Canadian company B2Gold Corporation has successfully completed a financial deal in which it sold convertible senior unsecured notes (a type of debt) to investors.

B2Gold owns Otjikoto (gold) Mine in Namibia.

The company raised US$460 million (N$8.6 billion) by issuing convertible debt, with the option for investors to turn it into shares of the company, paying interest of 2.75% until 2030.

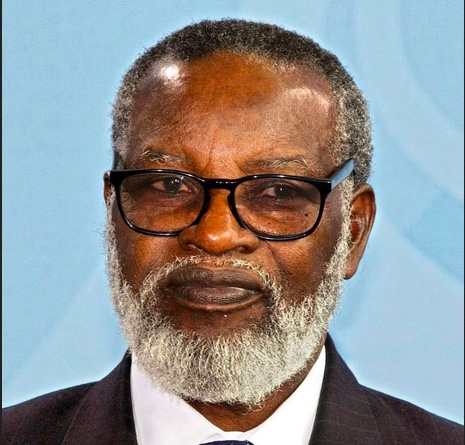

B2Gold chief executive Clive Johnson says the offering includes the option to buy an additional US$60 million principal amount of notes in total.

“The initial conversion rate for the notes is 315.2088 common shares of the company per US$1 000 principal amount of notes, equivalent to an initial conversion price of approximately US$3.17 per share,” he says.

The company intends to use the net proceeds from the offering to fund working capital requirements and for general corporate purposes, the statement says.

“To reduce interest expenses, the company will initially apply the net proceeds to pay down the outstanding balance under the company’s revolving credit facility, and then subsequently use future draws on the revolving credit facility to fund such working capital requirements and for general corporate purposes,” Johnson says.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada.

The company was founded in 2007, and currently has operating gold mines in Mali, Namibia and the Philippines.

It also has numerous development and exploration projects in various countries including Mali, Colombia and Finland.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!