As the year winds down, we take a look back at some of the business stories that caught the attention of the nation.

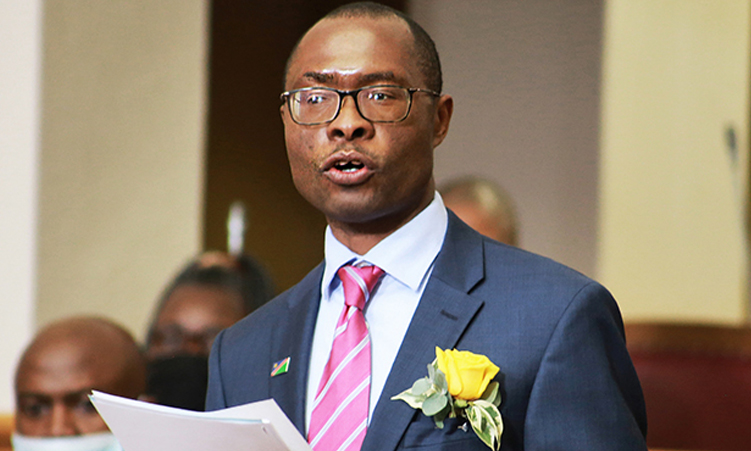

Shiimi’s tax relief

Minister of finance and public enterprises Iipumbu Shiimi announced a tax relief during the tabling of the budget in February.

The tax breaks include the first N$100 000 earned by employees being tax free.

Shiimi raised the tax threshold from N$50 000 to N$100 000 during his budget speech in parliament. This move exempts those whose earnings fall in that bracket from having to pay pay as you earn (Paye).

The new tax brackets came into effect in March, however, the law was only gazetted in October.

Members called to claim benefits

The Government Institutions Pension Fund (GIPF) has called on approximately 176 members to go and claim benefits that are due to them.

Edwin Tjiramba, the fund’s general manager of marketing and stakeholder engagement, says GIPF holds millions in what is referred to as ‘unclaimed benefits’.

“In terms of the GIPF rules, these benefits become ‘unclaimed’, where members or beneficiaries fail to claim them for a period of five years after the date on which they become payable.

The process to claim benefits typically begins at the employer’s human resources department, where personnel files are maintained,” says Tjiramba.

O&L terminates Pick n Pay franchise agreement

The Ohlthaver & List (O&L) Group announced in July that it will terminate its franchise agreement with Pick n Pay South Africa by 30 June 2025.

The O&L Group, through its subsidiary WUM Properties, owns and operates 19 Pick n Pay stores in Namibia. The group announced the termination to focus on being more customer-centric and Namibian market-oriented

O&L Group executive chairman Sven Thieme says the company’s priority has always been to serve Namibian customers with excellence and to contribute positively to the local economy.

Employers not Namra must refund workers’ tax deductions

Employers were instructed in September by the Ministry of Finance and Public Enterprises to adjust the Pay As You Earn (Paye) deducted from employees’ salaries to reimburse any over-deducted taxes paid from 1 March.

After the announcement, many businesses came out to complain that it should be the responsibility of the Namibia Revenue Agency (Namra).

“The employer will deduct the reimbursed Paye from the monthly employee’s tax amount to be paid to Namra,” says minister of finance Iipumbu Shiimi.

This was to ensure that the total tax paid by employees is equal to what they should pay in the 2024/25 financial year, according to the adjusted tax tables.

Standard bank hacked

Standard Bank Namibia reported in November that there was a limited number of unauthorised debit card transactions from an international merchant made from its clients’ accounts.

The bank sent a short message to some of its clients, confirming that their debit card details were compromised in an apparent hack.

The incident resulted in some clients’ bank balances going into minuses.

“Dear valued client, we have detected that your debit card details have been compromised.

We therefore blocked the card to avoid any further possible unauthorised transactions.

These unauthorised purchases will be refunded to you within 24 hours,” the bank said.

Fuel prices decrease

In September the Ministry of Mines and Energy reduced fuel prices by N$1.00 per litre.

This meant the petrol price at the port of import was N$20.25 per litre, while diesel 50ppm was N$19.72 per litre, and diesel 10ppm was N$19.82 per litre.

This was mainly due to a drop in global crude oil prices per barrel.

The drop was attributed to slower economic activity, particularly in China, which has reduced global oil demand.

The Namibia dollar also strengthened against the United States dollar, which reduced oil prices.

Oil is traded in US dollars in the international oil markets.

Namibia-ranks-10th-among-wealthiest-countries-in-africa

The Africa Wealth Report 2024 has placed Namibia among the ten wealthiest countries in Africa.

New World Wealth is currently the only known independent wealth research firm systematically tracking global wealth migration trends between countries and cities.

The firm tracks the movements of over 150 000 high-net-worth individuals in its in-house database, with a special focus on those with over $30 million in listed company holdings.

Namibia has a population of three million, out of which 2 300 have been recorded to be millionaires but no billionaires have been recorded.

Retail bonds for low to mid-income earners

The Bank of Namibia is set to introduce retail bonds, a new investment option for low to medium-income individuals.

These bonds offer a safer alternative to illegal financial schemes, backed by regulatory oversight.

Retail bonds are a form of a loan to a company or government. When individuals purchase a retail bond, they are lending to the government through the central bank.

Bank of Namibia spokesperson Kazembire Zemburuka said the initiative is to target individuals who ordinarily will not be able to afford the minimum N$10 000 required to buy treasury bills, or the N$50 000 required to buy fixed-income bonds.

“The purpose of introducing retail bonds is to provide individuals with a safe, accessible and straightforward investment option while promoting a culture of savings and financial literacy among Namibians,” says Zemburuka.

Tax relief to push up prices

Bank of Namibia governor Johannes !Gawaxab said the proposed tax relief will push up inflation.

This is because, the more money people have to spend, the more demand there is for goods and services, pushing up prices.

“Any tax relief means there will be more disposable income which will lead to people spending more,” said !Gawaxab.

Inflation is the rise in prices due to an over demand and limited supply.

N$14,2 billion leaves Namibia to South Africa

Capital outflow from Namibia to South Africa from January to August amounted to N$14,2 billion. This was a N$3,6-billion increase compared to last year.

!Gawaxab says this was mostly due to the interest rate differential with South Africa.

He said the country is still importing more than it exports.

Last year, outflow was recorded to be N$10,6 billion in the same period.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!