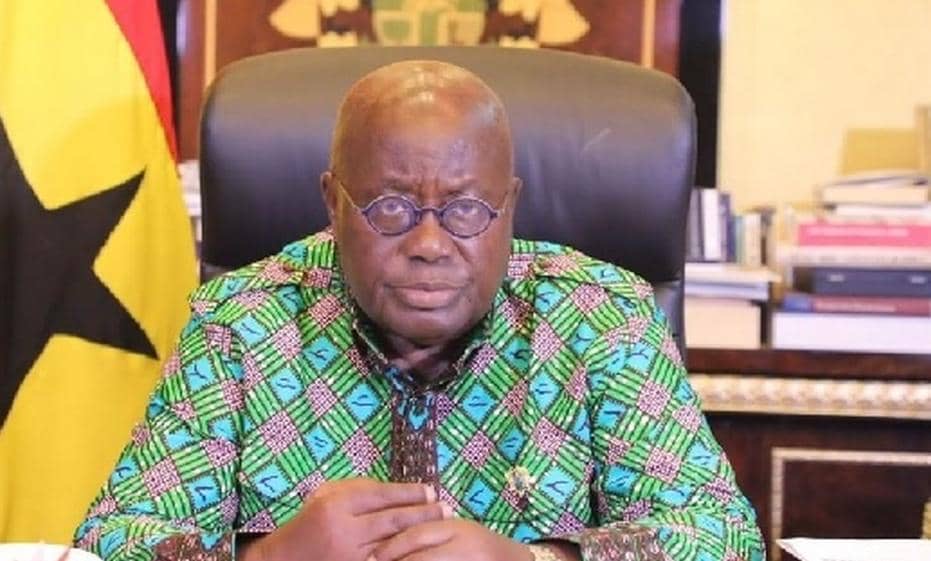

Financial Intelligence Centre (FIC) chairperson Johannes !Gawaxab warns of a double-edged sword as Namibia eyes a surge in oil and gas revenue, alongside a green hydrogen push.

Speaking at the launch of the financial watchdog’s annual report yesterday, !Gawaxab, who is also the governor of the Bank of Namibia (BoN), said while these sectors promise growth, there is a lurking threat of illicit financial flows through corruption, money laundering and terror financing.

“In light of this, it is essential for the FIC, accountable institutions and the entire financial sector to proactively establish the requisite capabilities for mitigating the introduction of new forms of financial crimes. By doing so, we cannot only protect our economy and resources but also attract more responsible and sustainable investments,” !Gawaxab said.

According to the Organisation for Economic Cooperation and Development, globally a mere 22% of the estimated US$1,2 trillion in annual proceeds from the sale of oil and gas commodities is remitted to government treasuries.

“This raises concerns regarding potential misuse and the subsequent depletion of resources for domestic mobilisation in oil-producing nations,” he said.

He further said there is a need to protect the local economy, particularly as new entities, such as foreign investors, multinational corporations and emerging technologies, enter the landscape. These entities, he said, bring with them complex financial structures and practices that may be vulnerable to exploitation for illicit activities.

“By being proactive, we can ensure that these entities operate within the bounds of the law and contribute to our economic growth in a sustainable manner. We are called to be responsible stewards of our resources for the sake of our country and the generations to come,” !Gawaxab said.

He said countries, including Namibia, must rethink financial crime policies and legislative and implementation design, as well as invest in technology and highly-skilled teams with individuals who can navigate hostile threats alongside regulatory changes and technological innovations.

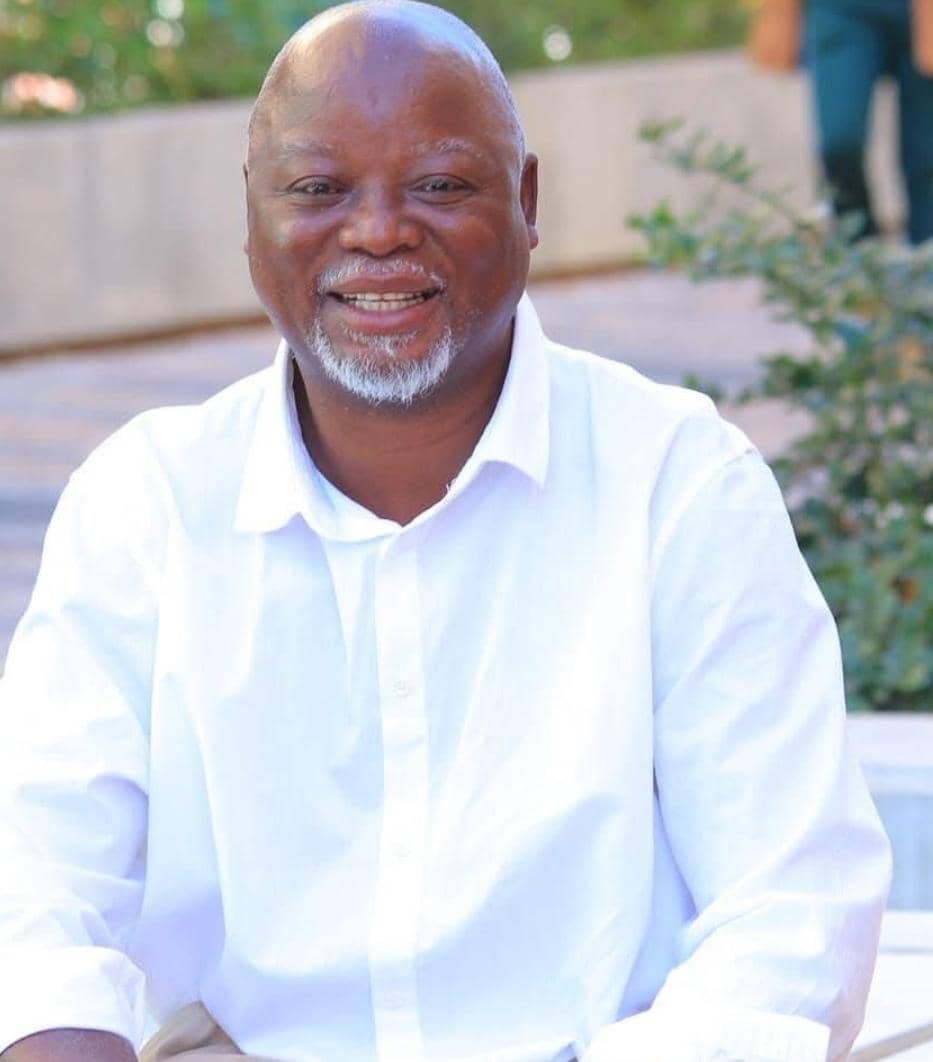

FIC director Bryan Eiseb last month said they are taking steps to counter potential money laundering and proliferation financing in the country’s booming oil, green hydrogen and betting industries.

Eiseb said the anti-money laundering, counter-terrorist financing and counter-proliferation financing legislative framework in Namibia comprises various complementary laws. These include the Financial Intelligence Act, the Prevention of Organised Crime Act, and various banking laws administered by BoN and the Business and Intellectual Property Authority Act.

Meanwhile, the FIC achieved an unqualified audit opinion. Reserves increased by 128% to N$44,3 million compared to the 2022/2023 financial year, reflecting robust financial management.

This represents a significant increase from N$19,3 million in the 2022/2023 financial year and N$22,8 million in the 2021/2022 financial year.

Total assets nearly doubled, showing a remarkable 93% year-over-year increase, driven by an increase in the liquidity pool held at BoN.

Operational cash flows saw a substantial increase of N$24,7 million year-over-year, bolstered by increased grant funding and strong expense execution.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!