The Bank of Namibia is set to introduce the country’s first-ever retail bonds that will allow low to medium-income individuals to invest in government debt.

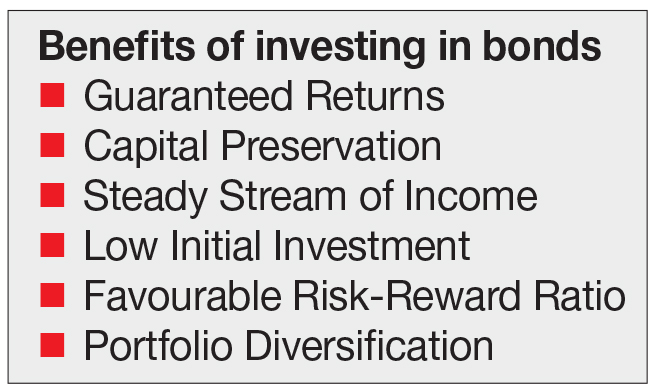

The bonds will offer a safer and reliable investment alternative to illegal financial schemes, says Bank of Namibia spokesperson Kazembire Zemburuka.

“Unlike illegal financial schemes, retail bonds are backed by regulatory oversight, ensuring that your funds are safe,” says Zemburuka.

Retail bonds are a form of a loan to a company or government. When individuals purchase a retail bond, they are lending to the government through the central bank.

Kazembire says the initiative is to target individuals who ordinarily will not be able to afford the minimum N$10 000 required to buy treasury bills, or the N$50 000 required to buy fixed-income bonds.

“The purpose of introducing retail bonds is to provide individuals with a safe, accessible and straightforward investment option while promoting a culture of savings and financial literacy among Namibians,” says Zemburuka.

He says the bonds will help in including more people in the financial system, especially those who might not have access to complex financial platforms.

“This is achieved through the lower minimum investment amounts compared to conventional bonds,” says Zemburuka.

Moreover, this will improve local financial markets through diversification of investment opportunities.

“Increased market participation is another benefit as a broad range of products attracts a wider range of investors which enhances liquidity,” says Zemburuka.

The bank is yet to decide on the minimum investment and tenure of the retail bonds.

Zemburuka says an update on the launch of the bonds will be provided at a later stage.

In South Africa, a retail bond can be bought for as little as N$1 000 and carries no commission, agency, or service fees.

News24 reported two years ago that RSA Retail Savings Bonds have attracted more than R25 billion since launching in 2004.

“Some 53 000 investments are still active, with about R9 billion invested. But the majority – 73% – of investors are 50 years or older,” the report said.

Investment specialist Arney Tjaronda says the move will empower ordinary citizens to participate in the bond market and grow their wealth through fixed-income instruments.

“This initiative fosters a culture of saving and investments, which helps inculcate financial discipline and long-term wealth accumulation among ordinary Namibians,” he says.

However, he says to be inclusive, these bonds should have a low entry barrier of N$500 or N$1 000.

“To prevent crowding out institutional investors, an upper limit of N$5 million per investor should be considered,” says Tjaronda.

According to Tjaronda, a retail bond is like a loan to a company or government, “in our case, the agent representing the government is the Bank of Namibia,”.

“When you purchase a retail bond, you are lending to the government through the Bank of Namibia for a specified period.

In return, the government promises to pay you regular interest payments, known as coupons,” says Tjaronda.

These coupons can be paid annually, semi-annually, or at other intervals, depending on the bond’s terms.

In Namibia, all the government bonds pay coupons semi-annually.

“At the end of the bond’s term, or maturity date, the government repays you the original amount you invested (principal) plus any accrued interest (if you have opted to reinvest those coupon payments),” says Tjaronda.

Tjaronda says the bonds usually offer lower barriers to entry compared to traditional government bonds traded which usually require large investments making it great for low income earners.

The bonds are also risk free investments as the government is legally obligated to honour interest payments.

However, redemption of retail bonds before the specified maturity date may incur penalties.

“Investors should carefully consider the bond’s terms and conditions before investing to avoid unexpected costs,” says Tjaronda.

To mitigate risk, he says the central bank should act as a guarantor for these bonds to “enhance investors’ confidence”.

“Offering fixed-rate bonds with a maturity of no more than five years is advisable,” says Tjaronda.

According to him, the central bank should establish an in-house bond portfolio for retail bonds and segregate the retail bond market from the institutional one.

“Establishing an in-house bond portfolio for retail bonds can help protect the market from potential volatility and ensure that the central bank’s borrowing plan remains unaffected,” says Tjaronda.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!