An investment expert has advised Namibia to investigate South Africa’s two-pot retirement system, which allows workers to use part of their retirement money without resigning.

South Africa’s finance ministry has proposed a retirement system that would give people early access to a portion of their retirement pensions.

The changes are expected to take effect on 1 March next year.

With Namibia trying to reform the non-banking sector, including the retirement system, the two-pot system might be worth looking into, said Ben Bertolini, the managing director of M&G Investments Namibia.

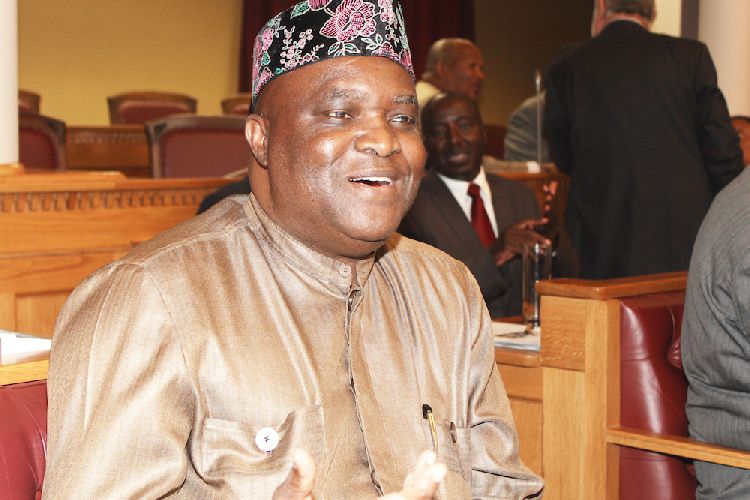

During a presentation to members of parliament last week, Bertolini noted that Namibia might use the two-pot system, though it comes with many complications.

“As Namibians, we need to craft out a solution […],” Bertolini said. “So, if we implement a two-pot system tomorrow, and when I get a job, 30% of my pension contribution goes to a savings pot, and the rest, or 70%, is going to a retirement pot.”

At any given time, a member of the pension and provident funds can access a portion of their retirement pension before reaching retirement age.

“So the benefits of the system are that at any given point in time, if a member experiences financial problems, they can go to the savings pot.

“Obviously, you know how people are. We need to have certain rules and regulations with regard to that. For example, you can only get a minimum withdrawal per year,” Bertolini said.

National Union of Namibian Workers secretary general Job Muniaro has warned against new systems that he says may risk members’ retirement funds.

He said if members are allowed to access part of their pensions, it will expose them to uncertainties, especially those that are due for retirement.

The introduction of the Financial Institutions and Markets Act (Fima) has widely attracted criticism, as the proposal seeks to introduce a mandatory preservation of pensions.

The main concern is that once Fima is implemented, members of retirement funds will lose access to 75% of their fund credits if they withdraw early, as this portion must be preserved until age 55.

According to the Namibia Financial Institutions Supervisory Authority (Namfisa), the draft regulation would apply to every retirement fund registered under Fima.

The implementation of Fima is currently on hold, after concerns were raised with Namfisa.

Finance minister Iipumbu Shiimi has said the postponement is to allow for broader consultations regarding the proposed regulation for the compulsory preservation of retirement benefits.

The pension fund industry is the biggest in the country, with assets in excess of N$160 billion.

Last year, analysts who preferred to be anonymous as they deal with pension money, told The Namibian that the two-pot system was an interesting concept, especially considering the emergency part such as that brought about by the Covid-19 pandemic.

“It could definitely actually be a way for there to be less reliance or dependence on the government to then step in and do some sort of an emergency income grant,” said one analyst.

South Africa is not the only country looking at introducing this pension withdrawal system. Last year, Zambian president Hakainde Hichilema passed into law a bill that allows for partial withdrawal of benefits by a member.

According to him, this law was going to enable employees to start investing part of their pension funds early in their working lives.

Like Namibia, most South Africans and Zambians have been resigning to get their hands on a significant amount of money in their retirement annuity for different purposes.

This normally comes at a high cost in terms of taxes and worries including people blowing their pension money, leaving more people more dependent on government help after retirement.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!