Africa continues to buy back what it sold, but at a higher price.

The continent exports most of its products in raw form and thereafter, imports the finished product.

These imports include raw minerals such as crude oil, diamonds, gold, iron ore, natural gasses and agricultural products.

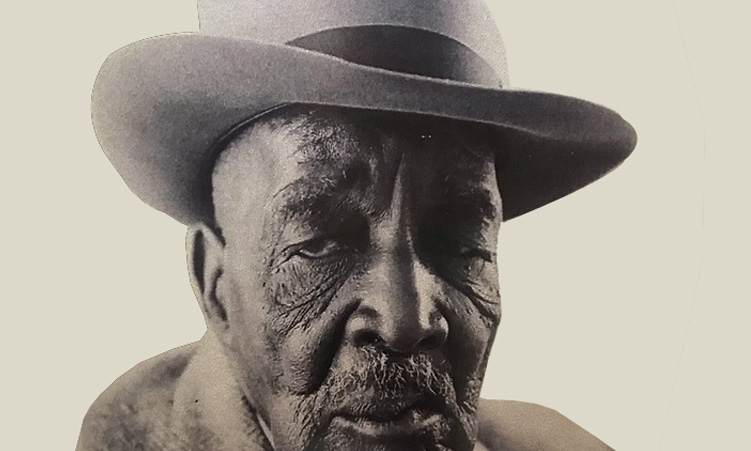

African Export-Import Bank (Afreximbank) vice president Haytham El Maayergi, speaking at the bank’s trade seminar in Windhoek yesterday, said Africa imports N$1.8 trillion (USD 100 billion) worth of food each year.

“This is an indicator that there is potential for value addition and job creation in the agribusiness,” said El Maayergi.

He highlighted that the continent has a deficit of about N$1.9 trillion (US$110 billion) in trade infrastructure.

He said Africa faces a challenge when it comes to accessing finance, because of the misconception that the continent is a risky investment destination.

“This perception, coupled with limited access to international financial markets, negative country-commercial balances and a shortage of local currency liquidity, has hindered the continent’s economic growth,” said El Maayergi.

The bank has introduced the African trade facilitation programme (Aftra) to address these challenges.

The programme offers guarantees and risk-sharing mechanisms to support African banks in securing the necessary financing for critical imports.

“Aftra provides information and guarantees solutions, enabling African banks to facilitate the critical inputs from machinery, critical raw material essentials for development, whatever they need for local industries,” he said.

El Maayergi said since its launch, Aftra has enabled African banks to facilitate billions of dollars in trade finance, alleviating working capital.

“Afreximbank has assumed a total of US$9 billion in African risk to facilitate wider input and active development of the country, with systematic refinancing to alleviate working capital stress for African banks,” said El Maayergi.

Over 150 banks across the continent are currently benefiting from the programme, and Afreximbank aims to expand its reach further.

“Our goal is to increase that number to 500 banks by 2026.”

Senior manager at Afreximbank Anthony Coleman said there are a lot of hurdles to small and medium enterprise trade finance uptake.

“There is a constraint to SME trade finance uptake, and this includes weak country and sovereign ratings,” said Coleman.

He added that there is also a lack of financial inclusion and knowledge on the continent.

Moreover, there is a lack of correspondent banking relationships.

“The way of doing business has changed and, therefore, the banking sector also has to change to the way it does business,” said Coleman.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!