Reportedly last week over 40 000 shareholders of Berkshire Hathaway from across the world attended the firm’s annual general meeting (AGM), filling an indoor sports stadium in the American city of Omaha.

Attending the Berkshire Hathaway AGM provided shareholders, for many an annual pilgrimage, with an opportunity to see, but more importantly hear the views and digest the advice proffered by the iconic 92-year-old Warren Buffet.

As has become tradition, Buffet was joined at the AGM that usually spans several hours, by his even older business and investment partner, 99-year-old Charlie Munger.

Based on personal experience, the AGMs of firms listed on the Namibian Stock Exchange (NSX) are very different – they are rushed events with shareholder attendance barely numbering, at best, half a dozen.

Resultantly, AGMs top the list of non-events on Namibia’s annual corporate calendar, when measured by shareholder numbers and the speed with which business is dispensed.

From what I have experienced first-hand, shareholder participation at firms listed on the stock exchanges of South Africa, Zambia and Zimbabwe contrast sharply with Namibian company AGMs.

Although not in the league of Berkshire Hathaway, in those three neighbouring countries, AGMs are also jam-packed events.

Other stark contrasts between AGMs in Namibia and those three countries are the low presence of the media and an apparent rush to swiftly work through the agenda.

Arguably, the most important event for any shareholder who has invested hard-earned savings in a firm, thereby sharing the investment risk with other shareholders, is the AGM.

It provides a platform for shareholders, as part owner of that firm, irrespective of the number of shares owned, to interact with the board, chief executive, senior management, and other shareholders.

And an opportunity to question decisions, acts, and omissions, such as lower dividend payments, whereas director fees have increased.

Or to keep a watchful eye on and question humongous benefits allocated to senior management in the form of performance bonuses and share option schemes, with the condonation of directors.

Or to voice concern about a board of directors not reflecting demographic reality, or having a gender imbalance.

It is important for minority shareholders to attend AGMs and to ask questions and point out errors in a firm’s published annual report.

Or as I did recently, to stress the compliance importance of auditor representation at a firm’s AGM.

Check any NSX firm’s annual financial statements and see just how much auditors are paid. It is an insult to shareholders, as the firm’s owners, when auditors don’t even bother to attend an AGM.

By questioning and commenting, experience shows that at some of the NSX listed firms, the message eventually sinks in.

An AGM must not be taken as a mere formality or denigrated to become a 20-minute affair, but accorded the seriousness it deserves.

Not only is it important for shareholders to attend, but they must participate in the proceedings.

However, as opined by another minority shareholder, the calibre of boards and the competency of chief executives must drastically improve to make attendance attractive.

He feels, and I agree, that AGMs must become exciting events, and here lessons can be drawn from seeing how it is done by Berkshire Hathaway and those two old-timers, Buffet and Munger.

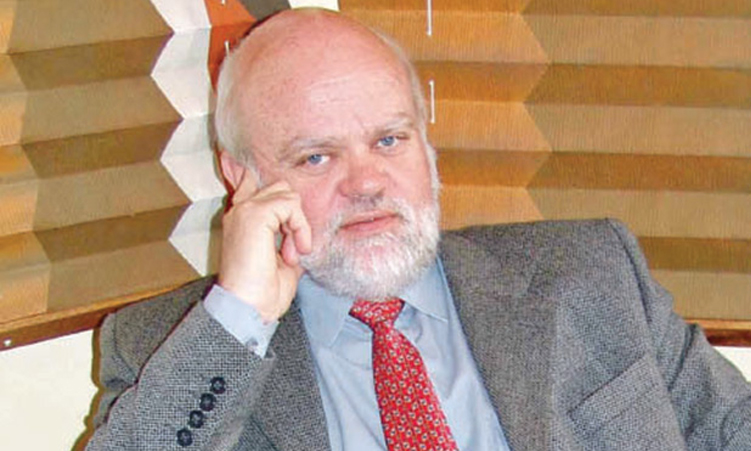

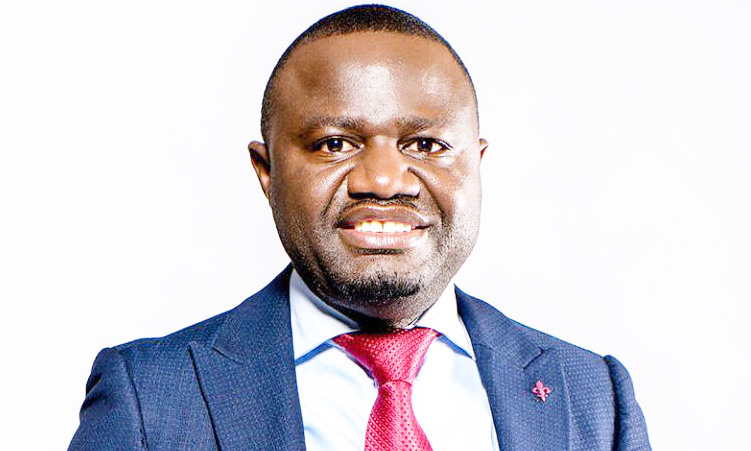

- Danny Meyer is reachable at danny@smecompete.com.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!