Countries worldwide are scrambling to tighten their defences against financial misdemeanours by harnessing the power of Artificial Intelligence (AI) to enhance anti-money laundering (AML) efforts.

Globally, we are witnessing a technological revolution that promises to reshape the way our financial institutions operate.

Recent headlines have highlighted shocking insider threats in the world of finance, most notably a high-profile case in Switzerland where a board member of a prestigious bank was accused of laundering millions.

This stark reminder that even the most secure institutions can be vulnerable underscores the need for a solid response to financial crime.

In Namibia, where the financial sector is growing significantly, the stakes have never been higher.

The integration of AI into our AML strategies could prove to be a game changer.

GLOBAL REALITIES

That jaw-dropping case in Switzerland shows that insider threats are very real, and they are not just a European problem.

While our Namibian boardrooms might not yet boast such dramatic betrayals (fingers crossed), AI is becoming our secret weapon against internal fraud.

The risk of insider betrayals can never be discounted.

AI can enhance our internal controls and help to identify unusual behaviour among employees, thus deterring or preventing potential fraud from within.

Unlike traditional auditing methods, AI systems are impartial and relentless; they are not swayed by seniority or charm.

If an employee’s actions raise alarms, AI will flag them without hesitation.

This capability is particularly vital as Namibia’s financial sector expands and becomes more interconnected with global markets.

With the rise of digital banking, the potential for money laundering activities increases, making effective internal controls essential.

LET’S LEAD THE WAY

As Namibia continues to strengthen its regulatory frameworks to align with international AML standards, the role of AI will only become more significant.

Imagine a future where AI systems can share information across financial institutions, creating a network of vigilance that detects and prevents illicit transactions in real time.

Such advances would position Namibia as a leader in AML efforts within the southern African region.

Moreover, introducing collaborative platforms akin to Singapore’s ‘Cosmic’ initiative could facilitate information sharing among both financial and non-financial entities, enabling them to work together more effectively to combat financial crime.

By creating a centralised system for flagging suspicious activities, we can significantly enhance our ability to prevent money laundering.

LOOKING AHEAD

As we reflect on the challenges and opportunities, it’s clear that AI is a vital tool that is already making waves in Namibia’s financial landscape.

As the global fight against money laundering intensifies, our local institutions are beginning to embrace innovative technologies to stay ahead of criminal elements.

With AI as our silent watchdog, Namibia can help ensure that our financial institutions remain secure and trustworthy.

We are no longer just playing defence in the battle against money laundering, we are striving to save the future of foreign investors’ trust in Namibia.

We must consider investing in bettering our AML efforts.

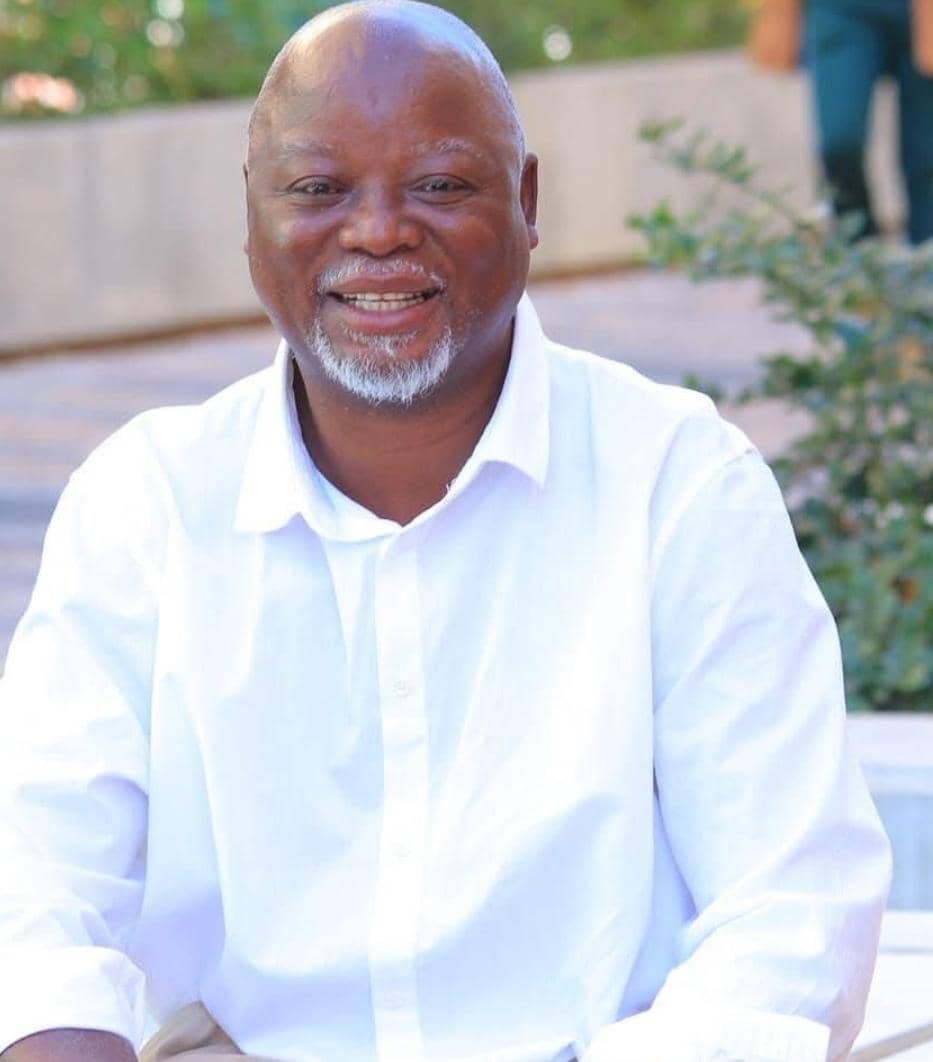

- • Karischa Schmidt is an AMLCPRAC (SA) compliance officer.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!