The Namibia Students Financial Assistance Fund (NSFAF) has only recovered at least 1% of the debt owed by former beneficiaries annually.

The fund have been spending N$7,3 million annually for student loans. This was revealed in a letter addressed to the parliamentary standing committee on public accounts, written by the fund.

This letter, which details the amounts paid back since 2013, was confirmed by the acting chief executive officer (CEO) Kennedy Kandume yesterday.

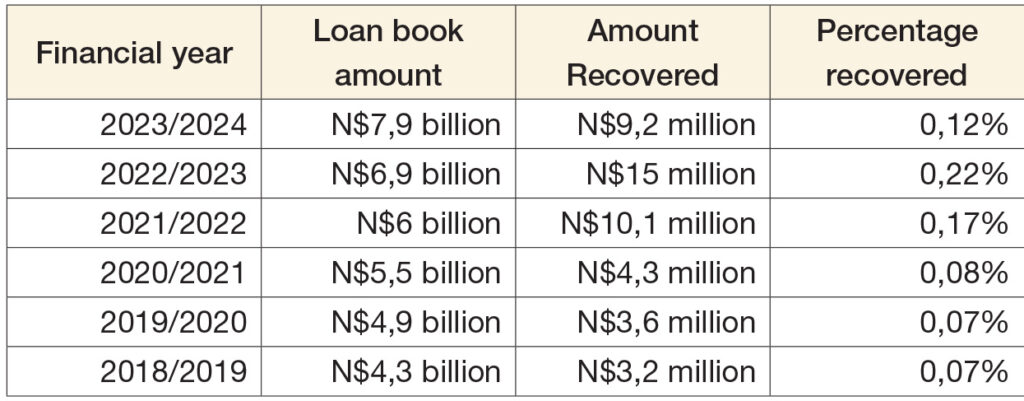

The highest amount recovered was N$15 million in the 2022/2023 financial year, while the NSFAF was owed N$6,9 billion.

For this financial year, NSFAF has recovered N$9,2 million, while the loan book stands at N$7,9 billion.

In the 2021/2022, they were paid back N$10,1 million while they were owed N$6,1 billion.

In the 2020/2021 financial year, they got back N$4,3 million while their loan book stood at N$5,5 billion.

The year before that, they recouped N$3,6 million while they were owed N$,9 billion.

In 2018/19, N$3,2 million was received while their loan book stood at N$4,3 billion.

In 2017/18, they were owed N$3,5 billion and only recouped N$4,1 million.

In 2016/17, they got back N$4,5 million and were owed N$3,4 million.

The previous year, N$4,6 million was reclaimed from the N$3,4 billion owed.

In 2014/15, they were owed N$3,4 billion and recouped N$4,2 million.

In the 2013/14 financial year, they recovered N$6,2 million while they were owed N$3,4 billion.

The fund has spent N$7,3 million to recover the money owed to it.

SPENT ON LOAN RECOVERY

NSFAF paid N$200 008 to KPMG, an auditing firm, for Microsoft access, database design and data capture in a “pilot basis”.

The Namibia Statistics Agency was paid N$2,6 million for data capturing and project management fees.

The fund has a data integrity project which costs N$3,4 million.

In 2020, the acting head explained that this project consolidates the database of past and current beneficiaries.

To develop this project, the fund paid N$38 000 to Neishot Websolution Technologies.

In 2020, employees demanded that the Central Procurement Board of Namibia investigate the contracting of Neishot Webolution Technologies at NSFAF.

Tribesmen debt recovery firm was also paid N$1,2 million. This is another controversial contract which was cancelled. The N$400 million debt recovery contract was given to the Tribesmen and New Integrated Credit Solutions joint venture by NSFAF in 2014.

In 2018, The Namibian reported that NSFAF was accused of hand-picking Tribesmen for the debt recovery contract, despite a public advertisement that was made in 2014, when 20 bids were submitted.

Tribesmen has been getting a fixed N$287 500 plus 10% commission of the total money collected between February 2014 until this was increased to 12% commission in 2017.

This means Tribesmen earned N$3,4 million on an annual basis.

This brings the amount spent on the loan book to N$7,32 million.

CHANGE REQUIREMENTS

Meanwhile, Popular Democratic Movement lawmaker Inna Hengari has called for NSFAF to change the repayment period, in the face of the unemployed graduate statistics.

“The biggest challenge with this policy is that the beneficiary is expected to commence paying back the fund within six months after graduation,” she said.

Hengari on Tuesday was contributing to the debate on the possibility that NSFAF incentivises loan beneficiaries, with the aim to stimulate entrepreneurship and job creation.

“I think, considering the environment and the economic climate in our country, it is almost impossible to find someone who comes directly from the university and gets a job within six months,” she said.

Hengari further pointed out that NSFAF has the prerogative to suspend the repayment of a loan if the debtor becomes unemployed.

“The different circumstances of each beneficiary should be considered when we look at this policy,” she added.

Hengari shared her experience, saying she was on probation for six months and her income was not yet stable, while the interest holiday repayment loan waiver was not sufficient.

In June 2022, NSFAF announced that it will be writing off N$2,6 billion interest on N$5,2 billion owed by beneficiaries from 1 July until 30 June 2023.

“The situation we have in our country is that the day that you graduate, within six months, the interest already starts to accumulate on the loan that you have taken,” she said.

Hengari blasted Kandume for the mismanagement of funds which he cannot account for.

“The fund is mismanaged and failed to account for monies allocated to it… The very acting CEO of NSFAF has miserably failed to account for money that has gone missing year-in year-out. I am standing here as a member of the public accounts committee,” she said.

Higher education minister Itah Kandjii-Murangi did not take kindly to Hengari’s statement, saying there has been notable transformation at NSFAF since the time Hengari was at the University of Namibia.

“As we sit here, we are aware of the ongoing transformation. We are still fixated on the past… We have moved. NSFAF is being transformed,” she asserted.

Kandjii-Murangi reiterated that the lost funds were due to files being moved from one office to the next.

“To talk about the fact that the CEO failed to account. We all know and I stood here to say that what is not accounted for has to do with lost, misplaced records when the institution was moving from the ministry to become an independent,” she said.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!