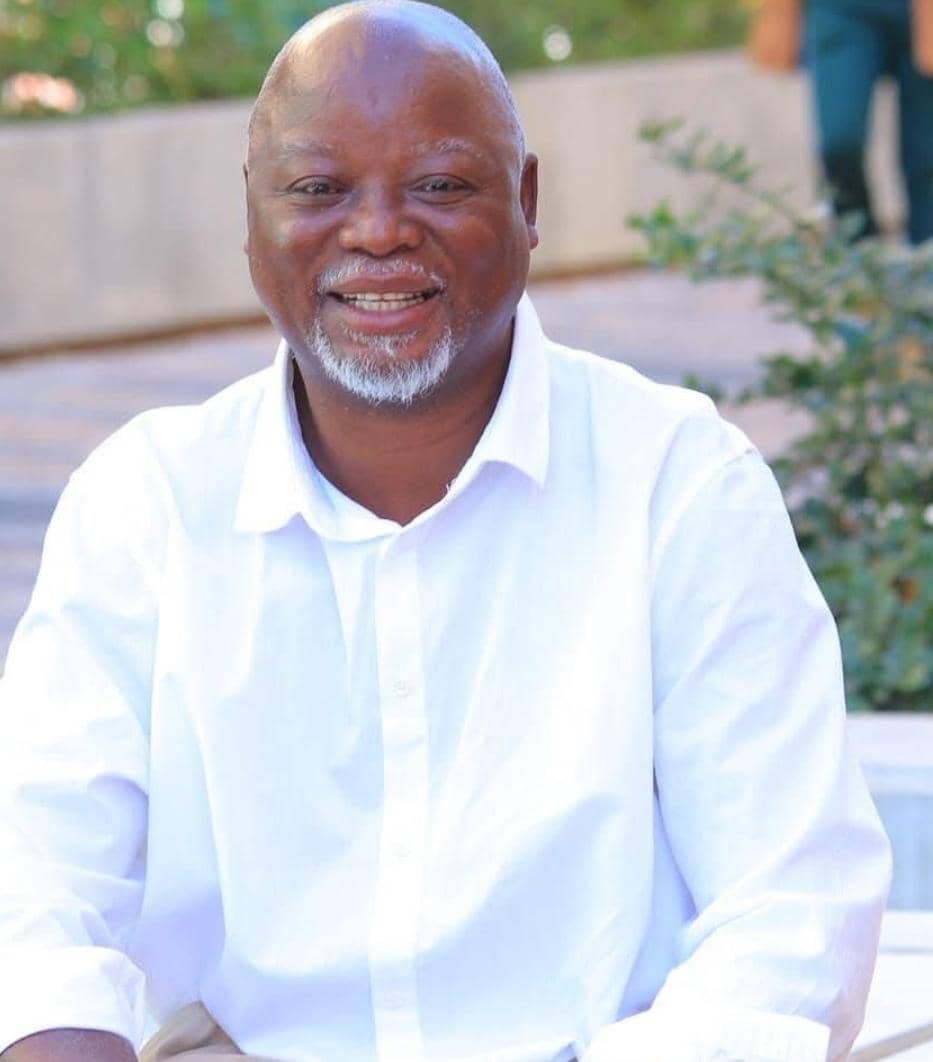

In this series of articles, Cameron Kotzé, the Tax Partner at Ernst and Young, discusses some topical issues for our readers In a previous article, I highlighted one of the amendments that will affect many taxpayers when completing their income tax return.

Taxpayers who have not claimed the cost of a vehicle against a travel allowance will not be affected by this amendment and you don’t have to read the rest of this article. The amendment simply does not affect you and you can carry on as if nothing has changed.The Receiver of Revenue wants to tax you on the selling price of your vehicle to the extent that you have recovered the cost of the vehicle that you have claimed in any prior tax year against a car or travel allowance that your employer paid you to use your own vehicle for purposes of the employer’s business.Schedule 19A of the tax return requires you to disclose information about the sale of any vehicle that has been used to claim expenses against a car or travel allowance received from the taxpayer’s employer.Note 31(a) to the tax return clearly instructs the taxpayer that vehicles reflected on schedule 19 (which have been used for business purposes and therefore expenses have been claimed against a car or travel allowance) should remain on that schedule until such time as the vehicle is sold or withdrawn from trade when it should be reported in schedule 19A.Note 31(b) to the tax return instructs the taxpayer to record the recoupment portion of the selling price of the vehicle in schedule 19A.The recoupment portion of the selling price is the amount by which the selling price exceeds the tax value of the vehicle sold.The tax value of the vehicle is the purchase cost less allowances claimed in prior tax years.It is the Receiver of Revenue’s practice to limit the deduction for vehicle expenses (the cost of the vehicle and the running expenses) to the amount of the car or travel allowance received from the employer.This practice results in some difficulty in determining the tax value of the vehicle because the Receiver disallows some of the expenses that are deductible for the tax year in question.We have now had confirmation from the Receiver of Revenue that the taxpayer can deduct the current year’s operating expenses (finance charges, fuel, repairs, insurance and licence fees) in the ratio of business kilometres to total kilometres first.To the extent that there remains any part of the allowance after deducting the allowable operating expenses, the cost of the vehicle is deducted but limited to the total allowance received from the employer.The Receiver has now also confirmed that the tax value of the vehicle will be determined by taking into account the amount actually allowed as a deduction against the allowance.This is very good news for the taxpayer as at least there is certainty about the method of calculating the tax value of a vehicle that is sold.The cost of the vehicle is only deductible against the allowance in the first three years of use.The tax value of the vehicle will therefore be fixed at the end of the third tax year.The longer the vehicle is used, the lower the proceeds will be and therefore the taxpayer may be entitled to a scrapping allowance (a deduction for tax purposes) if the selling price is less than tax value of the vehicle.Although the tax form makes no provision for a scrapping allowance the Receiver of Revenue has now confirmed that a taxpayer will be entitled to such an allowance should the selling price be less than tax value of the vehicle.The converse of the scrapping allowance is a recoupment which schedule 19A makes specifically provision for.So, where the selling price of the vehicle (or market value if you stop using the vehicle because you have given it to your spouse or child) is in excess of the tax value of the vehicle, the difference will be taxable in full in the year the vehicle is sold or withdrawn from use.Remember that you sign a declaration on page 1 of the tax return that all information disclosed in the return is true and correct.If you claimed a deduction for a vehicle against an allowance and you have stopped using that vehicle, you should complete schedule 19A of the tax return.Failure to complete the schedule could have the result that penalties are imposed for non-disclosure of the information.Should readers have queries, they are invited to send them to cameron.kotze@za.ey.com.The amendment simply does not affect you and you can carry on as if nothing has changed.The Receiver of Revenue wants to tax you on the selling price of your vehicle to the extent that you have recovered the cost of the vehicle that you have claimed in any prior tax year against a car or travel allowance that your employer paid you to use your own vehicle for purposes of the employer’s business.Schedule 19A of the tax return requires you to disclose information about the sale of any vehicle that has been used to claim expenses against a car or travel allowance received from the taxpayer’s employer.Note 31(a) to the tax return clearly instructs the taxpayer that vehicles reflected on schedule 19 (which have been used for business purposes and therefore expenses have been claimed against a car or travel allowance) should remain on that schedule until such time as the vehicle is sold or withdrawn from trade when it should be reported in schedule 19A.Note 31(b) to the tax return instructs the taxpayer to record the recoupment portion of the selling price of the vehicle in schedule 19A.The recoupment portion of the selling price is the amount by which the selling price exceeds the tax value of the vehicle sold.The tax value of the vehicle is the purchase cost less allowances claimed in prior tax years. It is the Receiver of Revenue’s practice to limit the deduction for vehicle expenses (the cost of the vehicle and the running expenses) to the amount of the car or travel allowance received from the employer.This practice results in some difficulty in determining the tax value of the vehicle because the Receiver disallows some of the expenses that are deductible for the tax year in question.We have now had confirmation from the Receiver of Revenue that the taxpayer can deduct the current year’s operating expenses (finance charges, fuel, repairs, insurance and licence fees) in the ratio of business kilometres to total kilometres first.To the extent that there remains any part of the allowance after deducting the allowable operating expenses, the cost of the vehicle is deducted but limited to the total allowance received from the employer.The Receiver has now also confirmed that the tax value of the vehicle will be determined by taking into account the amount actually allowed as a deduction against the allowance.This is very good news for the taxpayer as at least there is certainty about the method of calculating the tax value of a vehicle that is sold.The cost of the vehicle is only deductible against the allowance in the first three years of use.The tax value of the vehicle will therefore be fixed at the end of the third tax year.The longer the vehicle is used, the lower the proceeds will be and therefore the taxpayer may be entitled to a scrapping allowance (a deduction for tax purposes) if the selling price is less than tax value of the vehicle.Although the tax form makes no provision for a scrapping allowance the Receiver of Revenue has now confirmed that a taxpayer will be entitled to such an allowance should the selling price be less than tax value of the vehicle.The converse of the scrapping allowance is a recoupment which schedule 19A makes specifically provision for.So, where the selling price of the vehicle (or market value if you stop using the vehicle because you have given it to your spouse or child) is in excess of the tax value of the vehicle, the difference will be taxable in full in the year the vehicle is sold or withdrawn from use. Remember that you sign a declaration on page 1 of the tax return that all information disclosed in the return is true and correct.If you claimed a deduction for a vehicle against an allowance and you have stopped using that vehicle, you should complete schedule 19A of the tax return.Failure to complete the schedule could have the result that penalties are imposed for non-disclosure of the information.Should readers have queries, they are invited to send them to cameron.kotze@za.ey.com.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!