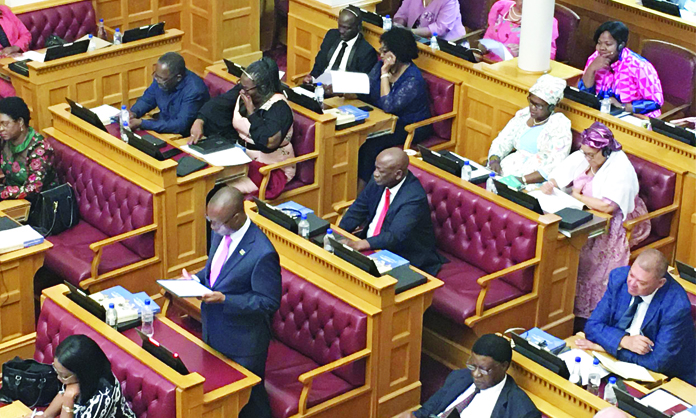

Minister of finance and public enterprises Iipumbu Shiimi on Wednesday tabled the biggest budget Namibia has seen, amounting to N$100 billion.

He said this comes after a strong revenue performance.

Shiimi, however, said there would be no new tax policy proposal.

“We maintained a policy stance to not consider new tax policy proposals.

“This budget continues specific tax policy proposals aimed at providing relief to taxpayers and boosting domestic demand,” he said.

One of the standout tax reforms is a substantial increase in the income tax threshold for individuals – from N$50 000 to N$100 000.

“This action will result in an injection of N$646 million directly into the pockets of taxpayers,” Shiimi said.

Corporate income tax rates are set to see a phased reduction, starting at 31% in January, and reaching 28% by the 2026/27 financial year.

“These proposed reforms on corporate income tax are expected to ensure revenue enhancement through improving corporate tax compliance.”

Shiimi said amendments to tax laws would eliminate non-resident shareholder tax exemptions for foreign insurance company shareholders.

The budget allocates N$44,3 billion to the social sector, reflecting a 12% increase from the previous year.

“Investments in the social sectors remain imperative for a developing economy like Namibia,” the minister said.

The economic and infrastructure sector received N$20,9 billion, and provisions include support for transportation, agriculture, and small and medium enterprises.

“This budget reflects a comprehensive strategy to stimulate economic growth, address social challenges, and ensure fiscal sustainability,” Shiimi said.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!