Local businesses fear they could be forced to close shop after a decision that employers have to pay employees Pay As You Earn (PAYE) tax refunds, and not the government.

Minister of finance and public enterprises Iipumbu Shiimi recently announced this move.

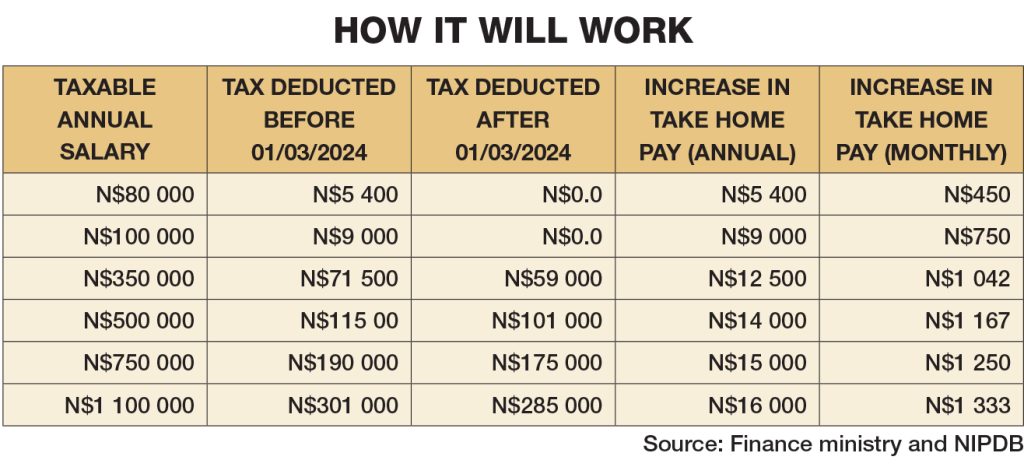

Earlier this year he announced tax relief measures that saw Namibians earning less than N$100 000 exempted from paying PAYE.

The tax threshold was raised from N$50 000 to N$100 000.

Black Business Leadership Network of Namibia (BBLNN) chairperson Eliphas Simon criticised Shiimi’s stance yesterday.

He said businesses are hard hit by the Covid-19 pandemic and the recession is ongoing.

Simon warned that forcing businesses to shoulder the burden of PAYE refunds could push many to the brink of closure.

“How do we afford to pay tax? Again this shows the insensitivity of the said minister when it comes to black empowerment in this country,” he said.

Simon said the ministry’s decision is not economically viable.

He said the ministry should rather dissolve the Namibia Revenue Agency (Namra), as it is using taxpayers’ funds to keep the agency operating.

“This is unconstitutional … It increases the rate of poverty and the minister is actually now saying small and medium enterprises should downgrade and send employees back home,” he said.

Simon said tax refunds may affect the day-to-day or year-to-year running of their businesses.

Namibia Local Business Association (Naloba) spokesperson Marius Nangolo believes the government should refund employers since overpaid PAYE amounts are paid to the government.

He said many businesses are already facing financial difficulties.

“Some companies have outstanding tax liabilities. If they were required to refund employees, it could lead to business closures,” Nangolo said.

“Some business owners are struggling to reach agreements with Namra due to their outstanding tax obligations, which are exacerbated by the challenging economic conditions in the country,” he said.

In a statement on Saturday Shiimi said employers must adjust the PAYE deducted from employees’ salaries to reimburse any over-deducted taxes paid from 1 March.

“The employer will deduct the reimbursed PAYE from the monthly employee’s tax amount to be paid to Namra,” he said.

This is to ensure that the total amount of tax paid by employees is equal to what they should pay in the 2024/25 financial year, according to the adjusted tax tables.

During a Cabinet briefing in May, Shiimi said the new tax brackets may only reflect on employees’ payslips in October.

He said the proposed law still has to go through the process of approval and gazzetting before it comes into effect.

Additionally, those who have changed employment would have to claim tax refunds from Namra next year on or before 30 June 2025.

“In the exceptional cases where employers do not have sufficient employees’ tax payable from which amount they can deduct and refund those employees now falling in the revised tax-exempt threshold of N$100 000 annual remuneration, the employee will have to claim a refund when submitting their 2025 return of income on or before 30 June 2025,” said Shiimi.

Employers will be mandated to refund employees for any over-deduction of PAYE taxes after the new tax rates become law.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!