In a world where financial tools and services are more accessible than ever, one question looms large: Why are so many people struggling with financial health?

Despite the abundance of financial services, platforms and tools available in the marketplace, consumers are more vulnerable than ever.

As life increasingly gets busier, these impacts are compounded, considering the sheer speed at which one often must take decisions that may have an extended impact on so many facets of everyday life.

Insights from a local financial services institution reveals troubling statistics for Namibians: 27% are finding it difficult to manage debt, one in four have fallen behind on household bills in the past year, and a staggering one-third have turned to friends and family to cover expenses. Additionally, 30% have had to dip into their savings to make ends meet.

“Consumers constantly face decisions that can either enhance or harm their financial well-being, and these choices often carry long-term consequences,” says Nedbank marketing and communications head Gernot de Klerk.

For instance, accumulating excessive debt can lead to high interest rates, living pay cheque to pay cheque, and even bankruptcy. The lack of retirement savings, a reality for 54% of Namibians in accordance with published data, is increasingly pushing elderly individuals into poverty.

“In today’s complex financial landscape, possessing money management skills is crucial.

This is why the concept of ‘financial literacy’ has grown in significance. It equips individuals with the knowledge necessary to establish a secure and prosperous future,” De Klerk says.

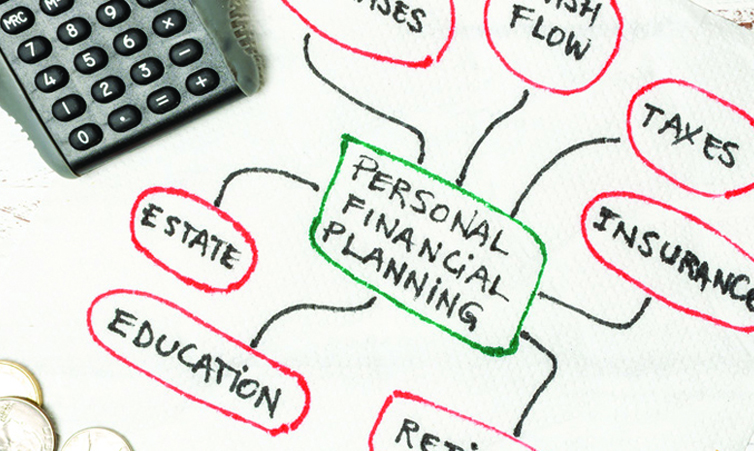

Although many skills fall under the broad umbrella of financial literacy, the most important is arguably budgeting – knowing how to manage expenses within one’s income; debt management – understanding credit, knowing when and how to borrow, and effectively managing loans and repayments; as well as saving and investing – learning to build and grow capital over time.

“The essence of what we continuously strive to achieve for our clients has been documented in a booklet, ‘Helping You Make the Most of Your Money’, in association with the Financial Literacy Initiative, which is squarely aimed at providing crucial information for maintaining financial health,” he said.

According to a 2017 report by the Namibia Statistics Agency, financial literacy of the average Namibian above the age of 16 was last estimated at 42.75% through a survey undertaken in 2013.

However, the average score for financial knowledge (51.18%) was higher than that for financial behaviour (32.26%).

In response to this pressing need to change financial behaviour, Nedbank Namibia launched the ‘Mokalefa’ campaign, which translates to ‘In the taxi’ in Oshiwambo.

Released in July 2024, the ‘Mokalefa’ campaign takes a departure from education curricula, opting instead for a humorous radio series complemented by engaging social media content and a YouTube channel.

Throughout the campaign’s eight episodes, passengers from diverse backgrounds discuss their financial concerns during their journey. Along the way, a knowledgeable passenger emerges as a financial expert, offering practical advice.

“The campaign seeks to fill knowledge gaps, with high jinks playing out in a setting familiar to so many Namibians: the taxi ride. This innovative approach addresses financial challenges in a relatable manner, aiming to make financial literacy enjoyable and accessible to everyone,” he said.

“By educating the public, the campaign aims to empower Namibians to take charge of their finances and it benefits our business as well. A financially literate population is less susceptible to scams and more likely to make informed financial decisions, which fosters a mutually beneficial relationship between banks and their clients.’

– Nedbank Namibia

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!