TREASURY has received N$4,7 billion from the Southern African Customs Union for the first quarter of this year.

Established in 1910, Sacu is one of the oldest customs unions in the world, with Namibia, South Africa, Botswana, Lesotho and Eswatini as members.

The union maintains the free interchange of goods between members, and provides a common external tariff and a common excise tariff to the customs area.

All customs and excise fees collected are paid into South Africa’s National Revenue Fund, and then shared among members according to a set formula.

South Africa is the custodian of the revenue pool.

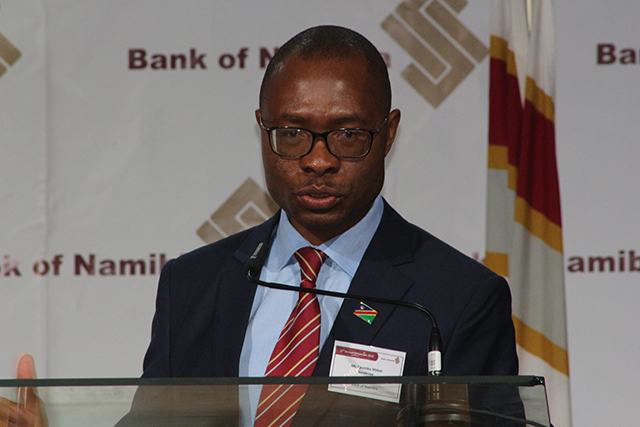

Ipumbu Shiimi, governor of the Bank of Namibia (BoN) and chairperson of the Monetary Policy Committee (MPC) disclosed Namibia’s share yesterday when he announced that the country’s repo rate will remain unchanged at 6,75%.

With the next repo rate announcement scheduled to be made on 14 August, yesterday’s announcement marks two years of a constant repo rate.

The MPC has all along stated that the current rate was appropriate to support the one-to-one link between the Namibia dollar and the rand, as well as support the local economy.

Shiimi said the committee did not see the need to change the rate on the global, regional or domestic level.

Unlike global economic growth which moderated during the first quarter of 2019, domestic economic activity slowed during the first four months of 2019, and is expected to remain weak for the rest of the year.

“The slowdown was reflected in sectors such as mining, agriculture, construction and wholesale and retail trade. Similarly, the manufacturing, tourism and electricity sectors also displayed declining activity during the first quarter of 2019,” he explained.

And this was what aided them in reaching a no-movement consensus.

Shiimi said on 31 May 2019, international reserves stood at N$34,1 billion, up from N$32,6 billion reported at the end of March 2019.

The increase in the reserves was partly aided by the local currency depreciation and the Sacu revenue inflows.

“This amount is estimated to cover 5,6 months of imports of goods and services,” Shiimi added.

Annual average inflation went down from 4,6% reported previously to 4,5%, and is expected to remain flat at 4,5% for the rest of the year.

Food, non-alcoholic beverages and transport continue to lead the pack of goods and services on price hikes.

Private sector credit extension, a measure of borrowing to the private sector, indicated that there was a slight increase in borrowing, with businesses taking up more short-term borrowing, but the growth of borrowing to individuals decreased since April this year.

Commenting on the announcement, Simonis Storm analyst, Indileni Naghonga said they expected the rate to be unchanged, but suggested that it be cut for the remainder of the year.

“Based on the stagnant macroeconomic factors, we are of the view that the BoN should consider cutting interest rates by 25 basis points in the second half of the year to give impetus to the dire economic environment,” she noted.

lazarus@namibian.com.na

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!