… for ‘misleading’ competition commission

The Namibia Economic Freedom Fighters (NEFF) has called for the Bank of Namibia (BoN) governor Johannes !Gawaxab to resign after he was fined N$1 million by the Namibian Competition Commission (NaCC) for not fully disclosing that he allegedly sold businesses and shareholding in a major insurance company to family and friends.

The NaCC says !Gawaxab declared that he had sold such interests to “unrelated parties”.

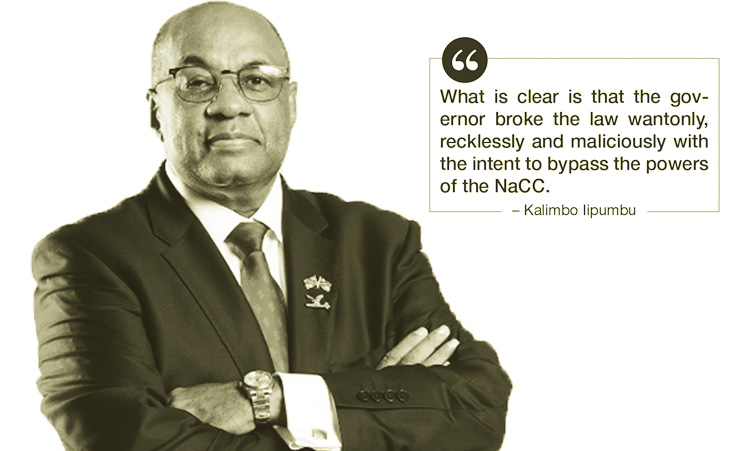

NEFF deputy leader Kalimbo Iipumbu has called on president Nangolo Mbumba to dismiss !Gawaxab from his position as head of the central bank within seven days.

Iipumbu says the head of an important institution like the central bank must be a person of integrity.

He says before being appointed as governor, !Gawaxab worked in the financial services sector for more than 27 years, and should have known what the Competition Act says about mergers.

“What is clear is that the governor broke the law wantonly, recklessly and maliciously with the intent to bypass the powers of the NaCC,” Iipumbu says.

He says the NEFF believes !Gawaxab should have resigned after he admitted that he contravened the Competition Act.

!Gawaxab did not respond to questions regarding the party’s call for him to resign yesterday.

LINGERING QUESTIONS

Questions are now being asked about whether !Gawaxab has willingly misled the central bank, while the legitimacy of the involved transactions has also been questioned.

To make matters worse, !Gawaxab, a business partner, and one of his former business entities were slapped with a N$1-million penalty by the NaCC in December last year.

The penalty followed an investigation by the NaCC, which found that !Gawaxab failed to inform the commission of his intention to sell his interest in the investment manager Eos Capital to friend and business associate Ismael Gei-Khoibeb.

The NaCC confirmed in a statement on Wednesday that a penalty of N$1 million was imposed on !Gawaxab, Gei-Khoibeb and Gamma Investment for implementing a merger without its approval.

This comes after an online publication, The Issue, on Monday reported that !Gawaxab declared to the BoN that he had sold his companies to “unrelated parties”.

NaCC spokesperson Dina //Gowases says !Gawaxab and others entered into a settlement agreement with the commission after an investigation found that the parties contravened a section of the Competition Act of 2003.

“To that end, the parties admitted to the commission that, on 10 June 2020, Mr !Gawaxab sold his member’s interest in Gamma Investment to Mr Gei-Khoibeb, in contravention of the act.

“The parties have also admitted that the transaction amounted to a merger in contravention of the act, and without the prior approval of the commission,” she says.

!Gawaxab in an emailed response to questions sent to him said: “All required disclosures in this matter were made to the BoN four years ago when I became governor, and the matter is closed.”

‘UNRELATED PARTIES’

In his declaration to the BoN, !Gawaxab stated that he had sold his members’ interests in Gamma Investment CC, the close corporation that owns Eos Capital, to an unrelated party, The Issue has reported.

Eos Capital is a financial services private equity firm which manages more than N$1 billion in investments.

Based on documents from the Business and Intellectual Property Authority (Bipa), Gei-Khoibeb took 100% control of Gamma Investment last year.

In 2020, he took over !Gawaxab’s 55%, but has now also acquired the 45% interest belonging to !Gawaxab’s former business partner, Nicole Maske.

The NaCC investigated !Gawaxab’s sale of his member’s interest in Gamma Investment to Gei-Khoibeb, and fined !Gawaxab, Gei-Khoibeb and Gamma Investment N$1 million for failing to seek its blessing before finalising the transaction.

!Gawaxab is quoted in court documents explaining that he was in a hurry to sell the shares, because he had to comply with laws governing the BoN, which prohibit him from holding interests in such a business.

He said continued ownership of Gamma Investments while occupying the BoN governor post would have constituted a contravention of the Bank of Namibia Act.

!Gawaxab sold another financial services company, Eljota Investment Managers, to Gei-Khoibeb for N$2 000.

He allegedly informed the BoN that he sold the company to an unrelated party.

Gei-Khoibeb did not respond to detailed questions about his business relationship with !Gawaxab at the time of publishing.

!Gawaxab further declared that he transferred his shares in the insurance giant Old Mutual to an “unrelated party” through a stockbroker.

The Issue reported that the “unrelated party” in this case was Anna Maria Kaoseb, believed to be !Gawaxab’s sister in-law.

The Issue further reported that this transaction involved 500 563 Old Mutual shares, with a combined value of about N$5,5 million at Monday’s trading price on the Johannesburg Stock Exchange.

Kaoseb could not be traced for comment at the time of going to print.

!Gawaxab referred questions to Gei-Khoibeb.

“May I suggest you contact Eljota Investments regarding the competition commission matter. I am no longer involved with Eljota Investments, as I disposed of my interest four years ago,” he said.

CASE SETTLED

Following the NaCC’s investigation of !Gawaxab’s sale of his 55% member’s interest in Gamma Investment to Gei-Khoibeb, !Gawaxab, Gei-Khoibeb and Gamma Investment, represented by Gei-Khoibeb, signed a settlement agreement with the commission in December last year.

In the agreement, !Gawaxab, Gei-Khoibeb and Gamma Investment admitted that they contravened Section 44 of the Competition Act of 2003, which states that the commission must be notified of a proposed transaction in which a party acquires control over the business of an undertaking, such as by acquiring the majority of the members’ interest in a close corporation.

They recorded in the agreement that !Gawaxab was appointed as governor of the BoN on 1 June 2020, and that he was required to comply with Section 25 of the Bank of Namibia Act to accept that appointment.

Section 25 of the act states that the central bank’s governor and deputy governors must dedicate their professional service to the bank and may not without the written approval of the minister of finance and public enterprises receive remuneration from any source other than the bank, or occupy any other office or position of employment except as an employee of the bank.

The section also states that a governor or deputy governor of the bank who contravenes the section commits an offence for which they can be fined up to N$100 000 or be sentenced to imprisonment of up to five years.

In the settlement agreement, it is stated that according to !Gawaxab and Gei-Khoibeb, it was “practically impossible” for !Gawaxab to comply with the Competition Act by notifying the commission of the transaction with Gei-Khoibeb at the same time that he had to comply with the Bank of Namibia Act by disposing of his interest in Gamma Investment.

!Gawaxab, Gei-Khoibeb and Gamma Investment agreed to pay the commission a penalty of N$1 million.

The settlement agreement was made an order of the High Court on Friday last week.

– The original article was produced in partnership with Integrity Namibia, a project of the Institute for Public Policy Research.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!