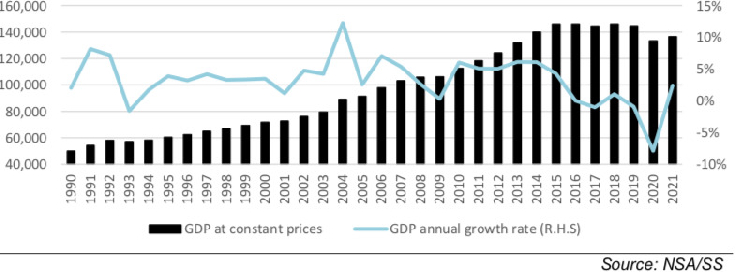

In its quarterly economic review for the first quarter of this year (1Q2022), Simonis Storm has predicted that agriculture, mining, tourism and information and communication technology sectors would spur economic growth forward, but revised its inflation forecast for 2022 upwards from 6,1% to 7,1%.Higher oil prices would likely fuel inflation, and the invasion of Ukraine, which has brought price shocks, has led to rising input costs for Namibian farmers – in higher fertiliser and livestock feed prices, brewers in higher barley and glass bottle prices, and food producers through higher wheat prices and Namibian car importers, among numerous other economic agents.Increased fuel and food prices are not only a constant theme for rising inflation in other countries, but also run the risk of adding to recessionary pressures.Oil price shocks have led to major recessions in the past, whereas higher food prices in the midst of elevated unemployment have led to social uprisings and revolutions.“Probabilities of a United States recession in the next 12 months stood at 28% in January 2022, increasing to 34% after the Ukraine invasion at the end of February, and is now at over 50% at the end of March,” said Simonis. Implications from the war in Ukraine for supply chains and price volatility also remain risks to the near-term outlook. Slower Chinese economic growth will likely weigh on commodity demand from Namibian miners, being a key risk to the growth outlook for Namibia in 2022.Maintaining Namibia's gross domestic product (GDP) growth forecast for 2022 at 2,5%, Simonis Storm said higher global inflation would lead to an increased import bill, which reduces the net export component of the GDP calculation.“Although a rebound in the mining sector is expected, and while commodity prices remain elevated, we believe that global inflationary pressures will lead to a greater increase in the value of imports versus the value of exports. This implies that net exports will contribute negatively to GDP in 2022,” said Simonis.The analysts said the monetary policy committee will meet on 13 April and 15 June, where a 25bps repo rate hike is expected in each meeting.The South African Reserve Bank (SARB) will meet on 19 May, where another 25bps repo rate hike is expected. This will take both the Namibian and South African repo rates to 4,50% in 2Q2022.Simonis added that about N$7,5 billion in liquidity left Namibia during December 2021 to January 2022 in search of better yields in South Africa when the Namibian repo rate was 25bps lower than the South African repo rate.“We, therefore, believe the Bank of Namibia will hike by 25bps more than SARB in 2022 in an attempt to minimise capital outflows in managing the rand/dollar peg,” noted Simonis.Foreign currency reserves increased by 28% in 2021, mainly due to loans from the International Monetary Fund and African Development Bank, which have not been utilised yet.“However, as these funds are utilised, foreign currency reserves will decrease and therefore we expect BoN to hike by more than SARB in 2022,” Simonis pointed out. Local liquidity levels were boosted towards the end of 1Q2022 by the partial liquidation of investment proceeds from the MTC listing, with the government receiving N$2,5 billion from the listing. These funds will most likely be paid over to the state in preparing for payments to be made. However, some local banks still earn higher interest on their deposits with SARB compared to the Bank of Namibia, hence the increase in the South African liquidity position“Year-to-date, inflation has averaged 4,5%. We revise our inflation forecast upward from 6,1% to 7,1% as a result of geopolitical developments in Ukraine and the potential threat of a Chinese invasion in Taiwan, as well as price shocks mentioned earlier. “We believe the risks to inflation remain on the upside and if history is to repeat itself, Namibia could see inflation as high as 10,4% in 2022. In 2008, Namibia averaged 9,1% inflation due to oil prices being close to US$150 per barrel,” said the analysis. Simonis said a stronger rand/US dollar exchange rate will keep some limit on inflation going into 2Q2022, but a weaker rand in 3Q2022 will add to inflationary pressures. “Inflation in 2Q2022 is likely to be driven higher by fuel, electricity and food prices. Namibia's fuel prices have increased over 51% compared to January 2021 and contributed 40% on average to the total change in annual inflation during 2021. “Remarkably, Namibia's petrol prices remain low compared to other advanced economies and emerging markets,” Simonis added. The full report is available on the Simonis Storm website.Email: matthew @namibian.com.na

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!