ALCOHOLIC BEVERAGES

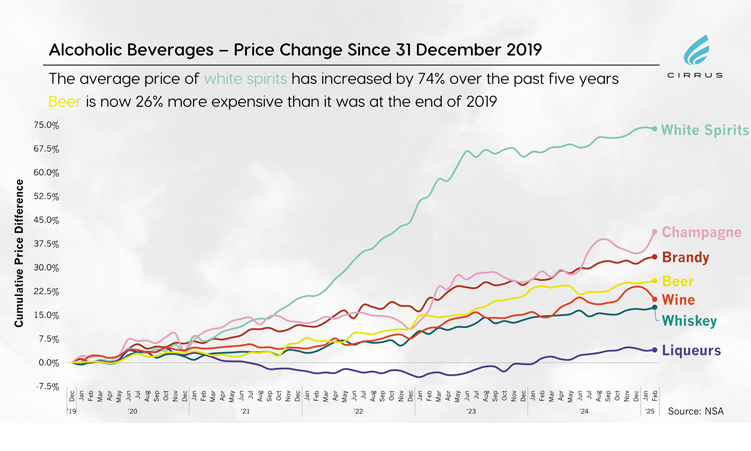

Since the end of 2019, the average price of white spirits has increased by 74%, while that of beer has risen by 26%. While other major alcoholic categories – such as champagne, brandy, wine and whiskey – have closely followed the trend of beer (which is by far Namibia’s most popular beverage), white spirits inflation spiralled in 2022 due to the Russia-Ukraine war, which severely impacted the supply of grains and other input costs used in vodka and gin production.

Namibians consume relatively high volumes of alcohol. In 2022, it was estimated that Namibia had an annual per-capita beer consumption of 85L, ranking seventh in the world.

Beer is also the second heaviest item in the Namibia Consumer Price Index (NCPI), behind rent, contributing 7% to the total basket – meaning 7% of total Namibian household expenditure went towards beer in the NCPI reference period of 2009 – with alcohol as a whole contributing 10%.

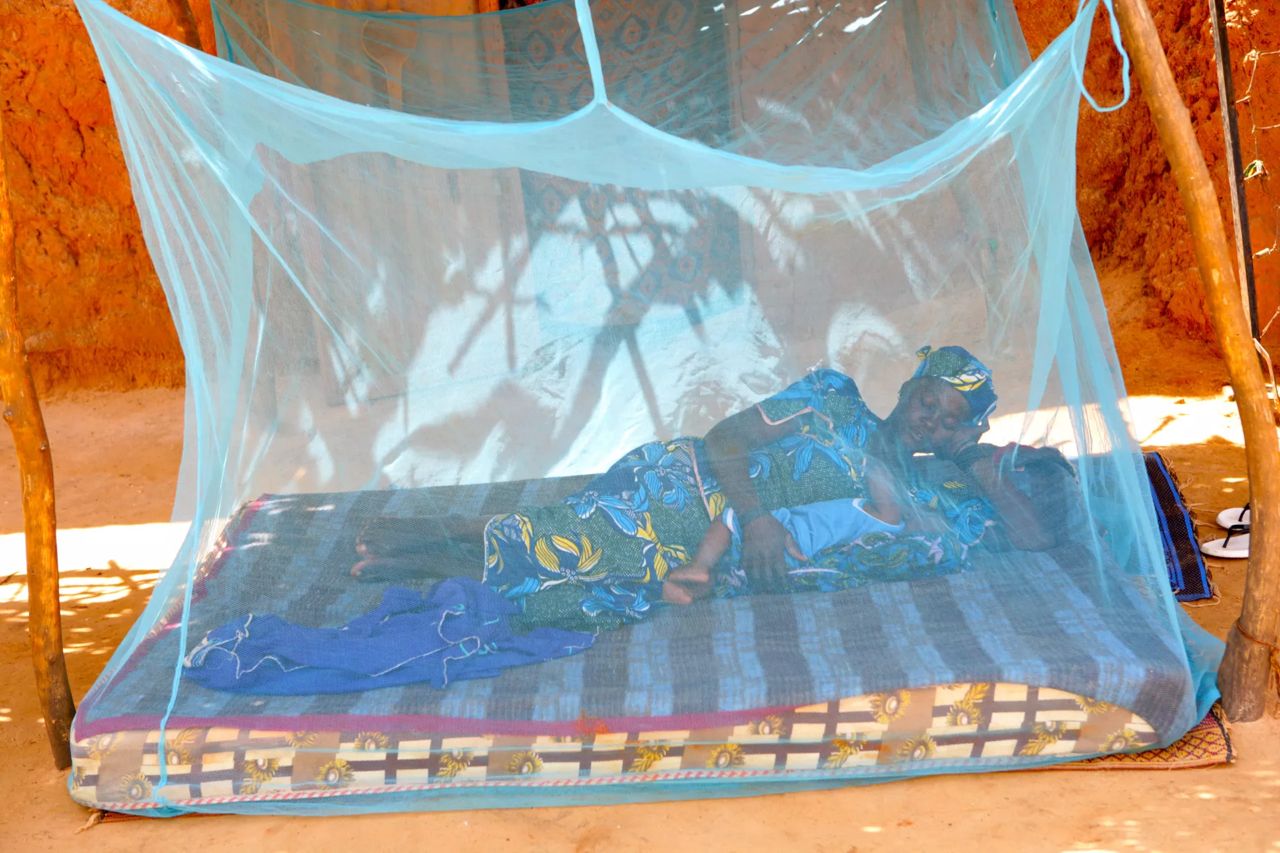

As a percentage of total expenditure/consumption, beer and white spirits are relatively more popular in the northern regions, contributing 8.8% and 0.6% of total northern expenditure, respectively.

Brandy, whisky, champagne and liqueurs are most popular in zone 3 (which includes the Erongo, Omaheke, Hardap and //Kharas regions), making up 0.7% and 0.5% of total expenditure in the zone.

Meanwhile, wine is most popular in Windhoek, where 1.7% of total expenditure goes towards wine. Expenditure patterns reveal that those in the northern regions are the heaviest drinkers, with 11.8% of total northern expenditure allocated to all alcoholic beverages.

In the south, the coast, and the Omaheke region, this stands at 10.4%, while Windhoek allocates only 7.9% of total expenditure to alcohol.

However, income levels should be taken into consideration – Windhoek residents have higher income levels than those in other regions, meaning the same expenditure on alcohol would make up a smaller share of total spending compared to other regions.

Nonetheless, the impact is felt by Namibian households, with moderate inflation possibly forcing consumers to switch to more affordable beverages or discontinue consumption entirely.

If your local bar still offers N$20–draughts, consider yourself lucky!

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!