Six former SME Bank directors could be slapped with a N$1 billion bill if the liquidators get their way at the High Court where they accused the board of recklessness and allowing widespread looting of the bank.

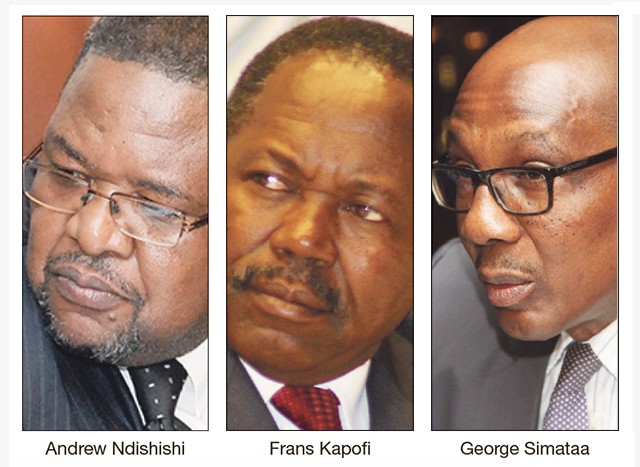

The directors are secretary to the Cabinet George Simataa, home affairs minister Frans Kapofi, and former Namibia Institute of Public Administration and Management (Nipam) boss Andrew Ndishishi.

Ndishishi served as NIPAM’s executive director between 1 August 2016 to 31 July 2018. He was succeeded by Maria Ndatiwelao Nangolo on 1 August 2018.

The others are Social Security Commission chief executive officer Milka Mungunda, Namibia’s commercial counsellor to the United States Petrina Nakale and businessman Justus Hausiku.

The liquidators have filed a case in the Windhoek High Court against the former directors as part of an ongoing legal process that began in August 2020.

This was after High Court acting judge Collins Parker found that N$247 million was indeed ‘stolen’ from the partly government-owned bank.

reported yesterday that the liquidators are suing to recover N$1,7 million from six former SME Bank board members – which was paid to them as board fees between 2013 and 2015.

The former directors have indicated that they will defend themselves.

Howeber, the six former directors could be in deeper trouble.

One of the main demands by the liquidators is that the High Court declares “that the defendants are jointly and severally liable to the plaintiffs, without any limitations, for all/any of the debts or other liabilities of the SME Bank.”

They also asked the court to hold ex-directors “personally liable or responsible without limitation, for the liabilities of the SME Bank”.

Former SME Bank legal adviser Tania Pearson explained the bank liabilities in court papers filed on 12 September 2019 as part of this case.

“The contracted liabilities of the SME Bank, as at 11 July 2020 amounted to N$1 billion in terms of depositors liabilities and N$60 million in respect of the promissory note issued to JM Busha,” Pearson said.

She provides details on the methods through which the bank was defrauded and the fraudsters tried to cover their tracks, until the Bank of Namibia took over the management of the bank.

Pearson held the position from September 2012.

Liabilities are what a company owes its stakeholders. It can be loans given to or money entrusted to such a company. For commercial banks, liabilities are mainly deposits paid into the bank by individuals, businesses, and institutions.

Liquidator David Bruni confirmed to yesterday that the SME Bank’s liabilities are around N$1 billion. He declined to comment further, citing confidentiality.

Bruni was appointed alongside Ian McLaren in July 2017 to shut down the bank after large-scale theft was uncovered.

in 2019 reported that the SME Bank had a total of 23 259 depositors, of whom 22 864 or 98,3% – still had amounts of less than N$25 000 in their accounts. Those depositors’ claims against the bank total N$16,8 million.

It was further reported that 390 of the depositors had more than N$25 000 in their accounts, with their claims against the bank adding up to N$1 billion.

The liquidators said the six former SME Bank directors were reckless and allowed Zimbabwean Enock Kamushinda free rein to steal N$247 million from the institution.

“They [the ex-directors] failed generally to act honestly and in good faith, or in the best interest, or for the benefit of the SME Bank and its depositors and therefore recklessly failed in the performance of their functions as directors of the SME Bank,” the liquidators said.

The SME Bank case could be another test on the consequences of directors who fail to protect the interests of the organisation they serve.

In this case, liquidators said the former directors accepted their appointment on the commercial bank – knowing that they did not have the required knowledge or skills to serve on a board of a banking institution.

A similar case regarding directors’ responsibilities is the Avid case where the Social Security Commission lost N$30 million in early 2005.

Judge Christie Liebenberg said the directors were reckless by “blindly” accepting the version by Lazarus Kandara who was accused of masterminding the scheme.

Political commentator, Ndumba Kamwanyah told that most directors are more interested in big cheques than serving.

“This case epitomises how a sloppy job our public boards of directors are doing. Careless, neglectful and mainly interested in the bountiful cheques they take home instead of taking their fiduciary duty seriously.

“What Namibia is reaping in terms of public boards of directors is the consequences of politically connected appointments instead of merit-based ones. They say you reap what you sow, and that’s exactly what we are seeing with the outcomes of some boards.

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!