… employers to back pay workers

Namibians paid N$100 000 and less per year would only enjoy the fruits of the tax exemption announced by minister of finance and public enterprises Iipumbu Shiimi last week in about 90 days’ time.

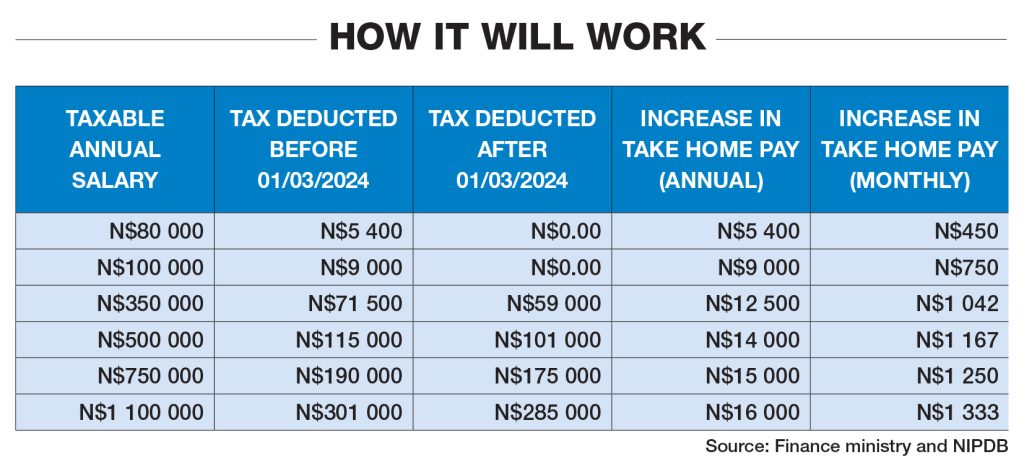

The tax breaks include the first N$100 000 earned by employees being tax free.

Shiimi raised the tax threshold from N$50 000 to N$100 000 during his budget speech in parliament last week.

This move exempts those whose earnings fall in that bracket from having to pay pay as you earn (PAYE).

Although Shiimi’s decision is effective from 1 March, it still needs to be gazetted before being implemented.

The deputy executive director of finance and public enterprises, Oscar Capelao, says although Shiimi declared the new threshold, it is still subject to parliamentary approval.

He says the tax year runs from 1 March to the end of February for individuals.

Therefore, even though the proposal was announced last week, it is still considered effective from 1 March due to existing legislation.

Capelao says the proposed amendments requiring legal approval will be submitted to the Ministry of Justice for review and gazetting.

“Parliament needs to approve these amendments, and once approved, they will be gazetted, officially making them law,” he says.

Capelao says the last time the tax table was changed in 2013, the relevant gazette was issued by the end of May.

This implies that the current process is expected to be completed within the next 90 days.

He says even though the legal process may take some time, taxpayers who have overpaid taxes between March and the official gazetting would be entitled to a refund.

“When the amendments are gazetted, employees will receive paybacks from their employers. Let’s assume you pay N$1 000 in taxes, but with the new tax bracket, you will only be paying N$800, this means you overpaid with N$200.

“In this case in the month that the law is gazetted, your employer will deduct what you overpaid from what you are supposed to pay that month and you only pay the difference,” Capelao says.

Employers will be responsible for making adjustments to their payrolls, he says.

Ministry of Justice spokesperson Edmund Khoaseb says gazetting a law should not take long.

He says once the ministry receives instructions, gazetting typically occurs within the same week, usually on Fridays.

“Instructions are sent to us, and as soon as we have them, normally within the same day or the same week it is gazetted.

“Gazetting always happens on Fridays, but the commencement date depends on the minister responsible for that specific function – in this case, finance,” Khoaseb says.

He says once gazetted, the new law takes immediate effect.

PwC tax expert Johan Nell says employers making back payments is the best way to go about the matter as it reduces the administrative burden on the Namibia Revenue Agency.

“Depending on what the [Government] Gazette stipulates as the effective date, the employer can then adjust the tax to reflect the saving at that stage.

“It should not be done by Namra as this would create an immense administrative burden on them. Best would be for employers to adjust the employee taxes,” he says.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!