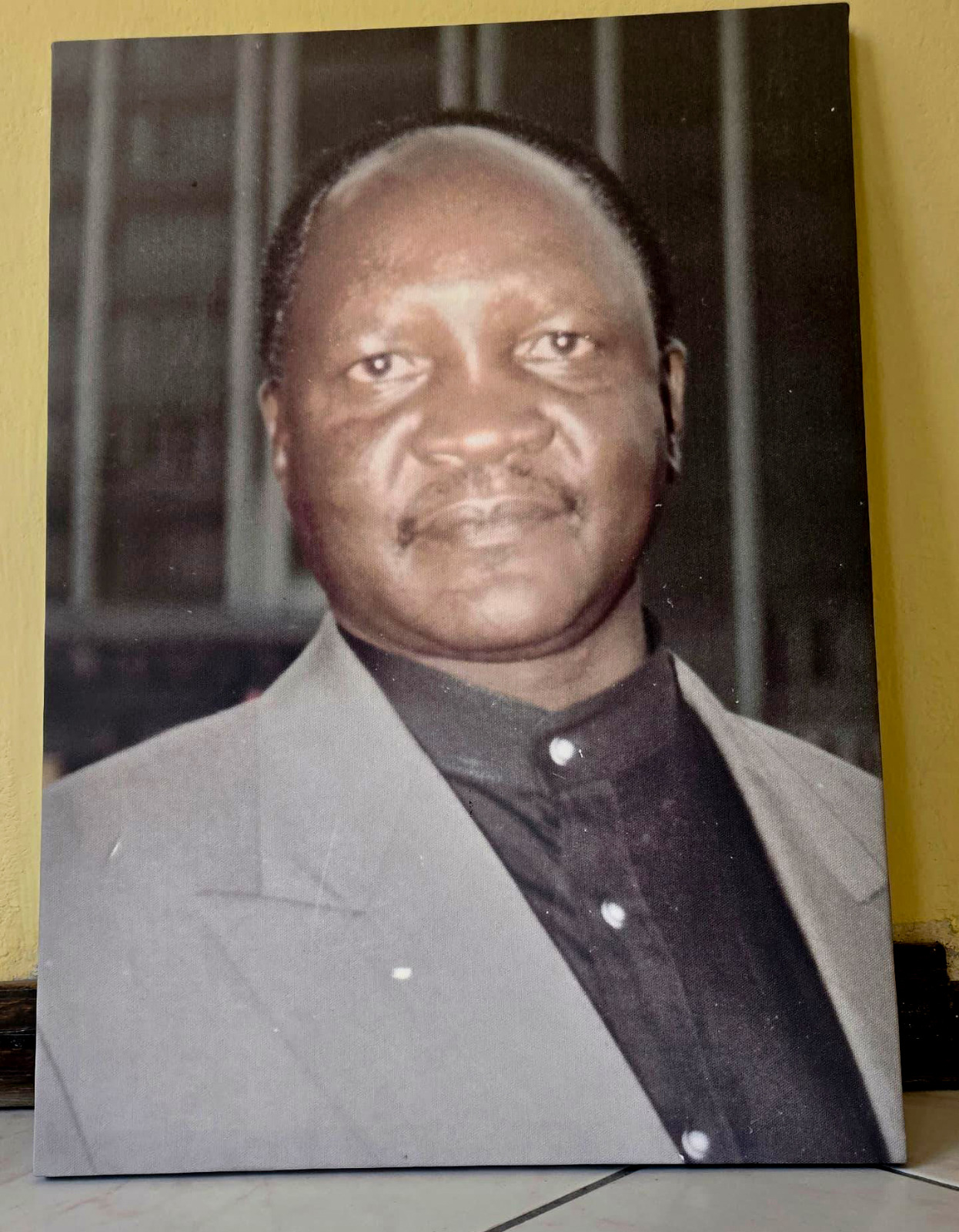

Bank of Namibia (BoN) governor Johannes !Gawaxab has emphasised the urgent need for financial inclusivity and robust cybersecurity measures.

“It is incumbent upon us to ensure that the sector is not only inclusive, but also caters to the majority of our population, including those involved in the informal economy,” he said at the the 46th meeting of the Committee of Insurance, Securities, and Non-banking Financial Authorities (Cisna) held at Swakopmund this week.

“Various financial inclusion surveys in the region consistently reveal high levels of informality in the usage of financial services. Hence, there is a need to harness the potential of the microfinance sector.”

!Gawaxab pointed out that recent data showed a sharp increase in the number of adults in the Southern African Development Community (SADC) region using non-banking financial services.

The number has risen from 33 million in 2011 to 88 million in 2022.

He, however, noted that “further interventions and initiatives are needed to address deficiencies and challenges, particularly in adopting technology and digital platforms”.

The governor highlighted the relatively low adoption of digital financial services in the SADC region, with only about 30% of adults using digital platforms.

He called on Cisna to identify opportunities to create an enabling environment that supports fintech in the financial sector.

On the regulatory side, !Gawaxab referred to the tension between market participants, regulators, and the pace of financial innovation.

“It is imperative that regulatory and supervisory frameworks prioritise consumer protection and transparency in services to establish trust between service providers and consumers,” he said.

As for cybersecurity, he said cyberattacks pose a “grave threat” to the integrity and security of the region’s financial ecosystem, making the investment in robust cybersecurity measures and cross-border collaboration a priority.

!Gawaxab cautioned that the sub-Saharan African region is expected to witness economic deceleration in 2023, attributed to weak export markets, high inflation, and tighter monetary policies.

“We are not out of the woods yet,” he warned.

Furthermore, he mentioned that non-banking financial institutions (NBFIs) hold a significant share of assets within the financial sector.

As of December 2022, the NBFI sector’s total assets in Namibia stood at approximately N$366 billion, accounting for about 68,8% of the financial sector’s total assets.

!Gawaxab urged regional cooperation through Cisna, and harmonising regulatory standards.

“Our financial systems transcend borders, and collaboration among SADC member countries is paramount,” he said.

The meeting, hosted by the Namibia Financial Institutions Supervisory Authority, served as a platform for regulators to exchange insights and forge a path towards a more resilient and inclusive financial ecosystem.

Cisna also unveiled its new logo at the event.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!