Last year saw a significant uptick in private consumption expenditure, particularly in the final stretch of 2024, as personal income tax amendments and subsequent over-deductions allocated to taxpayers boosted disposable income.

The over-deduction allocation led to many taxpayers in the previous financial year receiving lump sums worth several thousands, while all current taxpayers in the new financial year gained an additional N$750 to N$1 542 in monthly disposable income.

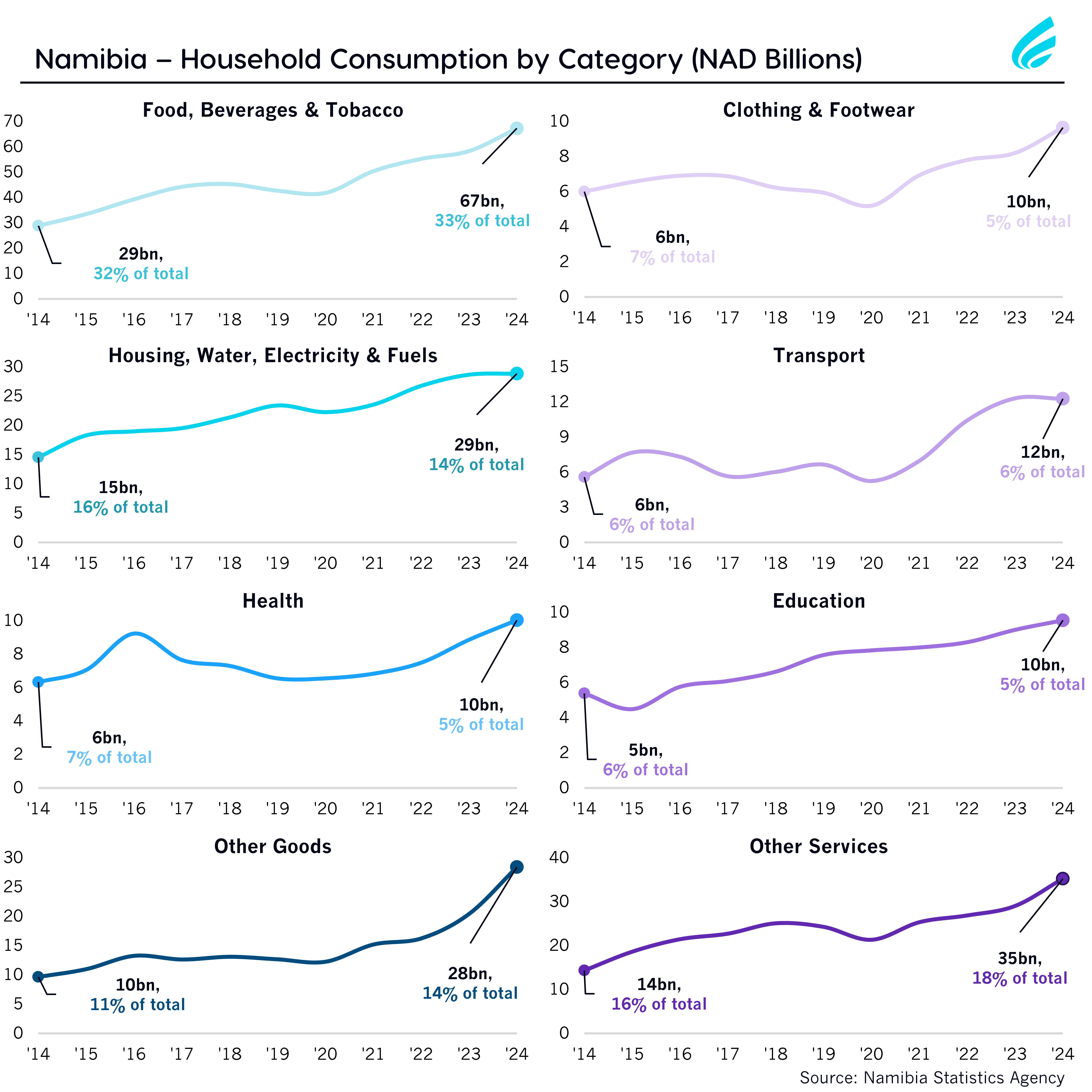

Real household consumption increased by 13.2% in 2024. Real spending on food, beverages and tobacco rose by 17.1%, while clothing and footwear increased by 19.4%. Expenditure on other goods, such as furniture and appliances, surged by a staggering 42.1%.

This trend is also reflected in Namibia’s import data, where imports of non-alcoholic beverages (e.g. soft drinks) doubled in the final part of the year compared to the three-year trend from 2022 to the third quarter of 2024 – before the tax amendments were implemented and over-deductions reallocated.

However, real consumption of housing and utilities declined by 5.9%, and transport expenditure fell by 3.1%.

At current prices, one-third of Namibian consumption expenditure in 2024 was directed towards food, beverages and tobacco, while 5% went to clothing and footwear. Expenditure on other goods, such as appliances and furniture, rose to 14% of the total, up from 11% a decade ago. Housing and utilities, meanwhile, accounted for just 14%, down from 16% ten years ago.

Although the 2024 expenditure patterns are likely to be unique due to the sudden cash influx from the tax over-deduction allocation, Namibians will still experience greater financial room going forward had the majority avoided lifestyle creep from the sudden influx.

Current consumption patterns also differ markedly from those reflected in Namibia’s inflation basket, which was last updated using 2008/09 data. As a result, it is difficult to assess the ‘true’ level of inflation faced by Namibians over the past 15 years – a distortion that contributes to significant misrepresentation in the market.

– Tannan Groenewald is Cirrus Capital’s head of data and analytics.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!