About 23 259 depositors who have lost millions in the looting of the now-defunct SME Bank will be paid back a total of N$30 million.

The key architect of the looting is allegedly Zimbabwean citizen and Small and Mediun Enterprise (SME) Bank shareholder Enock Kamushinda.

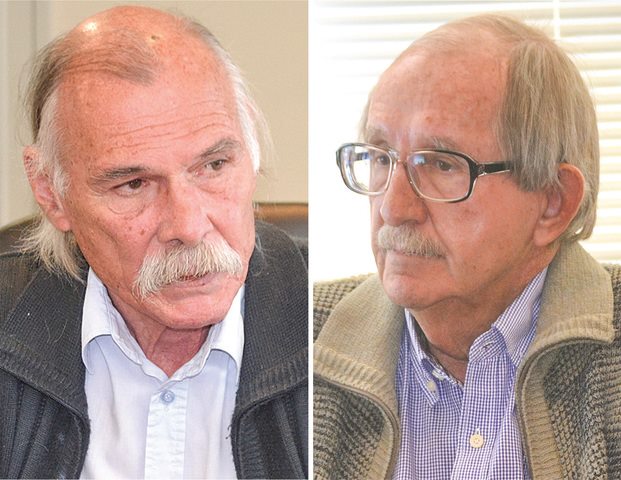

The bank’s liquidators, Ian McLaren and David Bruni, this week said depositors would be paid 15 cents for every dollar they have deposited into the bank.

This comes after the liquidators yesterday announced they have recovered N$130 million of the lost millions.

They said N$100 million of the recovered funds was used in the recovery process, leaving only N$30 million to be split among depositors.

The liquidators suspect over N$257 million of the bank’s money was lost in total.

The liquidators said the majority of this was traced from South Africa to cash-in-transit companies, which they believe went to Zimbabwe.

“Specifically two companies,” Bruni said yesterday.

When SME Bank was liquidated it had virtually no assets, McLaren said.

The N$100 million recovery price tag included forensic experts, they said.

“They [forensic experts] traced the money as far as five or six recipients,” McLaren said.

“The process revealed shocking depths of corruption,” he said.

The liquidators ordered the involved banks to provide information of where the money ended up, the liquidators said. This process could take another two or three years to be finalised.

Another N$67 million is currently in Dubai, which travelled via the Democratic Republic of Congo, Bruni said.

To recover this would cost more than that amount itself.

As far as records show, the misappropriated funds add up to N$257 million, but the liquidators believe the amount is “much bigger” than that.

FIVE CENTS PER DOLLAR

The depositors were initially estimated to receive only 25 cents per N$1 they invested, but the liquidators believed this would increase.

“To date, we have paid 15 cents on the dollar, and we anticipate meeting or exceeding our original estimate of 25 cents,” the liquidators said.

Depositors’ representative Daniel Nyaungwa yesterday said the liquidators have told them they may only receive five cents for every dollar they deposited.

“It’s been a long time. We need our money now. Some people have died of high blood pressure and depression because of this,” he said.

Nyaungwa said being unable to access their money has caused them emotional and physical strain.

He said the depositors want to avoid public unrest.

“We don’t see any position where the government cannot afford to give us our money back. They need to make a plan,” he said.

FAKE INVOICES

The liquidators said the misappropriation of SME Bank money involved numerous fictitious transactions and invoices.

“Auditors found invoices with bank account numbers not matching the supposed suppliers, revealing a systematic plundering of funds,” they said.

They have also found that the petty cash was misused, involving withdrawals of N$200 000 three times a week.

“Who draws N$200 000 three days consecutively for petty cash? Over the counter, even in the bank. Some guy sends his secretary to the counter.

“She draws the money on a little slip of paper. Takes the money back, gives it to her boss. Tomorrow she does it again,” McLaren said.

The liquidators believe that the entire endeavour was a scheme to defraud the government and the public.

“These well-disguised schemes meant the money wasn’t going where it was supposed to,” they noted.

DECADE OF HARDSHIP

Meanwhile, the depositors have urged the government to intervene.

They have suffered almost 10 years of financial hardships and their businesses have closed, they said yesterday.

Some have deposited amounts as high as N$2,2 million into SME bank, Nyaungwa said yesterday.

He said the government has a duty to ensure they are repaid in full as the majority shareholder.

“The government is a 65% shareholder in the bank. Why can’t they give all these poor people their money? Some of us have lost houses and cars, and our children were chased from schools. People are suffering,” he said.

He said their deposits were not loans, but funds entrusted to the bank.

“Our money is still in SME Bank, and we are suffering. Most of us are holding over a million dollars, and there are small people in the street who are selling tomatoes,” he said.

Nyaungwa said some small business owners are unable to access their capital, and have had to close down operations and retrench employees they have hired.

THE HUNT CONTINUES

Bruni and McLaren said their search for Kamushinda has stopped, but has not been cancelled.

“The process has stopped, and we don’t know what we’re going to recover there, because we understand he has relocated to Singapore.

“But even in his position, to liquidate his local assets in Zimbabwe is not so quick and so easy,” McLaren said.

So far they have investigated different banks through legal action on their journey to recover N$50 million from Kamushinda and his fellow executive management.

“We have attached 50 million of MetBank’s money, previously called the Metropolitan Bank of Zimbabwe, who were a shareholder in SME Bank. “They also have a South African branch in Johannesburg. But that will see its way through legal action,” McLaren said.

This action is enforceable because of the protocol of the Southern African Development Community (SADC), he said.

“We’ve got a judgement against MetBank here now. The protocols allow for our judgement to be valid throughout SADC,” the liquidator continued.

Depositor Reinhold Eliaser yesterday said the SME Bank was not owned by anyone other than “the people from Zimbabwe”.

“We lost our money, we are struggling, and don’t have anything any more. That was our money we worked for,” he said.

Eliaser said the government must intervene, because it was the bank’s majority shareholder.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!