ACTING SME Bank chief executive Benastus Herunga has opened a criminal case against dismissed senior executives seeking reinstatement at the troubled bank to recover close to N$200 million supposedly invested in South Africa.

Namibian authorities have so far failed to recover around N$150 million of the investment, which was made into untraceable companies.

Athough details of the criminal charges are sketchy, understands that Herunga wants former SME Bank CEO Tawanda Mumvuma, finance manager Joseph Banda and treasury manager Alec Gore to be held accountable for the losses.

The three former executives fled the country in February this year, just before the Bank of Namibia took over the SME Bank and dismissed them.

So far, the trio have lost an urgent court application through which they sought immediate reinstatement at the bank.

Their lawyer, Sisa Namandje, yesterday said he was not aware of the criminal case, which he said, if true, would be a distraction by the temporary management of the SME Bank.

“Whatever he [Herunga] is doing is illegal,” Namandje stated.

Efforts to get comment from Herunga yesterday were unsuccessful, but sources said the interim SME Bank leadership was going after the three executives over the questionable investment transactions after realising that the bank was on the verge of collapse because of the N$200 million hole on its books due to the so-called investment in South Africa.

About N$150 million of this was channelled into four untraceable entities.

The former board, chaired by Cabinet secretary George Simataa, has not been charged, a source added.

The central bank took charge of the SME Bank because of the suspicious transactions involving the N$200 million.

It is now close to three months since the central bank took over the SME Bank, but it appears that the investigation to locate and recover the N$200 million is about to hit a dead end.

“Efforts to recover the money is continuing, and that part will be led by the police,” a police source said yesterday.

Sources told yesterday that there were several reasons why the investigation into the missing millions was not progressing.

Documents submitted to the High Court in the ongoing case in which the former SME Bank executives are suing the central bank over their dismissal reveal how the money was moved out of Namibia and through various accounts to an unknown location, partly because of a lack of cooperation with the South African financial institution which received part of the N$200 million from the SME Bank.

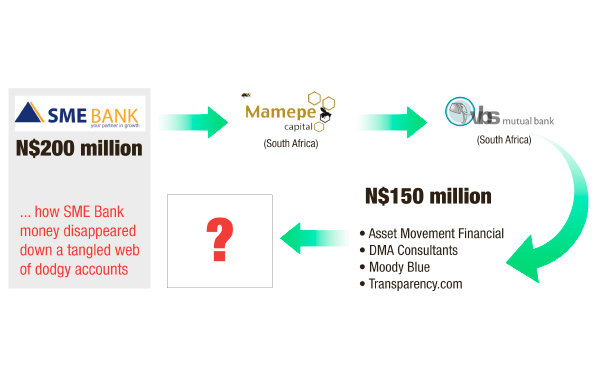

According to the court papers, about N$200 million was transferred to a South African company called Mamepe Capital, which, according to its website, specialises in corporate finance advisory, research and other financial services.

Banking statements cited by the central bank show that the N$200 million was invested in three batches between 12 August 2016 and 6 September 2016.

Central bank governor Ipumbu Shiimi said Mamepe Capital then invested N$150 million of that money in VBS Mutual Bank.

The documents also show that VBS Mutual Bank invested the N$150 million in several accounts of Asset Movement Financial Services, DMA Consultants, Moody Blue and Transparency.com. It is unclear how the N$150 million was spread amongst these four accounts.

An online search suggests that some of these entities probably do not exist, while others have few details to prove their authenticity.

According to Shiimi, the nature of these businesses was unknown.

“There are reasons to believe that at least N$150 million (if not all) of the alleged VBS/Mamepe investment may not be recoverable because the funds were paid into various accounts belonging to other beneficiaries,” he said.

Shiimi added that VBS Mutual Bank officials have indicated that the SME Bank’s account held only N$450 000, a sign that the rest of the money had been channelled to other entities.

To follow the money, the SME Bank had requested Mamepe Capital to provide details of the four accounts into which the money had gone.

“Mamepe is not responding,” a banker said.

Herunga wrote to the Financial Services Board – an independent body which regulates South Africa’s non-banking financial services’ industry – last month.

The SME Bank’s interim management also accuses Mamepe of stalling by questioning whether Namibian banking authorities had the right to demand such information.

A source familiar with the story said the money could not be located if Namibian officials are not informed about who owned the four accounts into which the money went.

“They cannot trace the missing money if they can’t get information on the ownership and flow of money from the four accounts,” said the source.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!