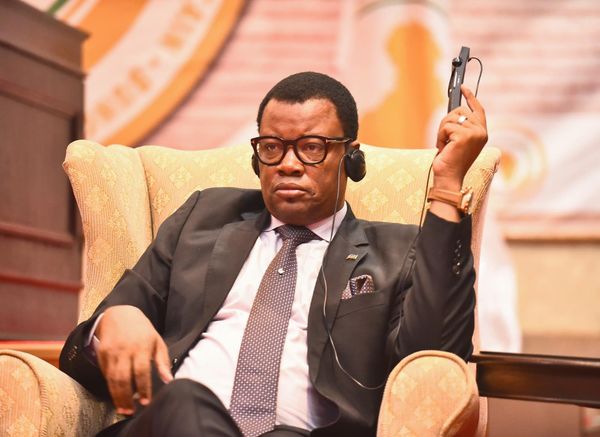

GEORGETOWN – Guyana’s President Bharrat Jagdeo yesterday accused major Western nations of failing to combat money laundering in their own jurisdictions while pressing the Caribbean to enact a wide range of laws and regulations.

Addressing the opening of the 34th Annual General Meeting and Conference of the Association of Caribbean Indigenous Banks (CAIB), Jagdeo also vowed that Guyana would not continue to enact laws that make the financial services sector of the Caribbean unattractive. “We should make sure that we don’t have a movement of illegal money across our jurisdictions, but we must not legislate ourselves out of competitiveness and we must not put burden on our banking system that other countries don’t have,” he said.Guyana’s revised Anti-money Laundering and Countering The Financing of Terrorism Bill has been sent to a bi-partisan parliamentary select committee for further consideration.He accused countries like the United States, United Kingdom and Luxembourg of having “tremendous double standards,” and noted that they had not been blacklisted by the Organisation for Economic Cooperation and Development’s punishing Taxation Regime for “practising imprudent lending” – although several Caribbean countries were.Between 1999 and 2005, the Bahamas, Cayman Islands, Dominica, St Kitts-Nevis, St Vincent and the Grenadines, Grenada, Panama and Guatemala were all black-listed by the OECD’s Financial Action Task Force (FATF) but were later de-listed after they had complied with international regimes and passed new laws and regulations to counter money laundering and terrorist financing.While the US State Department’s annual International Narcotics Control Strategy Reports continue to identify a number of Caribbean countries where moneylaundering thrives, the Guyanese leader said most illicit financial transactions related to drugtrafficking.”But you don’t see the US on the blacklist,” he said.”That’s where the financial transactions have their origin and the payment starts,” he said, adding that a lot of “hot money” was circulating in London from tax-evasion originating in the United Kingdom.Nampa-AFP”We should make sure that we don’t have a movement of illegal money across our jurisdictions, but we must not legislate ourselves out of competitiveness and we must not put burden on our banking system that other countries don’t have,” he said.Guyana’s revised Anti-money Laundering and Countering The Financing of Terrorism Bill has been sent to a bi-partisan parliamentary select committee for further consideration.He accused countries like the United States, United Kingdom and Luxembourg of having “tremendous double standards,” and noted that they had not been blacklisted by the Organisation for Economic Cooperation and Development’s punishing Taxation Regime for “practising imprudent lending” – although several Caribbean countries were.Between 1999 and 2005, the Bahamas, Cayman Islands, Dominica, St Kitts-Nevis, St Vincent and the Grenadines, Grenada, Panama and Guatemala were all black-listed by the OECD’s Financial Action Task Force (FATF) but were later de-listed after they had complied with international regimes and passed new laws and regulations to counter money laundering and terrorist financing.While the US State Department’s annual International Narcotics Control Strategy Reports continue to identify a number of Caribbean countries where moneylaundering thrives, the Guyanese leader said most illicit financial transactions related to drugtrafficking.”But you don’t see the US on the blacklist,” he said.”That’s where the financial transactions have their origin and the payment starts,” he said, adding that a lot of “hot money” was circulating in London from tax-evasion originating in the United Kingdom.Nampa-AFP

Stay informed with The Namibian – your source for credible journalism. Get in-depth reporting and opinions for

only N$85 a month. Invest in journalism, invest in democracy –

Subscribe Now!