THE Capricorn Investment Group announced that they expect earnings per share to increase to double figures for the 2019 financial year.

The company revealed this in an announcement on the Namibian Stock Exchange news platform that not only will earnings per share increase, but their after-tax profits are expected to similarly increase by a figure of between N$56 million and N$102 million.

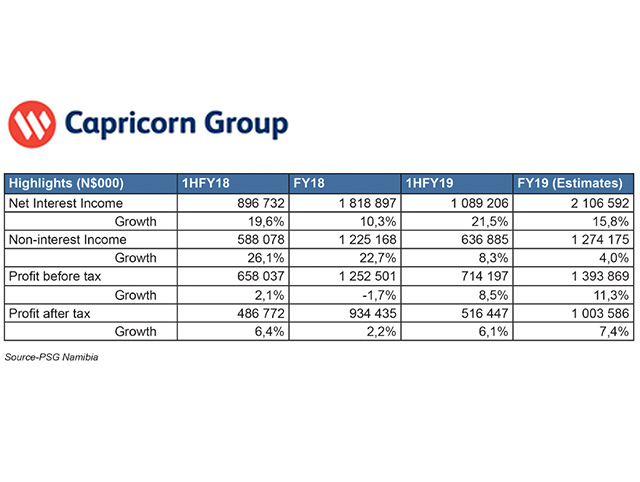

“The group’s profit after tax for the year ended 30 June 2019 is to increase between 6% and 11%, and headline earnings per share (HEPS) between 12% and 17%, compared to the prior year,” read the announcement.

Profit-after-tax last year stood at N$934 million, only a 1,8% increase if compared to the 2017 numbers.

The group and parent company of Bank Windhoek acquired Entrepo Holdings last year, which analysts expect to be the lead contributor to the increase in profit and revenue this year.

At the unveiling of the 2019 interim group results, Entrepo’s contribution to total group after tax earnings was around 15,5% or N$80 million, although it only has 2,4% of total group assets, according to an analysis made by IJG research analyst Dylan van Wyk.

Entrepo is competing with Letshego in the microlending space, with an estimated market share of around 18%. Letshego’s share is around 45% of the total micro-lending market..

Segments such as Zambian Cavmon Bank made a N$15,9 million loss at interim from its property development, unit trust management, asset management and Zambian banking operations portfolio, though losses were much lower, compared to previous years.

The group earned a net interest income figure of N$1,8 billion in 2018, which analysts at PSG Wealth Namibia expect to grow by at least 15% and hit N$2,1 billion for the 2019 financial year, while non-interest income stood at N$1,2 billion, and is expected to remain in the region of N$1,2 billion.

On assets, the group had a loan book of N$36 billion, matched to deposits of N$33 billion in 2018. Financial assets designated at fair value stood at N$5,2 billion, while debt securities in issue stood at N$4,7 billion.

Equity stood at N$5,8 billion, largely concentrated in distributable reserves of N$4,6 billion in 2018. The same distributable reserve was used to run IFRS 9 day-one adjustment of N$298,5 million during the first six months of 2019.

Non-performing loans at interim had increased by 60%, from N$1 billion to N$1,6 billion, which according to the bank were due to five large but “well-secured” loans being classified as non-performing, the IGJ research analysis reads.

A 30 cents per share dividend was declared last year, being the same average dividend paid since the company listed in 2014. The highest dividend paid by the group was in 2016, at 36 cents per share.

Other than their flagship Bank Windhoek, Cavmon Bank, Bank Gaborone and Entrepo Holdings, the Capricorn Group has stakes in Nimbus Infrastructure Limited (co-owners of Paratus Namibia), Sanlam Namibia and Santam Namibia.

Capricorn will release their 2019 financial results next week Friday, 23 August 2019.

Email: lazarus@namibian.com.na

Twitter: @Lasarus_A

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!