TotalEnergies also withdrew from the 5/6/7 offshore exploration block, in which it holds a 40% stake

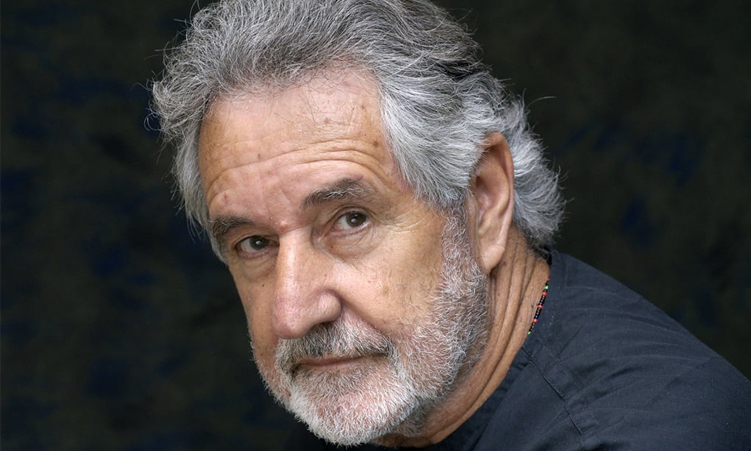

Busisiwe Mavuso, the CEO of Business Leadership SA (BLSA), has blamed the government’s “dramatic flip-flops” in regulating the gas sector for TotalEnergies’ withdrawal from gas fields on the south coast of the country.

TotalEnergies said last week that it would withdraw from Block 11B/12B, where it made two gas discoveries, Brulpadda and Luiperd.

The reason it put forward was that Brulpadda and Luiperd could not be “converted into commercial development due to the difficulties encountered in developing and upgrading these gas discoveries on the SA market”. The energy major held a 45% stake in the block.

In her weekly letter, Mavuso said indications were that TotalEnergies, which was the operator of the project, withdrew because of regulatory hurdles.

“French energy company TotalEnergies quit its two large offshore gas fields, Brulpadda and Luiperd, last week where it had made major discoveries back in 2013. At the time there were major hopes that the discoveries would enable SA to develop gas independence and tap the energy source to transition from the relatively more polluting coal,” Mavuso said.

“But now TotalEnergies has said it is too difficult to economically develop and monetise the resources for the SA market. While the company did not say it, I am sure that ongoing regulatory uncertainty is a major contributor to that difficulty.”

“Since TotalEnergies’ discovery, there has been a series of dramatic flip-flops over regulating the gas sector. Government has at times announced it should get a free 20% ownership interest in all gas projects, only to then abandon amendments to the Minerals and Petroleum Resources Development Act.”

The withdrawal of TotalEnergies and other partners, have left Canadian firm Africa Energy Corporation as the sole participant in the project.

TotalEnergies also withdrew from the 5/6/7 offshore exploration block, in which it holds a 40% stake. The block is on the southwest coast between Cape Town and Cape Agulhas. The other partners in the block are Shell and PetroSA, which have interests of 40% and 20%, respectively.

Mavuso urged the government to provide policy certainty and urged President Cyril Ramaphosa to send the bill meant to govern gas exploration in the country back to parliament.

“The department then introduced a new bill to govern gas exploration and development, which was passed by parliament in April, that experts have said violates the constitution in several respects. It reintroduces the state’s right to a 20% interest in new projects at exploration and production phases. It allows the minister to order companies to sell a percentage of petroleum to any state-owned company designated by the minister,” Mavuso said.

“For any company looking to develop gas or petroleum resources, this is a new source of considerable uncertainty. The bill is sitting on the president’s desk for ascent, and would be better sent back to parliament for reworking that would enable companies to take on the huge risks of developing major new gas resources.”

Mavuso also weighed in on the backlog crisis facing the Johannesburg high court. Business Day reported last week that the city’s high court was buckling under the pressure of case backlogs. Commercial litigants were expected to wait until at least August 2025 for hearing dates.

The situation is so bad that some Road Accident Fund (RAF) cases have trial dates allocated as far ahead as April 2029.

“The Johannesburg high court, the busiest commercial court in our country, can now only give court dates for commercial litigants over a year from now. Road Accident Fund litigants will have to wait over four years,” Mavuso said.

“The reason is one of capacity: there simply aren’t enough judges to hear cases. Deputy judge president Roland Sutherland has taken to pleading with the legal community to provide experienced lawyers to help deal with the backlog on a pro bono basis. The swift resolution of commercial disputes is key to business and the backlogs in our courts mean investment and other commercial decisions get held up.”

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!