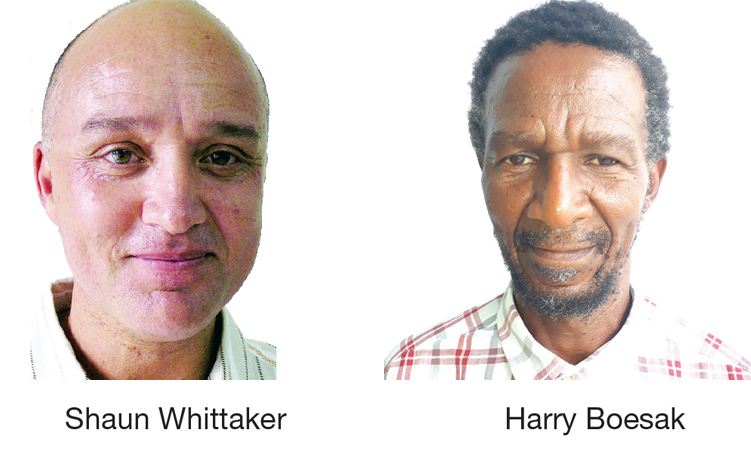

The article by Shaun Whittaker and Harry Boesak in The Namibian of 28 March views the proposed cutting of the public sector wage bill through a flawed lens.

Retrofitting the analysis of a complex issue through a Marxist viewpoint has its limitations. It is a seriously flawed argument to suggest that the Namibian state is also bailing out local banks because of the liquidity effect of interest rate hikes on central bank deposits held by local banks.

It is disingenuous to suggest the Namibian state is paying subsidies to any local commercial bank.

To argue that the Namibian state is acting in a manner to prop up the “immense wealth” in the financial system at the “expense of working people” is just factually wrong.

It is also wrong to insinuate that the Namibian economy is playing in the international capital big league. Good luck with finding enough wealth in the current Namibian economy to allow all our people to wallow in the false comfort of a social security system. It is intellectually lazy to cut and paste dogmatic explanations onto the Namibian reality.

A more useful analysis is to reflect upon the underlying driver of the current inflationary trend – government indebtedness. As government debt is rising in both wealthy and emerging economies, it is becoming more and more apparent that it is excessive government borrowing that is driving current inflationary pressure.

That is why inflation remains stubbornly high despite rising interest rates. Central banks are thus increasingly under pressure to print money to finance public sector consumption expenditure obligations, resulting in inflationary pressure.

A flaw in the Marxist world view lies with the dependence on the state to achieving social security. Governments’ role in rolling out social equity measures without the ability to afford it lies at the hart of the current financial crisis.

The root cause behind governments’ inability to facilitate effective social equity lies in their inherent structural inefficiencies. As the authors admit, governments are simply not good at prioritising resources. Keeping armies of expensive public sector workers as part of an extensive patronage system is obviously not an optimal allocation of resources – especially if that wage bill is driving inflationary pressure that makes everybody poorer. Propping up loss-making state-owned enterprises similarly does not make sense.

It is therefore a double whammy – firstly because governments spend more than they can afford in dishing out current benefits, while indebting future generations.

Secondly, governments do not spend productively by prioritising fixed asset creation, but rather focus on social consumption.

Expecting the unemployment crisis to be resolved through public sector employment is expecting to harvest without planting.

Andre Olivier

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!