A PERSON seeking to trade in foreign currency in Namibia should have minimum starting capital of N$1,6 million, approved by the Ministry of Finance, and be willing and able to pay N$5 200 to get such approval.

• LAZARUS AMUKESHE

The above is an extract from the rules referred to by the Bank of Namibia (BoN) in a recently released statement explaining foreign exchange (forex) trading, and the requirements for persons carrying out such activities to register with the central bank.

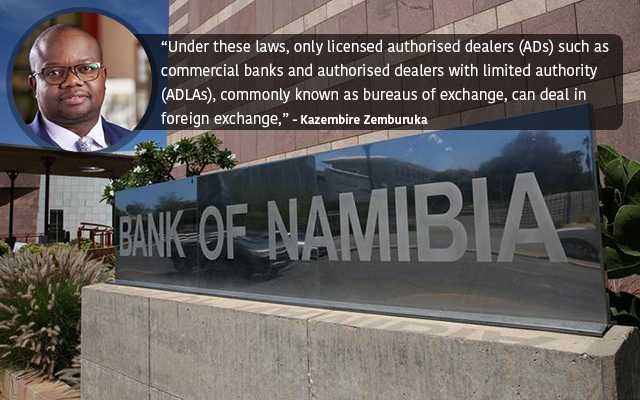

Kazembire Zemburuka, the deputy director of communications, said in the statement that trading in forex in Namibia is not for everybody.

Referencing the Currency and Exchanges Act, the Exchange Control Regulations, and the Rules and Orders issued under these laws, Zemburuka added that these provide guidance on the foreign exchange market in Namibia.

“Under these laws, only licensed authorised dealers (ADs) such as commercial banks and authorised dealers with limited authority (ADLAs), commonly known as bureaus of exchange, can deal in foreign exchange,” he stressed.

The BoN said there are seven ADs and seven ADLAs registered with them who deal and trade in foreign currency in Namibia, as well as facilitate foreign exchanges.

Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another. People buy and sell currencies with the aim to make money on the difference between the two currencies. They will buy currency ‘A’ against currency ‘B’ in the belief that the price of A will increase against B after some time.

Additionally, there is also pure foreign exchange, which individuals with foreign currency can use to buy the Namibia dollar for local use.

For typical exchanges such as these, a notice issued by the BoN states that the buying and selling of foreign currency by unauthorised persons in Namibia is illegal, and only commercial banks and bureaux de change may hold and deal in foreign currency.

These authorised dealers are either banks or authorised dealers with limited authority (ADLAs). For an ADLA, a minimum start- up capital of N$1,6 million is required, of which N$100 000 will need to be kept as reserve cash float. To apply for an ADLA licence, registration is N$200, and the actual fee is N$5 000, including value added tax.

“The exchange or conversion of the Namibia dollar into any foreign currency is regulated to control the use of Namibia’s foreign currency reserves in the best interest of the economy,” stated Zemburuka.

He added that despite the above, the central bank recognises that there may be a legitimate need for individuals to transfer or invest money abroad. Hence, the law permits the purchasing of foreign exchange under specified conditions.

“It should be noted that Namibian residents 18 years and older are entitled to an investment allowance of N$6 million per year for investment purposes abroad. The utilisation of this allowance can only be done through an authorised dealer, while the choice of investment is up to the discretion of the individual. “ Zemburuka said.

Additionally, members of the public are entitled to a single discretionary allowance of N$1 million per year for any foreign exchange transaction through authorised dealers, and authorised dealers with limited authority.

“It should be borne in mind that the above-mentioned transactions can only be done with the individual’s own money,” he cautioned.

Zemburuka said individuals making use of these licensed entities to acquire foreign exchange do not need to register with the Bank of Namibia.

However, “any person or entity transacting in foreign exchange without complying with the above applicable laws and the process described above, does so unlawfully,” he reiterated.

The list of all licensed ADs and ADLAs are available on the BoN’s website.

Email: lazarus@namibian.com.na

Twitter: @Lasarus_A

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!