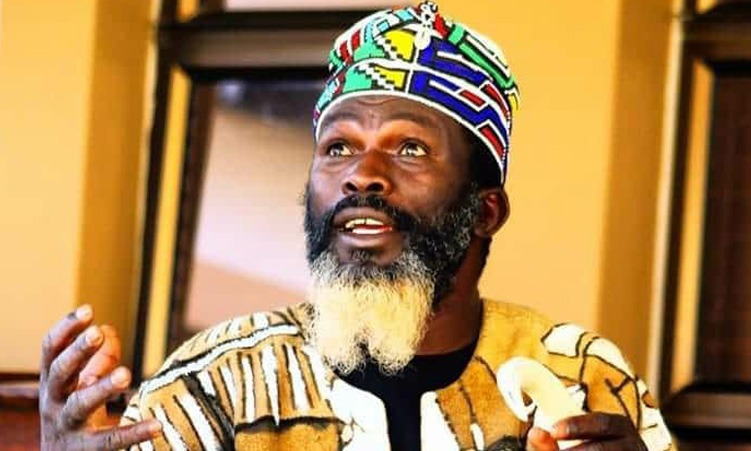

The Bank of Namibia and a retired army general from the Democratic Republic of Congo are in a court battle about more than N$40 million in a Namibian bank account, after the central bank decided to forfeit the funds in the account to the state.

The retired general, François Olenga, is suing the Bank of Namibia (BoN), the director of the Financial Intelligence Centre (FIC) and Nedbank Namibia (Nedbank) in the Windhoek High Court in an attempt to avoid losing more than N$40 million in a Nedbank Namibia investment account in his name.

Olenga is asking the court to review and set aside a decision of the BoN to forfeit funds in his bank account to the state.

He also wants the court to set aside all processes and decisions that led to the forfeiture order, and to declare that the central bank’s Foreign Currency Exchange Manual is invalid, null and void.

Olenga has informed the court that BoN deputy governor Leonie Dunn on 4 August last year issued a notice that the central bank decided the funds in Olenga’s investment account with Nedbank should be forfeited to the state.

The account had a positive balance of about N$39 million at that stage.

With the funds continuing to grow through interest, the account held about N$40.5 million in April this year, the court has also been informed.

The BoN’s exchange control department informed the bank’s board of directors in a memorandum in July last year that the bank was notified that Olenga received payments totalling N$70.5 million in Namibian bank accounts in his name from July 2010 to February 2015.

The payments came from Hungary, China and the West Indies, via a company registered in the United States of America.

The BoN board was also informed that, in addition to the funds in his Nedbank investment account, Olenga had about N$39 million in an account at the defunct Small and Medium Enterprises Bank, and that the BoN has had that money attached in terms of Namibia’s Exchange Control Regulations.

COMPLAINTS

Olenga says Nedbank notified him in August 2018 that his accounts with the bank had been restricted and that he should provide the bank with information about the source of his wealth.

During March 2019, Nedbank received a directive from Dunn, who at that stage was the director of the FIC, to place a restriction on his bank accounts.

Olenga says his accounts were kept blocked or restricted beyond a period of 12 days that is allowed in terms of the Financial Intelligence Act.

“This was a serious abuse of power and flagrant disobedience of the law,” he claims in a sworn statement filed at the court in October last year.

In August 2019, Dunn again directed Nedbank not to allow any withdrawal of funds from Olenga’s accounts with the bank.

“This was outright unlawful,” Olenga alleges.

He further says Nedbank informed his lawyer, Sisa Namandje, in October 2019 that the restrictions on his accounts had been lifted, but despite that he was not allowed to carry out transactions using the accounts after that.

In August last year, he was informed that Dunn – in her capacity as deputy governor of the BoN – issued a notice stating that the central bank has forfeited the funds in his investment account to the state.

Olenga is claiming that Dunn was “heavily compromised” and biased, because as director of the FIC she was previously involved in placing restrictions on his accounts, and as a result could not have an impartial mind when it came to the decision to forfeit the funds in his account to the state.

He is also alleging that the orders to block his accounts were done without him first being given an opportunity to be heard.

According to Olenga, “the forfeiture is unreasonable, unfair and in fact irrational”.

The funds in his bank account are not proceeds of any unlawful activities and were not deposited in the account in a manner that contravened Namibia’s foreign exchange regulations, Olenga says.

BOARD ACTION

According to Dunn, the decision to forfeit the funds in Olenga’s account to the state was taken by the BoN board of directors, of which she is a member.

Dunn says, in an affidavit filed at the court, that six of the BoN board’s nine members approved a recommendation made by the bank’s exchange control and legal services department, adding that “my involvement made no difference to the outcome”.

She also says Olenga’s accounts were being analysed, and not investigated, by the FIC for possible money laundering offences while she was the FIC’s director.

That process was independent from a later investigation by the BoN’s exchange control department to determine if there were contraventions of the Exchange Control Regulations involving the funds in Olenga’s investment account, Dunn says.

In another affidavit filed at the court, the BoN’s former director of exchange control and legal services, Bryan Eiseb, alleges that Olenga contravened the Exchange Control Regulations and the BoN’s Foreign Currency Exchange Manual by receiving payments of foreign currency in his accounts without submitting all relevant documents to substantiate the transactions.

Olenga “provided false and misleading information in respect of the transactions of foreign currency and therefore transgressed the regulations and the manual,” says Eiseb, who is currently the director of the FIC.

Eiseb says after the FIC received information about payments made to Olenga’s bank accounts, he issued an order to block Olenga’s investment account with Nedbank in August 2020.

Since then, Olenga has not clarified inconsistencies regarding the source of the funds in his account, and has not provided supporting documents to prove the source of the funds, according to Eiseb.

Judge Hannelie Prinsloo heard oral arguments on Olenga’s application against the BoN, Nedbank and the FIC’s director in the Windhoek High Court on Tuesday.

Prinsloo postponed the delivery of her judgement to 4 April.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!