Paladin Energy Limited’s uranium mine, Langer Heinrich, will restart next year, the company has told investors, and about 600 contractors are on site to ensure this reality.

As of last week, the restart project was still 60% incomplete.

They are operating on a N$2,1 billion restart budget, and all is on the back of improved uranium prices.

According to the company’s quarterly update to investors, about N$337 million was spent during the first quarter, and another N$305 million in cash is set aside for further work on the mine, including its actual restart and the operations.

In its recent annual report, the Bank of Namibia indicated that the uranium price increased by 41,2% to an average of US$49,81 per pound last year, driven by geo-political uncertainty, which started in Kazakhstan in January last year.

Due to the growing focus on decarbonisation, there is increased demand for safe, clean and reliable electricity, and nuclear energy has become an alternative of choice.

This might just set Langer Heinrich on a strong footing.

Last year, Bannerman Energy chief executive Brandon Munro said uranium prices need to hit US$80/lb to spark enough production to avoid a shortage this decade.

At last year’s average price, uranium prices were still well below the long-term incentive price of US$60/lb generally accepted as the entry point to bring new production online.

More than N$2,5 billion worth of uranium has been exported in the first two months of this year already.

According to the company, Paladin’s owner team, alongside its support partner, continues to progress and execute activities focused on returning the Langer Heinrich Mine to production.

“The project is on track and on budget (US$118 million) for first production in the first quarter of 2024,” reads the update.

The company is, however, still running on a N$2,6 billion budget for the project should anything go south.

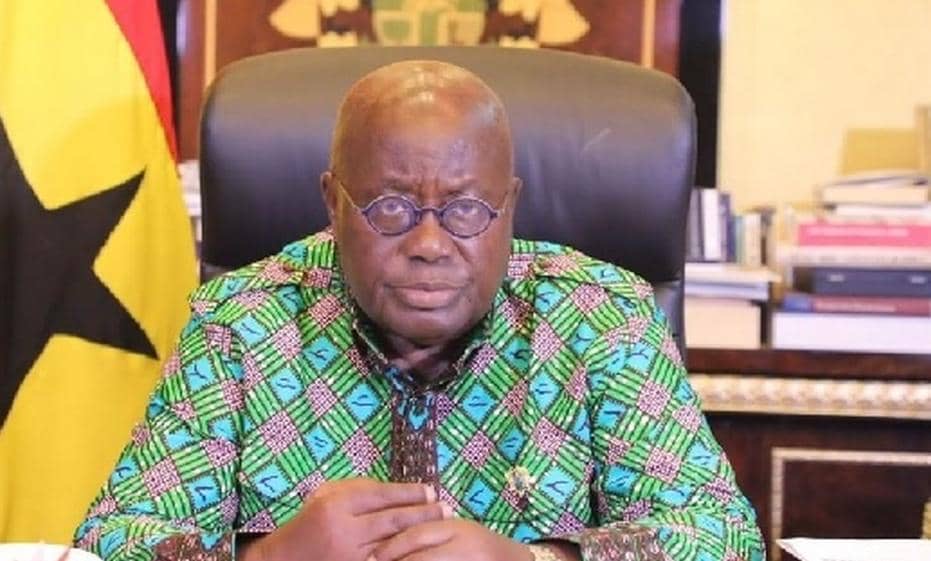

Paladin chief executive officer Ian Purdy said Paladin continues to make progress on restart activities at the Langer Heinrich Mine in Namibia.

“The work executed to date, combined with our well-defined pathway to production and our on-site project execution team ensures that the project remains on time and budget with first production targeted for 2024.

With a strong uranium contract book and a world-class asset in the Langer Heinrich Mine, Paladin remains well positioned to deliver long-term value for our stakeholders,” he said.

The Bank of Namibia, in its economic outlook, recently cautioned that although the uranium mining sector is expected to grow by 4,5% this year and 4,3% next year, water supply interruptions continue to negatively affect the sector, which has led mines to frequently reduce production targets in the past.

“The occasional prevalence of the high sulphur content in the sea forces a halt in the production of desalinated water, leading to water supply interruptions,” the bank had noted.

Paladin shares started off the week trading at N$7,69 per share.

Email: lazarus@namibian.com.na

Twitter: @Lasarus_A

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!