ECO-Atlantic Oil & Gas (Eco), a Canada based oil and gas company, struck a deal to acquire a 75% stake in the Block 1 basin offshore South Africa.

Simultaneously, Tosaco Energy, plans to sell their 25% stake to Orange Basin oil and gas, a newly formed South African company with a ‘broad-based economic empowerment’ status.

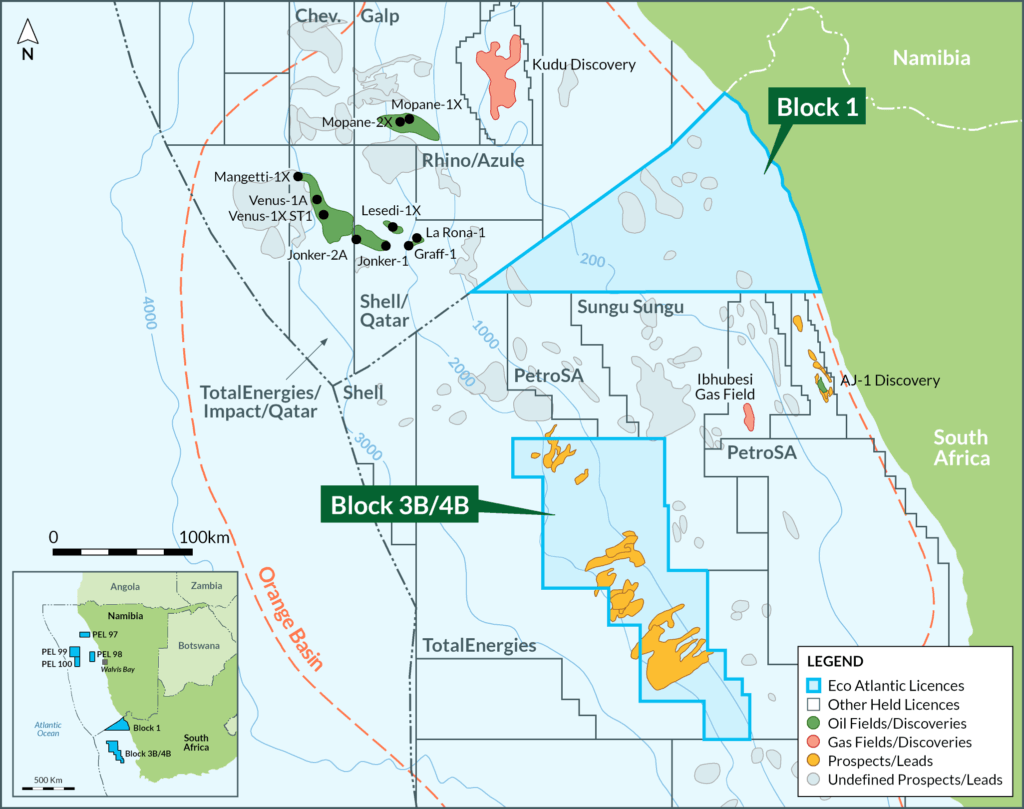

Eco will farm into Block 1, an offshore exploration block in the Orange basin on the South African and Namibian border.

Eco chief operating officer Colin Kinley says: “The Orange Basin continues to prove to be one of the newest and most prolific plays in the world and is running similar statistics to our Guyana play. Following completion of this farm-in, Eco will have one of the largest blocks in the entire Orange Basin.

“This is a strategic play for Eco that we have worked on over the past year, focussing on both oil and gas potential, and where we believe there are significant near-shore prospective gas resources,” he says.

“There are inboard gas discoveries on the block, Kudu to the north, and multiple discoveries in the Ibhubesi field to the south. With the reach of the block some 250km out into the Atlantic, this puts the west end of the block into highly prospective opportunities for oil being just south and on trend with Shell’s Graff discovery and Galp’s Mopane discoveries, and north of our 3B/4B block oil targets recently farmed out to TotalEnergies and QatarEnergy,” says Kinley.

Eco in a press statement says the payment will be made in three instalments totalling $750 000, each upon the fulfilment of certain conditions including the transfer of the title by the South African government and the completion of a resource report to be commissioned by Eco.

Eco also says it is relinquishing its 50% working interest and operatorship of Block 2B, also on the South African side of the Orange Basin.

It says the company has completed all necessary documentation, environmental audits and has informed the Petroleum Agency of South Africa.

In accordance with this, The Economist wrote that the strategic acquisition is on trend with a strong line-up of companies looking at tapping into the Orange Basin.

Since play-opening discoveries were made by energy majors Shell, TotalEnergies and Qatar Energy in 2022, over 15 finds have been made by an assortment of majors and independents.

The article continues to say in February 2024, TotalEnergies intersected hydrocarbon-bearing intervals in the Mangetti-1X exploration well in Block 2913B – marking the second discovery made by the company in the basin.

TotalEnergies is currently leveraging the Tungsten Explorer drillship to assess reserves available at the well.

The discovery followed the company’s Venus-1X find made in February 2022.

Research firm Wood Mackenzie estimates that Venus alone could hold as much as three billion barrels of oil – making it sub-Saharan Africa’s largest oil discovery.

The article emphasises that these discoveries underscore the size and potential of the Orange Basin, with substantial deposits likely extending into South Africa.

Block 1 is located on the maritime border of South Africa and Namibia, close to blocks held by Shell, Galp and TotalEnergies.

The block is also situated by the Kudu Development Project – Namibia’s inaugural natural gas project with 1,3 trillion cubic feet of reserves.

Kudu is poised to be a game-changer for the country, providing low-cost power and fuel, while laying the foundation for gas-driven economic growth.

As such, Block 1’s proximity means that the asset could likely yield similar developments and the Eco acquisition is the first step towards realising this goal.

“The Orange Basin continues to prove to be one of the newest and most prolific plays in the world and is running similar statistics to our Guyana play,” Kinley says.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!