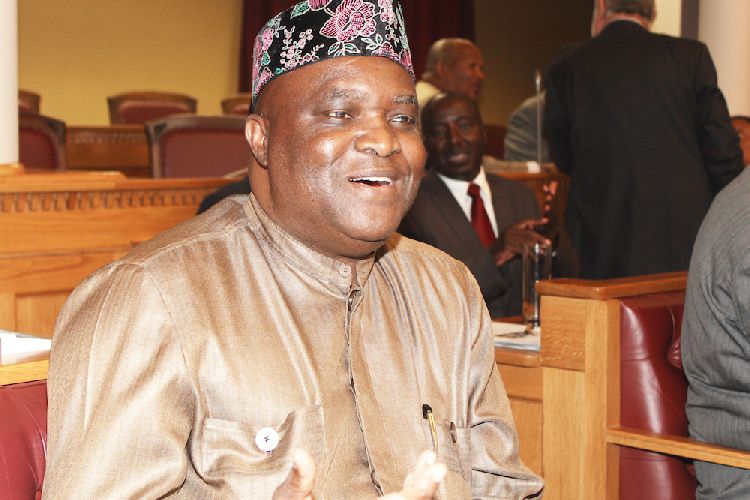

Chairperson of the National Council Lukas Muha says Namibia needs to urgently reinforce its financial and related bills to evade a potential grey-listing by the Financial Action Task Force (FATF) within a year.

He was speaking at the ongoing financial and related bills workshop in the Erongo region on Monday.

The FATF grey-list includes jurisdictions identified as having weak measures to combat money laundering and terrorist financing (AML/CFT).

As of February, the FATF has reviewed 125 countries and jurisdictions and publicly identified 98 of them. Of these 98, 72 have since made the necessary reforms to address their AML/CFT weaknesses and have been removed from the process.

“The situation we find ourselves in cannot be delayed and is unavoidable. We are expected to make the necessary amendments to some existing laws and, if possible, craft brand new ones,” stressed Muha.

He also highlighted the challenges posed by the global interdependence of economies and stressed the need for laws that are relevant to the current changing financial market environment.

“Businesses and individuals in one country can buy and sell or exchange currency in another country by a click of a button,” he stated, further adding that “an economic crisis in one state can quickly spread to other states, leading to a global economic crisis”.

Erongo governor Neville Andre emphasised the urgent need for Namibia to comply with anti-money laundering laws to avoid the risk of FATF grey-listing.

“This risk has potential grave consequences for Namibia,” Andre warned.

Grey-listing could potentially impact foreign direct investment, trade with other jurisdictions, national trade-related payments and revenue for diplomatic missions, among other things.

Andre urged lawmakers to pass the necessary legislation within the required time to prevent such adverse effects.

Deputy governor of the Bank of Namibia Leonie Dunn highlighted the critical need for strong policies and enforcement to prevent money laundering and the financing of terrorism.

“Our beautiful Namibia is a critical spokesperson, not only around the table of the Eastern and Southern African Anti-Money Laundering Group but also on the international arena, championing the protection of national and global financial systems,” she stated.

In an urgent bid to avert potential international sanctions, Namibia is intensifying its fight against money laundering and terrorism financing.

The Anti-Corruption Commission (ACC) and the Financial Intelligence Centre (FIC) announced earlier this year that they would soon start receiving and analysing data from Interpol on individuals suspected of these activities. This initiative is a part of an action plan to enhance the effectiveness of Namibia’s AML/CFT regime, aiming to gain international recognition in this area.

To date, 11 existing laws have been deemed inadequate, and two new laws are needed to shield the country from being grey-listed by the FATF.

The workshop, co-hosted by the National Council, Ministry of Finance, and Bank of Namibia, aims to provide members of parliament with an enhanced understanding of several legislative proposals due for consideration during the special session of the National Council set to resume next week.

These bills include proposed changes to several key pieces of legislation such as the Financial Intelligence Act of 2012, the Payment Systems Management Act of 2003, and the Prevention and Combating of Terrorist and Proliferation Activities Act of 2014.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!