The South African Revenue Service (SARS) collected N$1.855 trillion in tax revenue for the 2024-25 financial year, marking a 6.6% growth in net revenue from the previous year, driven by higher inflows from personal income tax.

“The finance, community and wholesale sectors had robust gains, contributing to the 6.6% year-on-year growth in total revenue collections,” the tax agency said on Tuesday.

“A recovery in consumer spending and a reduction in inflation helped these industries, providing a sign of economic resilience.

However, given the structural inefficiencies, relatively increased prices and muted demand, the mining, manufacturing, transportation and construction sectors underperformed against the national average growth rate.”

SARS said it collected N$733.2 billion from personal income taxes during the financial year ending 31 March 2025, a 12.6% growth on an annual basis.

This was partly a result of above-inflation growth in the finance and community sectors’ pay as you earn, which increased by 11.16% to N$701.63 billion, as well as gains from the two-pot retirement annuity withdrawal system. This amounted to R11.87 billion.

Corporate income tax collection increased to N$323.4 billion, mainly driven by growth in the finance sector, and value added tax (VAT) rose to N$458 billion for the just-ended financial year.

Domestic VAT was supported by household expenditure, with growth for large vendors and non-large vendors increasing to N$12 billion and N$22 billion, respectively.

Revenue collection from the fuel levy declined by 6.3% to N$85.8 billion in the 2024-25 financial year, compared with N$91.5 billion in the previous year.

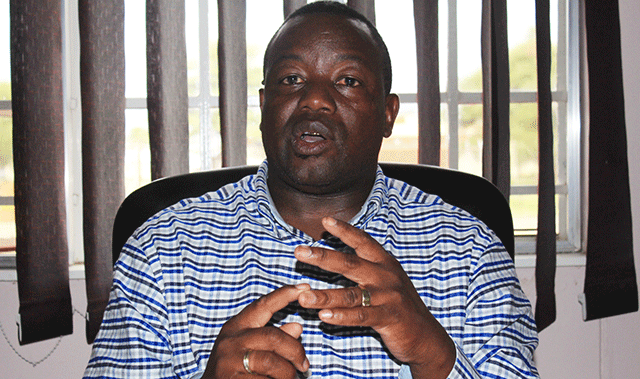

The tax revenue collection for the current financial year was higher than finance minister Enoch Godongwana’s estimate of N$1.846 trillion during his budget speech on 12 March, SARS commissioner Edward Kieswetter said in a media briefing this week.

The revenue agency refunded N$447.7 billion to taxpayers, compared with N$413.9 billion the previous year, he said.

“I am pleased that the N$447.7 billion returned into the hands of taxpayers is good for the economy,” Kieswetter added.

The commissioner said tax compliance had improved among South Africa’s 32 million registered taxpayers.

The voluntary compliance index rose by 0.38 percentage points to 75.48%, compared with the previous year.

“This uptick in compliance efforts is shaping taxpayer behaviour,” SARS said.

In its recent budget review, the treasury allocated N$3.5 billion to support SARS’ digital services to enhance tax revenue collection, a move which Kieswetter welcomed.

“A smart modern SARS cannot exist in a government that is not smart and modern.

We recognise that we need to fix the entire system because the train is only as strong as its weakest link,” he said on Tuesday.

We have an opportunity to leverage the progress we made at SARS in terms of digital transformation … and artificial intelligence.”

The treasury has forecast revenue collection of R2.006 trillion for the 2025-26 financial year.

“This conveys confidence by the minister on SARS’ ability to meet this challenge,” Kieswetter said. – Mail & Guardian

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!