Namibian Stock Exchange-listed Andrada Mining has produced its first lithium concentrate as part of its off-site pilot test programme.

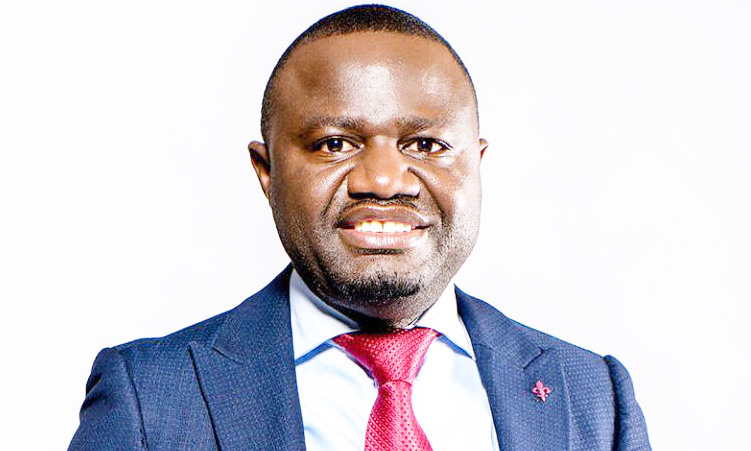

This was announced by the company’s chief executive officer, Anthony Viljoen, in an interview with a British media house (London South East) for the London Stock Exchange community.

Andrada (formerly known as Afritin) which is listed in London, is currently producing tin and tantalum at Uis in the Erongo region.

Viljoen said the company has a polymetallic ore body, meaning “we can derive revenues from a number of different elements”.

He said the lithium concentrate production marks a significant turning point for Andrada Mining, as the mineral is expected to be the primary driver of the company’s future growth.

“So we’ve got an existing operation, we’ve got a huge, huge resource, and we’ve got production that can come on stream relatively quickly.

“And we’ve got a very unique lithium product that can be sold to the industrial market with that. That accounts for 25% of the world lithium demand, but also, and very importantly, into the burgeoning battery market,” he said.

Viljoen said the company has put in place an aggressive timeline to unlock value in the short term in terms of getting the operation plant up and running to start producing lithium concentrate.

He said once the plant comes on stream, the company would gain a better understanding of the variability in all lithium body ore across a multitude of different pits.

“… it will also be able to give us the most consistent highest quality grade. We can then integrate that lithium circuit into the plant and start realising, realising early, and establish our company as a lithium producer and establish Namibia as a lithium-producing country,” he said.

Alongside its current mining licence areas, Andrada Mining is also exploring other licence areas with promising mineralisation potential.

Viljoen said the Lithium Ridge licence, previously known as Nanas, has shown impressive results with substantial mineralisation in soils.

Another area of interest is the spodumene hill (an area with potential lithium deposits), located just 11km from the company’s operations, which he says offers additional revenue-generating opportunities.

Furthermore, Viljoen revealed that debt funding of US$5,5 million (N$108 million) from the Development Bank of Namibia is set to be signed off at the end of the month, with a drawdown scheduled for June.

“We obviously also make very good cash on a monthly basis. Margins are really good, that’s with the expansion.

“So it’s a very well-designed share register, a very well-backed up and robust balance sheet, and it really puts the company in a strong position for growth,” he said.

– email: bottomline@namibian.com.na

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!