Carbon markets are trading systems that sell and buy carbon credits.

Carbon markets allow businesses and individuals to compensate for their greenhouse gas emissions by purchasing carbon credits from entities that remove or reduce greenhouse gas emissions.

The main question is whether Namibia can become a leader in this carbon market trade, considering that Namibia has the world’s best irradiation. The answer, in my view, would be a definite yes, as we have the necessary infrastructure to attain tradable carbon credits thanks to our abundant solar energy resource.

One tradable carbon credit represents one tonne of carbon dioxide, or the equivalent amount of another greenhouse gas reduced, sequestered, or avoided. When a credit is used to reduce, sequester, or avoid emissions, it is considered an offset and is no longer tradable.

The importance of carbon credits stems from 2021, when the Intergovernmental Panel on Climate Change (IPCC) released a new report card on the world’s progress towards slowing climate change.

The bad news is that greenhouse gas (GHG) emissions continue to rise in all major sectors worldwide. Among the good news, renewables are now less expensive than coal, oil and gas.

Despite some progress, the world faces a significant challenge.

Scientists warn that 2°C of warming will be exceeded during the 21st century unless we achieve substantial reductions in GHG emissions now.

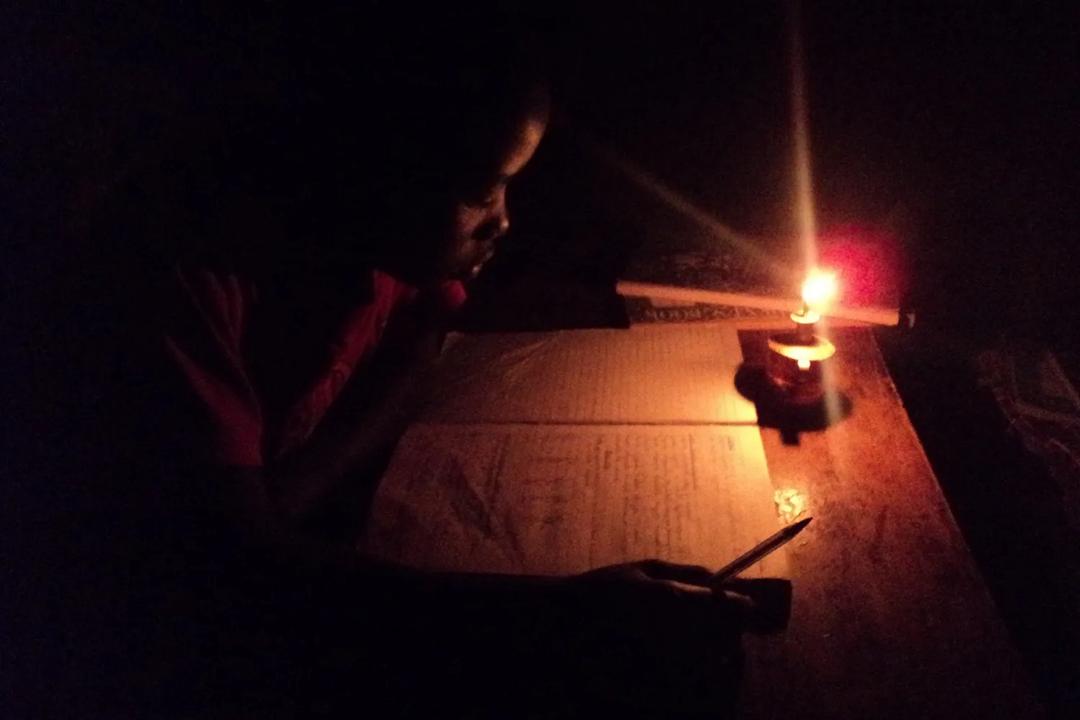

Effective action will necessitate concerted and sufficient investment, with the understanding that the cost of inaction will be significantly higher. Developing countries will need up to US$6 trillion by 2030 to fund only half of their climate action targets, as outlined in their Nationally Determined Contributions.

According to the most recent IPCC report, all countries are falling short, with financial flows three to six times lower than the levels required by 2030, with even greater disparities in some regions of the world.

So, how do we drive and finance the transformation necessary to address the climate crisis?

Many countries are considering carbon markets as part of the solution.

Carbon markets are broadly classified into two types: compliance and voluntary. Compliance markets emerge because of national, regional, or international policy or regulatory requirements. Voluntary carbon markets, both national and international, refer to the voluntary issuance, purchase and sale of carbon credits.

The current supply of voluntary carbon credits is primarily derived from private entities that develop carbon projects or governments that develop programmes certified by carbon standards that result in emission reductions and/or removals.

Demand comes from private individuals who want to offset their carbon footprints, corporations with corporate sustainability goals, and other actors who want to trade credits at a profit.

Emissions trading systems are one type of compliance market that many people are familiar with. Using the ‘cap-and-trade’ principle, governments issue emission/pollution permits or allowances to regulated businesses — or countries, as in the case of the European Union’s ETS — that add up to a total maximum, or capped amount.

Polluters who exceed their permitted emissions must purchase permits from others who have them available for sale (trade).

The European Union implemented the world’s first international Emissions Trading System (ETS) in 2005. In 2021, China launched the world’s largest ETS, which is expected to cover roughly one-seventh of global carbon emissions from fossil fuel combustion.

Many more national and sub-national ETS are currently operational or undergoing development.

Another well-known example of an international compliance market is the Clean Development Mechanism (CDM), which was established in 1997 as part of the Kyoto Protocol.

Under the CDM, emission-reduction projects in developing countries generated carbon credits that industrialised countries used to meet a portion of their emission-reduction targets.

- Lilongeni Unoovene is a renewable energy consultant.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!