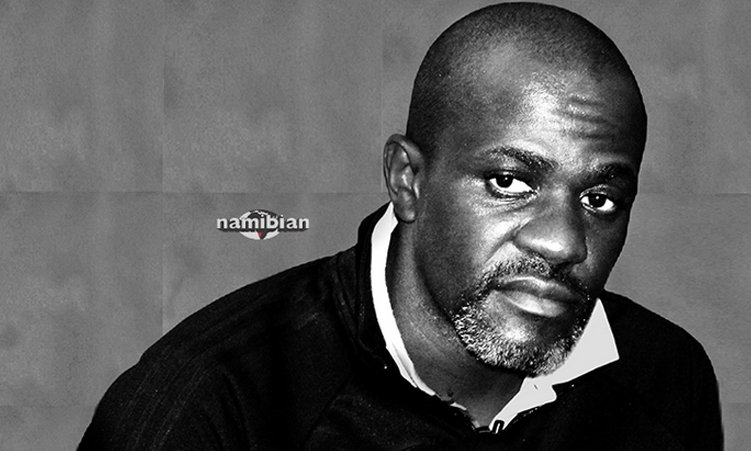

James Hatuikulipi, the man accused of masterminding Namibia’s biggest fishing corruption scandal, had the world at his feet, earning a total package of around N$30 million a year from his daily investment job.

His net worth was estimated to be more than N$1 billion in mostly cash, making him one of the richest people in Namibia.

That world came crashing down on 27 November last year when he was arrested for alleged corruption, fraud and money laundering.

It saw the emergence of Hatuikulipi as one of the key players in the Fishrot scandal that includes alleged corruption deals of more than N$2 billion.

How did Hatuikulipi go from being one of Namibia’s elite investment minds to an awaiting-trial prisoner?

This article is based on the accounts of 17 people who knew him intimately, as well as on court and public documents.

Hatuikulipi – the lastborn of four children – was politically connected from birth. His late father, Tauno Hatuikulipi, a church leader in the north, was a respected Swapo member.

His father died under mysterious circumstances after being persuaded to go into exile in Angola, where he was appointed head political commissar at Lubango.

Hatuikulipi was six months old at the time.

Some believe that one of the driving forces in Hatuikulipi’s life can be traced back to the father he never knew. It was the prelude to a long and complex relationship with the ruling party.

RISE AND SHINE

Hatuikulipi’s rise to the top started around 20 years ago. His eventual downfall would prove to be the slippery world of fish deals.

In 1998, a young analyst at stockbroking firm HSBC Securities Namibia wrote a critical industry analysis of Namibia’s fishing industry and the case for investing in it. He was also known for his analysis of the grape market.

That analyst was Hatuikulipi, then a University of Namibia commerce graduate.

He went on to become one of Namibia’s top-paid executives, allegedly earning about N$30 million a year, which included bonuses and other incentives such as shares and the purchase of houses abroad as the managing director at Investec Asset Management Namibia (now renamed Ninety One Assets Management Namibia).

Hatuikulipi’s N$1 billion nett worth estimate mainly includes cash parked in various bank accounts, sources said.

Some sources claimed that these figures were not correct as Hatuikulipi earned around N$7 million a year from Invester.

As he established himself, Hatuikulipi all but became embedded among Namibia’s ruling elite, some of whom ended up being his business partners, others his friends.

Whether it was his intention, or whether it was the affirmation of being accepted, he seemed to relish the position he found himself in.

He was not shy when it came to bragging about his connections. He often let slip that he delivered president Hage Geingob’s wedding suit in February 2015.

Hatuikulipi was apparently in London when he was asked if he could pick up the incoming president’s navy blue suit, made by Geingob’s personal tailor in London.

He delivered the suit just a few days before Geingob said “I do” on Valentine’s Day.

The Office of the President did not respond for comment.

ENABLERS

Up until last year, the sky appeared to be the limit for Hatuikulipi: He had thriving businesses, a multimillion-dollar farm, a mansion outside Windhoek, friends in high places and a top-paying job. But he wanted more.

At Outapi last year, Hatuikulipi boasted that he was building apartments for €80 million (N$1,2 billion) in the Spanish capital, Madrid – in a suburb frequented by football stars.

By November, though, the high-flying financier had fallen from grace: He and five close associates were arrested in connection with the Fishrot scandal.

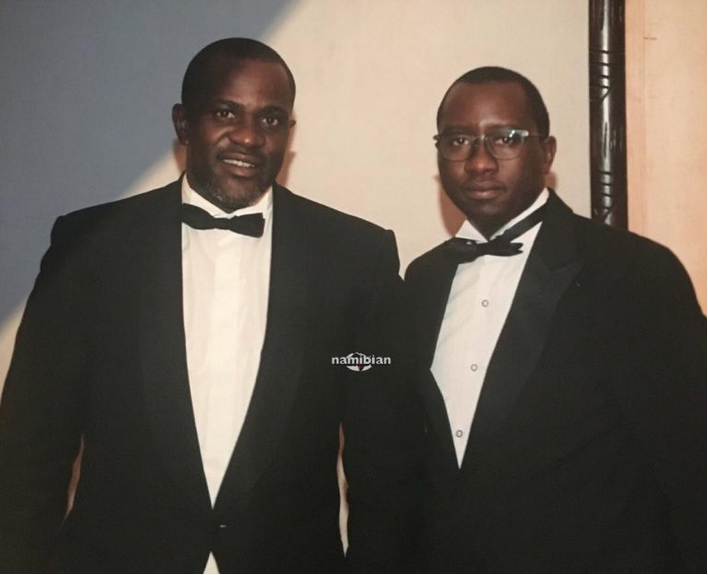

Among others, Hatuikulipi, Sacky Shanghala and Bernhard Esau have been charged with money laundering, bribery and corruption in exchange for granting lucrative fishing rights to Icelandic company Samherji.

Hatuikulipi’s arrest led to the collapse of some of his assets – at least in Namibia.

“My account has been garnished by the finance minister or officials under his authority and now appears to be in negative N$150 million,” he said in court papers this year.

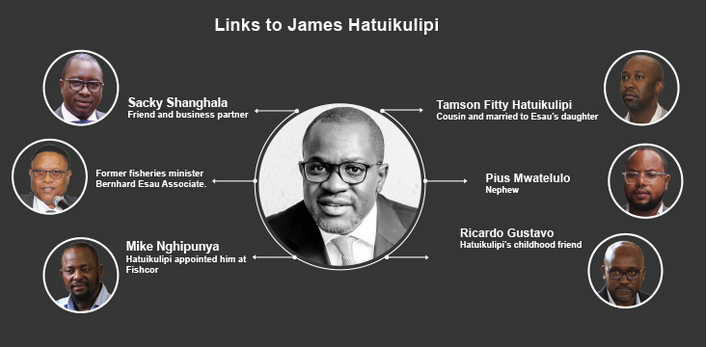

Of all the accused, Hatuikulipi stands out as the person with direct ties to each of the Fishrot suspects.

“He is the only person in this saga who is connected to every single person,” a source said.

His alleged involvement would not have been possible without several key enablers, such as former fisheries minister Esau and former justice minister Shanghala, who changed the law to facilitate the scheme.

Friend and business partner Shanghala was attorney general when the scheme was devised.

“Hatuikulipi is greedy but not stupid. He wouldn’t have put this together without Shanghala assuring him he would provide cover. Those two have a diabolical relationship and often convinced each other to do the dumbest things,” says a source who knows the two.

Unlike Shanghala, who opted for politics and allegedly harboured aspirations of one day becoming prime minister or president, Hatuikulipi preferred to operate in the shadows.

Tamson ‘Fitty’ Hatuikulipi, accused by the authorities of receiving N$70 million from the scheme, is his cousin.

Fitty is married to Ndapandula – former minister Esau’s daughter. Esau and James Hatuikulipi are also close.

Another Fishrot accused, Pius Mwatelulo, is his nephew, and ran some of Hatuikulipi’s businesses such as the Emona private hostels at the University of Namibia (Unam).

The other suspect, Ricardo Gustavo, is Hatuikulipi’s childhood friend.

As board chairperson, Hatuikulipi was key in employing Fishcor chief executive Mike Nghipunya, who authorities said, was not qualified for the job.

In 2015, Nghipunya employed Paulus Ngalangi as general finance manager.

Ngalangi’s family is close to James Hatuikulipi. Ngalangi often refers to Hatuikulipi as his big brother.

Hatuikulipi’s fingerprints stretch beyond Namibia’s borders.

He also has South African permanent residency.

According to Botswana’s newspaper Mmegi, Hatuikulipi also traces his relations to Botswana. He is allegedly engaged to Kelly Sibisibi, daughter to Jeffrey Sibisibi, former Kweneng District Council chairperson and former campaign manager for president Mokgweetsi Masisi.

THE ARCHITECT

Hatuikulipi generally preferred to stay out of the public eye, but was increasingly thrust into the limelight as his role in the Fishrot scandal unfolded in court.

Some painted him as the mastermind who pieced together the scheme, which allegedly enriched his family and friends and is claimed to have been used to fund Swapo’s and Geingob’s election campaigns. Hatuikulipi’s decision to operate in the shadows was deliberate.

Some also describe him as ruthless and say he loved being the main person in charge of money-making schemes.

A long-held dream – according to sources he often spoke to – was to own a private jet.

Hatuikulipi was fascinated by fisheries millionaire Adriaan (AJ) Louw, who has a large business base in Angola.

Hatuikulipi allegedly constantly spoke about him and dreamed of buying a jet like Louw’s.

“He really looked up to him. He wanted to amass the same wealth as he did,” a source said.

Louw told The Namibian earlier this month that he first met Hatuikulipi in 2016 in Angola.

“We showed him our land-based plants. I found him to be very intelligent and charismatic. He understood the fishing industry and he understood business,” he said.

“The fact that he was head of Investec Namibia really put me at ease and that indicated to me he had very good boardroom manners. As a businessman, he could catch something in the first three seconds. It was quite nice to deal with him at the time,” Louw said.

‘MOTHER OF ALL DEALS’

Hatuikulipi, Leevi Hungamo and Shanghala were beneficiaries of what has since been dubbed ‘the mother of all deals’ in 2004 – a multimillion-dollar state oil tender from which they pocketed profits estimated to be in the region of N$120 million over three years.

The government had awarded a fuel supply deal for three years to Namibia Liquid Fuels (NLF), a joint venture with Sasol, South Africa’s synthetic fuel producer.

Hatuikulipi, Shanghala and Hungamo controlled NLF through Hanganeni Investments.

Another of Hatuikulipi’s close friends is Ricardo Gustavo.

The two have known each other since childhood, when they played football for their neighbourhood team ‘Die Jollers’ from Windhoek’s Wambo Lokasie.

While Hatuikulipi was an above-average midfielder, his late older brother, Dennis (Ngelema), was the exceptional footballer in the family, playing for elite Windhoek sides such as Tigers.

Hatuikulipi’s partnership with Gustavo was rekindled in 2013. Hatuikulipi appointed Gustavo as Investec Namibia’s client manager, making him second in command of the company.

At the time, Hatuikulipi and the Investec team were struggling to convince the Angolan government to invest N$2 billion of its sovereign wealth fund in the Investec portfolio.

He roped in his childhood friend to help him with the deal.

It remains the single biggest investment of the entire Investec group worldwide, sources have said.

Those close to Gustavo say he has a vast political and business network in Angola that gave him access to power.

His father was the head of the association of Namibian-based Angolans, a highly rated body recognised by the Angolan embassy in Namibia.

Angolan president Joao Lourenço attended the association’s commemorative dinner in 2018.

Gustavo is accused by Namibia’s Anti-Corruption Commission (ACC) of transferring N$120 million of alleged Fishrot money to a Dubai-based company, Tundavala Invest, set up and owned by Hatuikulipi.

The name Tundavala refers to an escarpment near Lubango in Angola, where his father and other Namibians allegedly disappeared.

Hatuikulipi is the owner of Grey Guard CC, Otuafika Logistics CC and is a trustee of Cambadara Trust, which have also been named as Fishrot beneficiaries.

It’s unclear what inspired James and Shanghala to name some of their companies, but there appears to be a sequence.

‘Cambadara’ means ‘try’ in Rukwangali while ‘otuafika’ means ‘we have arrived’ in Oshiwambo.

The combination of two names of their companies – Hanganeni Emona and Olea Investment – appear to send out a message.

‘Hanganeni, emona olea’ can be loosely translated as ‘come together, wealth is here’ in Oshiwambo. Sources said this was a coincidence.

PROXIMITY TO POWER

To try and understand Hatuikulipi, we traced his footsteps. Born in Windhoek on 21 June 1975, James Hatuikulipi was six months old when his father, Tauno Hatuikulipi, joined the liberation struggle in exile. He would never see him again.

Tauno Hatuikulipi, a charismatic Swapo political commissar with the People’s Liberation Army of Namibia (Plan), died in mysterious circumstances in Angola in about 1984 during Namibia’s war of independence.

Some people suspect he was tortured to death at Swapo’s camp in Lubango.

At the time, Hatuikulipi was 10 years old. His mother was a nurse.

His paternal aunt, Toini, is married to Swapo’s current deputy secretary general and former deputy prime minister, Marco Hausiku.

He lived with the Hausikus during his high school years at St Pauls’ College and Centaurus Secondary School in Windhoek. They paid his school fees and took care of him.

FRIENDS IN HIGH PLACES

Hatuikulipi graduated from Unam with a BComm. He also holds a bachelor of commerce honours (investment analysis and portfolio management) from the University of Cape Town.

Most of his closest business allies are long-time friends or acquaintances.

He met two of his business partners, Leevi Hungamo and Shanghala, as students at Unam.

In 1997, Hatuikulipi was put in charge of Unam’s SRC finance committee.

Shanghala was actively involved in student politics through the Namibia National Students Organisation (Nanso).

Shanghala, who studied law, went on to become Namibia’s attorney general. Hungamo, who did an economics degree, went on to work in the Presidency and later as permanent secretary in the National Planning Commission.

In 1998, Hatuikulipi worked for stockbroking firm HSBC Securities Namibia. He moved to Metropolitan Namibia as an investment analyst, later landing a senior job as portfolio manager at Alliance Capital. In 2002, he moved to Cape Town, eventually joining Investec Asset Management and was promoted to head its Namibian subsidiary.

‘KAMARADA’

On a personal level, Hatuikuilipi is said to be committed to tightening family ties.

Some suggest that he values family and other close relationships because he was an orphan and has no children of his own.

In the family, the 45-year-old is known as ‘Kamarada’. On the business front, his combative skills made him a household name in the financial sector.

Hatuikuilipi is also known as ‘Jimo’ or ‘Okaana Kadjuu’, which refers to ‘a tough person’ in Oshiwambo.

He is described as intelligent and hardworking and is reportedly an early riser – heading to bed by 21h00 or 22h00 and then getting up at 05h00 to work.

Hatuikulipi loved cycling, sometimes covering up to 70 kilometres at a time.

He is known to be something of a traditionalist and allegedly prefers to date women who can cook and do the chores.

Hatuikulipi is said to have been engaged to the last four women he has dated over the past few years.

Sources close to Hatuikulipi describe him as moody, charismatic and a person who knows how to position himself as the ‘go-to guy’ in business deals or family engagements.

“Hatuikulipi is a numbers man and he sees the world through numbers,” one of the sources said.

His main interest lay in investing on the stock market and buying properties such as office blocks to rent.

“He is not into things such as farming, so for me it came as a surprise when he bought a farm with Sacky,” the source added.

A friend told The Namibian he was surprised to learn that he had taken a seat on the Fishcor board.

“He never wanted to serve on boards as he felt they were too politically inclined and not good for his reputation. Although he had access to the political elite, he never saw himself as having a political role,” the friend said.

DECEMBER DEALER

Hatuikulipi has interests in rail construction, real estate, catering and finance. At first glance, his businesses appear to be genuinely entrepreneurial, with offices, staff and operational activities across the country.

However, closer scrutiny shows that his business empire was mainly built using his proximity to power.

One method was to create joint ventures between his companies and state-owned agencies – a sustainable business model, because government revenue is often guaranteed in agreements that last longer than 20 years and in some cases are open-ended.

His joint ventures with the state often included people in powerful positions.

Hatuikulipi’s Hanganeni Investments had at least three politically connected owners when the company won a N$120 million state petroleum enrichment deal in 2004.

They were:

Ndeutala Angolo (permanent secretary in the Office of the President), Leevi Hungamo (director and economic adviser to the president) and Shanghala (special assistant to the attorney general).

Hatuikulipi also invested in D&M Rail Construction, a rail maintenance company, in which he bought a minority stake. It later became Namibia’s main rail construction company, partly due to its deals with state-owned TransNamib.

Hatuikulipi loved making deals while most of Namibia was on holiday.

The Namibian reported in mid-December 2011 that while the construction industry was on holiday, the Cabinet was presented at one of its final meetings of the year with an emergency request to come up with a N$150 million package to renovate a dilapidated 400-km stretch of railway line between Kranzberg and Tsumeb.

To cement D&M Rail Construction’s dominance and long-term survival, a joint venture with TransNamib was formed to create Namibia Rail Construction.

Media reports at the time said Hatuikulipi’s close friend, Sacky Shanghala, had a hand in ensuring that the open-ended contract received the necessary blessings from the authorities.

In December 2016 Hatuikulipi eyed another deal.

He travelled to Angola and visited a fish factory run by businessman Adriaan Louw.

The following month, Hatuikulipi oversaw the formation of a joint venture between Louw and Fishcor. The partnership was called Seaflower Pelagic Processing.

Even Hatuikulipi’s day job at Investec relied heavily on government deals.

Last year, The Namibian reported that Investec Asset Management Namibia manages N$17,2 billion in state funds, including N$16 billion from GIPF, N$800 million from the Social Security Commission, and N$300 million from the Guardian Fund for orphans.

COMPANIES

The Namibian understands that some of Hauikulipi’s fellow shareholders plan to remove him from the companies he owns. Some are allegedly under pressure from the banks to remove him, as he has been tainted by serious allegations of money laundering.

His main company is Hanganeni Investment Holdings, which brands itself as a preferred investment partner “in agriculture, mining, brewing, information and communications technology, industrial catering, manufacturing, and property development and management”.

His stake in Hangangeni is allegedly worth around N$10 million. Hatuikulipi and Shangahal resigned from Hanganeni as directors.

Hanganeni owns Hanganeni Emona – a 800-bed hostel development at the University of Namibia constructed for N$160 million. The partnership between Hangeneni and Unam is for 30 years.

Hanganeni also owns Ububele Holdings, which consists of two subsidiaries: Alpine Inflight Catering and Enviro Weed. Alpine provides in-flight catering services at Hosea Kutako International Airport, while Enviro Weed is a distributor of pesticides and herbicides for the agricultural sector.

Hanganeni also has an interest in Network Energy & Telecom Solutions, which operates in the telecommunications and energy sector.

Another Hanganeni subsidiary is JaLeSaNd Properties, the group’s investment vehicle. Hauikulupi’s other companies include Olea Investment Number 9 CC, which allegedly received at least N$4,5 million in payments from Fishrot deals; and ERF1980, a shelf company that was paid N$2 million from the same source.

* This article was produced by The Namibian’s Investigative Unit and the Advancement of Journalism Centre. It is part of profiles into key figures involved in the Fishrot scandal.

– Read more on James Hatuikulipi’s rise and fall, including a section on his father, a London meeting, his ties with Fishcor’s finance manager and more.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!