At the end of the month, when government workers receive their payslips, a small line towards the bottom of the document connects everyone – from cleaning staff to senior government officials – to the richest companies in the world.

These monthly deductions are towards the Government Institutions Pension Fund (GIPF), the largest investment fund in the country, valued at N$136,2 billion, with shares in over 700 companies all over the world.

Those shares, in turn, mean that everyone who contributes to the fund owns a tiny part of automakers, diamond mines, casinos, movie makers, and even Silicon Valley.

The funds seemingly simple mission is to take monthly retirement contributions from workers, invest them wisely, and pay out pensions upon workers retirement.

The governments 101 000 employees each pay 8% of their salary, and the government matches that with an amount equal to 16% of their salary.

“The money contributed needs to be invested wisely to be able to pay out the promised benefits to these members and their dependants upon retirement,” says PSG Namibias former head of research, Eloise du Plessis.

“That is the only responsibility of the GIPF.”

If the fund were to deposit all contributions into a bank account, and then pay them out later, it could run out of money.

MANAGING RISKS

The funds managers have to consider various risks, such as inflation.

An individual who starts working at the age 25 would pay a lot more for a loaf of bread in 35 years when she retires than now.

The populations age is another factor to consider.

Currently, Namibia has more young people than pensioners, but in the future these young people will retire and would need to be paid pensions.

There are additional concerns, such as the global economy and possible financial crises, such as the one in 2008.

In order to manage risks, the fund invests in different ways.

It buys government bonds, among others. The treasury is legally required to repay this money with interest.

Some of the funds money is invested in giant, global corporations, which is also seen as a safe investment, like government bonds. This means the GIPF owns shares in companies like Toyota, Google, and Microsoft.

Of course, companies that seem safe today may not be in the same position tomorrow.

The fund has sold its N$3,5 million shares in Nokia, which once looked positive, for example.

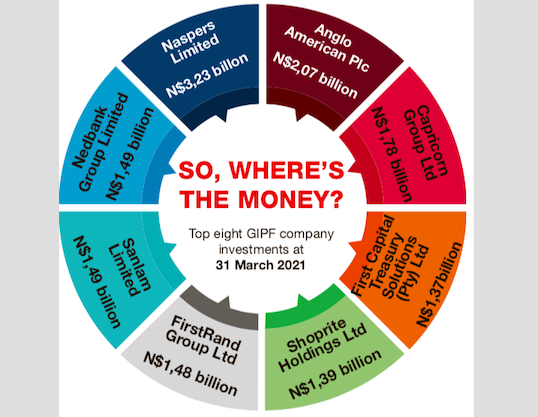

Now it has shifted money to newer companies, like Zoom, betting on office workers continuing to video conference after the Covid-19 pandemic ends. The pension funds biggest shareholding is a N$3,2 billion stake in South Africas Naspers Limited, which owns MultiChoice and News24.

Its money is, however, spread around the world, from Air Canada to De Beers to Samsung.

More than 50 companies and individuals manage the funds investments, including Namibians, but also managers in Dubai, South Africa, the United Kingdom, and the United States.

Theyre paid a percentage of the money they manage, which adds up fast.

Their payouts totalled N$1,2 billion in the last two years alone.

THE BRAND

Since the fund was founded in 1989, its assets have grown larger than the national budget.

That kind of money draws attention.

Last year, former prime minister and defence minister Nahas Angula said he knew there was corruption at the fund during his time in office.

Investment decisions for GPIF and all other pension schemes are overseen by the Namibia Financial Institutions Supervisory Authority (Namfisa) to prevent meddling.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!