Namibia’s privately owned tourism company Gondwana Holdings Limited has listed a N$250 million bond on the Namibian Stock Exchange.

According to the company, the auction which closed on 8 May, received total bids that resulted in the issuance being oversubscribed 1,9 times, demonstrating strong investor demand.

“A total amount of N$250 million has been issued to participating investors, with maturity periods staggered between three and five years,” the company said yesterday.

The entity, which has ownership of close to 30 lodges and accompanying facilities, said the proceeds will be used to refinance the company’s existing bank financing and forms part of Gondwana’s ongoing strategy to improve its financial flexibility.

“We are thrilled with the success of our auction and grateful for the overwhelming response from investors.

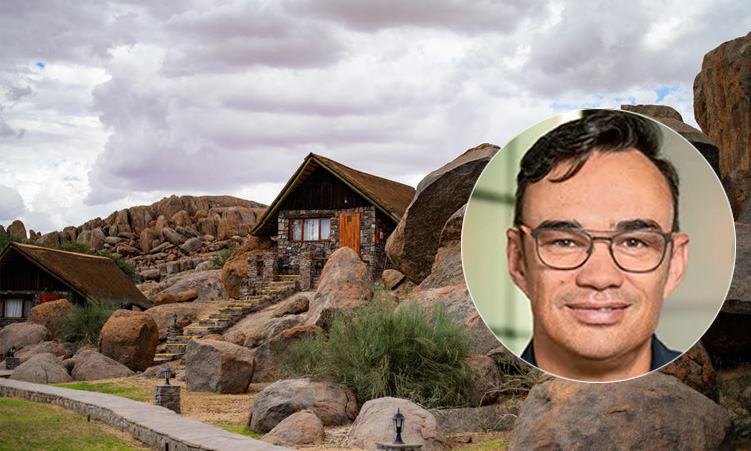

We are humbled by the confidence shown in us,” said Gondwana chief executive Gys Joubert.

Joubert said the listing was an important step in the company’s strategy and a strategic enabler to optimise capital structure, and reduce financing costs.

“With the restructuring of our balance sheet, Gondwana will be positioned to generate growth from future opportunities, while balancing stakeholder expectations,” he said.

Gondwana is a prominent group in the tourism sector, and specialises in providing accommodation, experiences, and sustainable tourism initiatives.

Gondwana has a wide portfolio including accommodation, tour consulting, car rental, and also offers online travel agency services, promoting Namibia as a must-see destination.

According to an internal memo by Gondwana’s management, the listing of this bond has always been on the cards as the company was seeking to free itself from the “restrictive and often cumbersome regulations associated with commercial bank financing”.

Last year, Gondwana issued its first unlisted bond which was supported by Old Mutual, and that enabled the growth in its Namibia2Go product.

PSG Namibia facilitated the auction, which will now have Gondwana replacing all the commercial bank debt, excluding the Development Bank of Namibia loan.

The bids received for this new issuance were at N$475 million, and again tells that the local economy has much floating capital seeking to locate solid assets for investments.

The listed bonds are paying a floating rate of Johannesburg Interbank Average Rate plus 220 and 250, and this will have a huge saving in finance costs to Gondwana when compared to financing from commercial banks.

According to the internal memo, the commercial banks including Bank Windhoek have agreed on early settlement of the company’s entire long-term debt, cancellation of all sessions and negative pledges and an extensive overdraft facility.

Many local companies have been avoiding commercial banks over the last few months, dropping the private sector credit extension growth for corporates to average at just 0,5% over the first three months of 2023.

The high repo rate at 7,25% has been keeping commercial entities away from commercial bank’s doors for some time.

Email: lazarus@namibian.com.na

Twitter: @Lasarus_A

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!